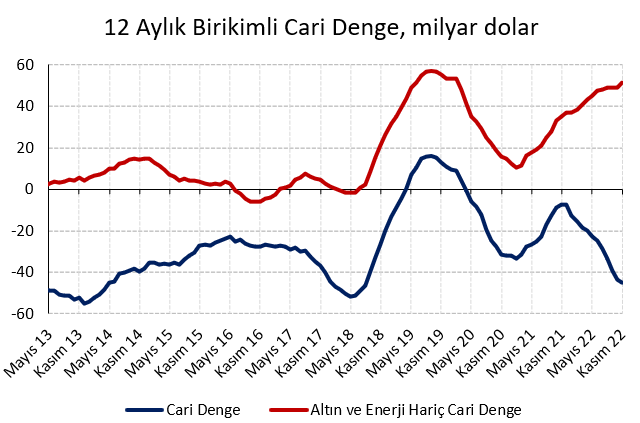

Cover chart in Turkish: Annualized current account deficits

November’s balance of payments data show that reserves increased by $3.6 billion MoM, thanks to cash FX and deposit inflows to banks and stronger-than-expected foreign direct investment revenues. Despite the huge foreign trade shock and negative global backdrop, Central Bank’s (CBRT) FX reserves increased by $9.9 billion in the first eleven months of the year. Excluding swaps, the increase is $4.3 billion.

In November, current account deficit came in at $3.7 billion, below the market’s ($3.8 billion) and IS Investment’s ($4.1 billion) estimates. Current account surplus excluding gold and energy contracted by 5.3 billion dollars (October: 8.6 September: 6.9) compared to the record level in October. On a 12-month cumulative basis, the current account deficit rose from $43.4 billion to $45.0 billion, and the cumulative core current surplus (excluding gold and energy) rose from $50.0 billion to $51.3 billion.

The deviation in our current account balance forecast for November is due to record high foreign direct investment income. This item, which normally yields a deficit (net FDI outflows) of between 0.1 and 0.3 billion dollars, recorded a surplus of 0.5 billion dollars.

When we look at the sub-items of the current account balance, we see a services surplus of 3.7 billion dollars against a foreign trade deficit of 7.1 billion dollars and an income deficit of 0.2 billion dollars. Services continue to be strong thanks to tourism. The monthly gross foreign exchange inflows from tourism correspond to 146% of the pre-pandemic November 2019 level. This rate is 122% for the first eleven months of 2022. Rising incomes in the Middle East due high energy prices and the refugees coming from Russia and Ukraine due to the war continue to affect tourism positively.

In November, an inflow of 6.4 billion dollars is seen from the financial account. On the basis of actors, 1.4 billion dollars inflow came from the general government (foreign borrowing), 4.7 billion dollars from banks, while a 0.4 billion dollar outflow was reported from companies—net foreign debt redemptions.

When we analyze the a.m. details on the basis of channels of inflows, we see 7.1 billion dollars inflow from FX cash sales and deposits of non-resident entities in Turkish banks, 0.5 billion dollars from portfolio investments. 1.5 billion dollars from financial loans and 0.5 billion dollars commercial loans left the country to banks and corporates net foreign debt payments.

When we look at the details of the portfolio account, we see an inflow of 1.5 billion dollars from the Treasury Eurobond issuance and 0.3 billion dollars from equity investments. We see a total outflow of 0.9 billion dollars from banks and companies’ Eurobond redemptions, 0.3 billion dollars from foreign securities purchases of domestic institutions, and 0.1 billion dollars from government domestic debt securities.

When we look at the borrowing side of loans, we see a net debt payment of 1.5 billion dollars by banks and a net borrowing of 0.1 billion dollars in the corporate sector. When we look at bonds and loans together, there is a similar sectoral divergence. In November, long-term external debt rollover ratios were 58% for banks (January-November 56%) and 83% (January-November 2022, 179%) for non-financial companies. In the first eleven months of 2021, these rates were 84% for banks and 138% for companies.

To summarize, we see a reserve increase of 3.6 billion dollars in the balance of payments, combined with a current account deficit of 3.7 billion dollars, a financing inflow of 6.4 billion dollars and a net error and omission of 0.9 billion dollars. In this way, there is an increase in reserves of 9.9 billion dollars in the first eleven months. When we adjust for swaps, the increase regresses to 4.3 billion dollars.

We estimate a current account deficit of around 6.5 billion dollars in December

We estimate a current account deficit of around 6.5 billion dollars in December, when exports increased less than imports. Weekly data point to a total inflow of 0.8 billion dollars in stocks, and Eurobonds on the portfolio front. According to high-frequency data, the CBRT’s gross foreign exchange reserves increased by 3.1 billion dollars in December.

Due to the deterioration in the foreign trade balance in December, we are increasing our current account deficit forecast for 2022 from 47.5 billion dollars to 48.3 billion dollars (5.8% of 2022 national income). We maintain our current account deficit estimate of 27 billion dollars for 2023 (2.7% of 2023 national income).

By Serhat Gürlenen, Research Director and

Dağlar Özkan, Economist, IS Investment

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/