Foreign trade deficit increased by 72% yoy in February

According to TURKSTAT, the volume of exports increased by 2.3% yoy and reached 14.7 billion USD in February, while imports rose by 9.8% yoy to 17.6 billion USD. Thus, the foreign trade deficit widened by 72% yoy and reached 3 billion USD. During January-February 2020, exports and imports expanded by 4.1% yoy and by 14.3% yoy, respectively. The import coverage ratio, which was 87.5% in January-February 2019, declined to 79.7% in the same period of this year.

In February current account gave 1.2 billion USD deficit

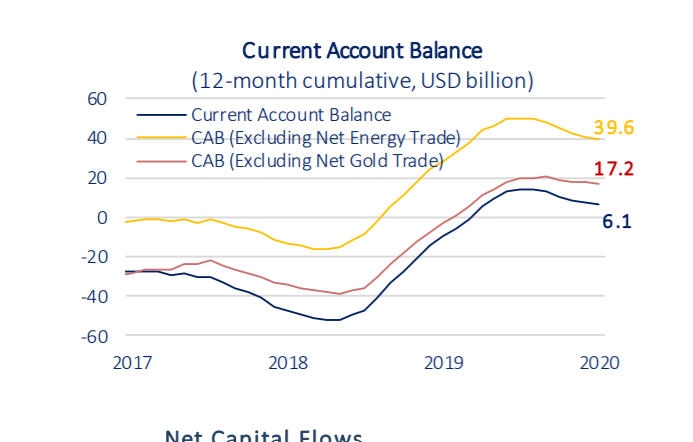

In February, when the effects of the Covid-19 outbreak on Turkish economy have not been felt yet, the current account gave 1.2 billion USD deficit, in line with market expectations. In this period, relatively favorable course of economic activity reflected in the current account balance through foreign trade figures. Also the rise in nonmonetary gold imports played a role in the course of the current account balance in February.

FDI remained weak

Capital inflows through foreign direct investment remained weak in February. Net foreign direct investment, which was 438 million USD in January, was realized as 309 million USD in February. Outflow posted in the equity capital investment in February exceeded 1 billion USD for the first time since June 2017 and led net direct investments to decline. On the other hand, real estate investments continued to support foreign direct investment.

In February, portfolio investment posted 382 million USD capital inflow. Government’s bond issuance abroad, which was 4 billion USD, came to the fore in this development. In February, non-residents made net sales of 687 million USD in equity market and 1.8 billion USD in government domestic debt securities due to decline in risk appetite led by virus outbreak. In this period, banks made 497 million USD net repayment for the debt securities held abroad decline in February and became 6.1 billion USD. Current account surplus excluding net gold trade decreased to 17.2 billion USD in this period.

Other investments posted 2.4 billion USD inflows

In February, other investments posted 2.4 billion USD capital inflow. The decline in domestic banks’ currency and deposits held abroad, which exceeds 3.2 billion USD, was the main driver of this development. In this period, nonresident banks’ deposits held within domestic banks also increased approximately by 1 billion USD. While the short and long-term debt of banking sector decreased in February, short-term debt of other sectors’ posted a limited increase of 21 million USD despite the decrease in their long-term debts. However, other sectors, similar to banks, made net loan repayment in this period. In February, 12-month cumulative long-term debt rollover ratios became 73% in banking sector and 90% in other sectors.

Expectations…

According to the preliminary data released by the Ministry of Commerce, the coronavirus outbreak led the exports to decline by 17.8% in March, and the foreign trade deficit to expand rapidly by 181.8%. We estimate that the uncertainties created by the epidemic on a global scale will continue to put pressure on foreign trade and tourism revenues in the coming period. On the other hand, we think that decline in oil prices and the slowdown in domestic demand will limit the expansion in the foreign trade deficit and current account deficit by suppressing the increase in imports. On the financing side, it is understood that a fluctuating trend will prevail especially in portfolio investments in the following months in parallel with the financial markets.

Is Bank Economic Research

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/