Reuters just published the following new item on Turkey, which we replicate here in summary form. We emphasize that Reuters’ headline is based on Anecdotal evidence. If we receive confirmation from Turkish bankers, we will update the story.

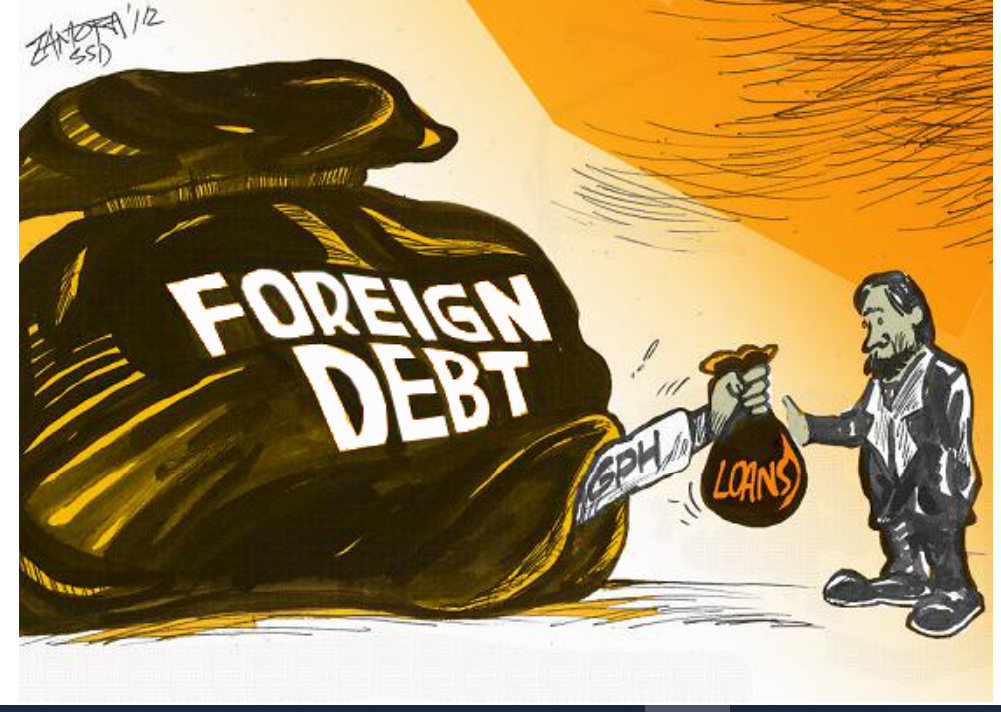

Some foreign banks are reviewing limits for dollar lending to Turkish businesses amid the lira’s wild fluctuations, two banking sources said, in a move that could drive up borrowing costs if the foreign lenders cut back.

At least two foreign banks have also withdrawn from cash trading the lira, separate sources at those banks said, potentially limiting local firms’ access to foreign currency and hindering foreign investment.

The lira has been on a roller-coaster ride since September when Turkish President Tayyip Erdogan pushed for interest rate cuts.

On Monday, it plunged 10% to 18.4 to the U.S. dollar, taking its losses for the year to almost 60%, before whipsawing back to 12 after Erdogan unveiled a plan he said would guarantee local currency deposits against market fluctuations.

Turkish banks are regular international borrowers, and foreign lenders’ reluctance to expose themselves to large currency gyrations could make it more expensive and more difficult for them to refinance their debts.

Fitch estimates foreign liabilities of Turkish lenders – mostly short-dated and held by large international banks – were equivalent to 22% of their funding at the end of June.

Total external debt at Turkish banks amounted to $138 billion at the end of the third quarter, with $83 billion due within 12 months, Fitch estimates.

According to Turkey’s central bank, CBRT, foreign debt maturing within 365 days is ca $170 bn. As of October, banks rolled over only 88% of their maturing loans YoY.

Non-financial corporates also turned net debt payers. Traditionally, the rise in Fed rates and Turkey’s CDs, hovering at 600 basis points should increase the “spread” Turkish entities will have to pay in the next refinancing.

Turkish banks rolled over their one-year foreign currency loans in October before the lira’s latest plunge, but could be impacted in the next roll-over period in the first quarter, a regional banker said.

“We had a few banks that came to us and said they will review Turkish limits for the next roll-over period based on the kind of update they get on the economy,” the banker said.

A second banking source said their bank had recently further limited short-term trade business with Turkey after cutting exposure on term loans.

“Every single deal needs to be approved by the risk department,” the source said.

WATCH: 2022 Predictions For Turkish Politics

The sources declined to be named due to the sensitivity of the matter.

One senior Turkish banker said on Tuesday he was not aware of foreign counterparts reviewing or curbing lending.

Turkish banks have a long record of being able to access foreign funding despite multiple periods of stress, said Lindsey Liddell, head of Turkish bank ratings at Fitch.

“Nevertheless, foreign currency liquidity could come under pressure from a prolonged market closure or significant foreign currency deposit outflows,” Liddell said.

“Banks’ access to foreign currency liquidity has also become more reliant on the central bank and could be uncertain at times of market stress.”

The first banker said some Turkish companies had also made requests to relax conditions on their loan agreements due to the market turbulence, without providing details.

CAUTION

Erdogan’s push for 500 basis points of interest rate cuts since September has set off Turkey’s worst currency crisis in two decades, with the lira crashing nearly 40% in just the five weeks to last Friday.

Bid-ask spreads on the lira, a gauge of how easy it is to trade the currency, have widened sharply in recent days, with quotes nearing their widest in about a month.

In a further sign of waning investor confidence, implied volatility on the lira – or expected price swings – jumped to the highest on record as the lira fluctuated wildly.

One large European bank and an Asian bank said they had stopped cash trading in the lira and were extremely cautious about offering liquidity for forwards contracts, citing market volatility and policy risks. They also declined to be named due to the sensitivity of the issue.

JPMorgan has pulled back from offering algorithmic trading facilities in the lira, according to a notice seen by Reuters late last week when the market crashed. The U.S. bank did not immediately respond to a request for comment.

John Marley, chief executive of consultancy forexxtra, said some banks were likely to switch to a system where they will only execute trades if they have another client transaction to offset it, meaning they take on no direct risk themselves.

“The last thing in the world you need is a small position in the lira blowing a hole in your annual trading statement,” he said.

Still, for Sergey Dergachev, a senior portfolio manager at Union Investment, the currency crisis is unlikely to trigger defaults on international bonds by Turkish corporates, partly because they refinanced 2022 maturities earlier this year.

“Most issuers are also exporters and benefit operationally from lower lira levels, and severe credit deterioration … is not a likely scenario I envisage for the Turkish corporate Eurobond issuers, and stay invested in them,” he said.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng