Core Views

Although Q1 felt like a strong one for the USD, the BBDXY only rose by 3% over the quarter. Compared to a 9% decline in H2 2020, this is an unimpressive outcome given the sharp rise in longer-term US Treasury yields seen in the quarter and the strong upgrades made to US growth expectations relative to the rest of the world.

Below the surface lies a more complex picture. Funding currencies like the EUR (-5% vs USD) and JPY (-7.5%) struggled, while other large counterparts like CAD (+1.3%) and GBP (+0.8%) with good vaccination or pro-cyclical stories did well. Similarly, emerging markets with a high global growth beta and lack of clear vulnerabilities (INR, ZAR, RUB) performed while the policy-fragile (BRL, TRY, COP) struggled.

We suspect market confidence that the Fed will fight hard to quash US rate hike expectations up to end-2023, irrespective of the strength of US data, is behind the tepid rise in the greenback so far. If this is challenged more aggressively in Q2 by data outcomes, the USD can post generalized gains from still-low levels.

We look for more USD strength in Q2 against the funders, targeting EURUSD 1.15, USDJPY 112.50 and USDCHF 0.9650. But we see scope for pro-cyclical reflation currencies to also outperform the funders for yet another quarter as long as growth drives further US rates rises – not Fed-spooking, risk-off-fanning US inflation levels.

WATCH: A Perfect Storm for Turkish Economy

Turkish Lira Outlook

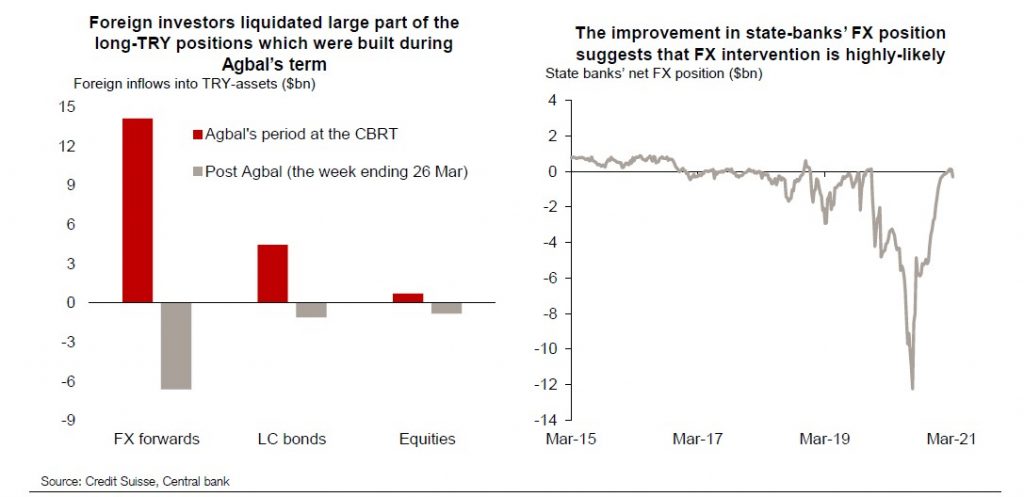

The removal of Nagi Agbal from the central bank on 19 March ended the “shift to orthodoxy” narrative abruptly and paved way for a re-pricing in USDTRY above the 8.00 mark.

Since late March elevated FX implied yields and possible FX selling by state-owned-banks have eased the pressure on the lira and allowed range-trading in USDTRY between 8.00 and 8.40.

WATCH: Four Horsemen of Turkish Lira

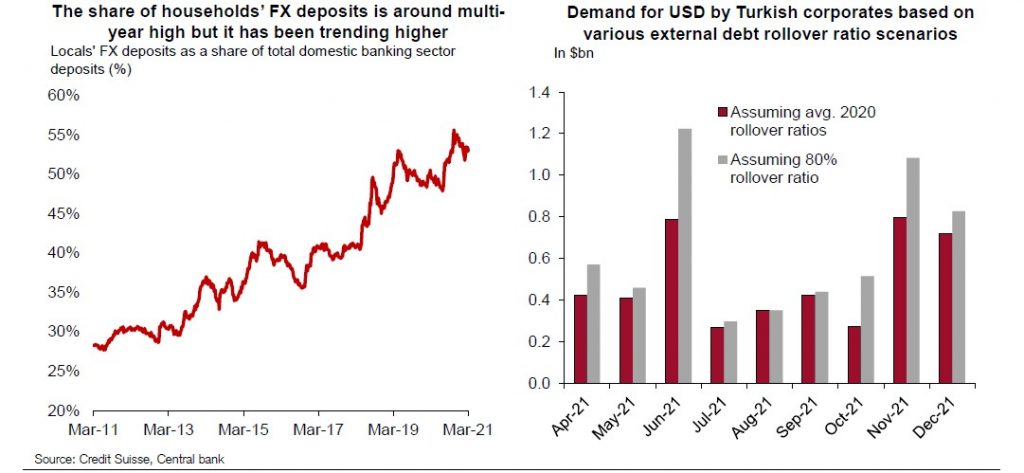

Renewed sources of USD-demand are likely to put pressure on the lira in 2Q: (a) further increases in households’ FX deposits are possible as the outlook for real rates has deteriorated; (b) corporates will need to buy USD in case external debt rollover ratios fall below 100% (like they did in 2020).

Against this backdrop we see a high-likelihood that USDTRY will break above its all-time high from November (of 8.58) in 2Q.

The central bank’s rate decision next week (15 April) is the main near-term risk-event to watch.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/