Turkey’s central bank to support the sinking lira, directly intervened the foreign-exchange markets for the first time in seven years.

The main difference in the central bank’s announcement today is that intervention came in a transparent way and the sales were not directed by the state-owned banks, who have frequently taken secret action to support the lira as was the case during 2019-2020 when the central bank reserves were totally burned down. .

The central bank statement issued following the intervention said its move came to combat “unhealthy price formations” in the market. The central bank is obliged to declare the amount of the intervention in the next 15 days yet according to Bloomberg the sale was at around $1 billion.

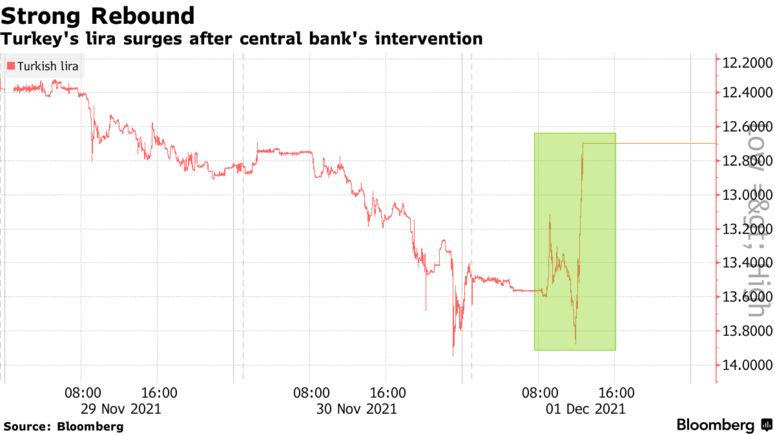

The lira strengthened after the announcement gaining as much as 8.5% against the dollar. Yet the gain was lost in the following hours given the facts that the central bank would continue with its rate cuts and has net reserves stripped for swaps at USD-35 bn dollars. The sustainability of intervention is thus under debate.

President Erdogan determined to get lower borrowing costs said the central bank “can make the necessary intervention if that’s needed,” to reporters in Ankara on Wednesday.

Speaking to Bloomberg, Piotr Matys, an analyst at InTouch Capital said ” It reflects how serious the situation is. But it’s likely to prove insufficient. Turkey doesn’t have sufficient FX reserves to sell substantial amount of dollars on a regular basis.”

Turkish central bank gross reserves stand at $129 billion with $61 billions coming from the bank’s swap deals, according to latest data released on Nov. 19. When swaps and other liabilities such as required reserves are stripped out, Turkey’s net reserves stand at negative $35 billion.