The global backdrop

After a decent start to the second half in July, EM local assets came under severe pressure in August and September. While domestic developments were in line with our expectations, we had underestimated the external backdrop. In August and September, USD strength caused a pause in inflows into EM and a noticeable increase in the term premium. In September and October, the pressure further increased on EMFI due to the sharp rise in US rates, with the 10Y reaching 5%.

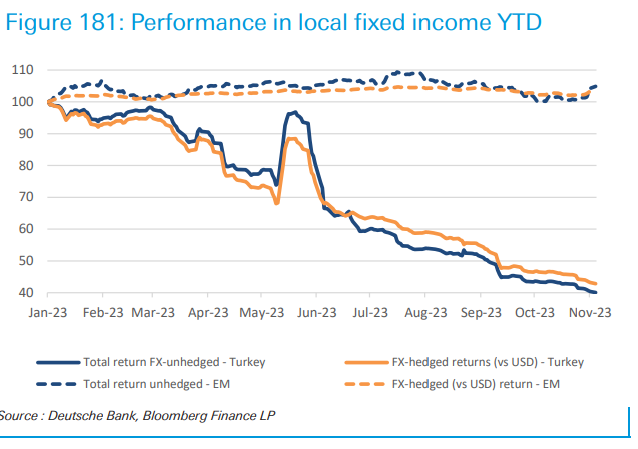

While EMFI had been quite immune to higher core rates for most of H1, the asset class could not escape the fast repricing in core rates in Q3 – at a time with noticeably less attractive valuations in EMFI from an outright AND relative perspective. Despite all this, EMFI has still held up reasonably well and YTD has provided a positive return – both FX-hedged AND FX-unhedged.

What’s next?

Although it took longer than expected for our bullish view to materialize, and despite the recent rally, we believe there are still various arguments to stay bullish on EMFI. In fact, we argue that the outlook is now even more favorable compared to mid-2023.

Where does Turkiye stand?: Stay underweight for now, but watch developments closely

Turk government bonds (GBs) have been the by far worst performance EM local bond market YTD. On the back of aggressive front-loaded tightening, a further increase in inflation pressure and record high issuance, local bonds have sold off by 30-35pps YTD. In fact, local bonds have lost more than 60% YTD (FX-hedged & FX-unhedged). Despite the repricing already seen (and the aggressive recent rate hikes), we believe it is still too early to re-enter Turkish local markets.

Future could be bright

This said, we believe Turkish local bonds will be among the best-performing EM local bond markets in 2024, though it is still a few months too early to turn structurally bullish. Why? Further rising inflation pressure combined with additional high issuance into year-end and at least another 500bps of tightening should lead to further weakness in duration. We believe for now that FX is the better trade and we would only re-engage in local bonds with 2Y bonds trading closer to 40% and 10Y bonds closer to 35%.

How to position: We stay underweight for now. This said, we are watching the price action closely and slowly see value emerging. We believe local bonds need to reprice another 200-400bps, but then offer value from a structural perspective.

Excerpt from Deutsche Bank Research CEEMEA report titled “Where is the value in fixed income? Country views into year-end (& beyond)”

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/