Bloomberg signed analysis point at how Turkey’s President Erdogan is pushing for lower borrowing costs aiming to transform the economy into a job-creation engine to keep him in power when elections come around in 2023 when ordinary Turks are so far paying the price.

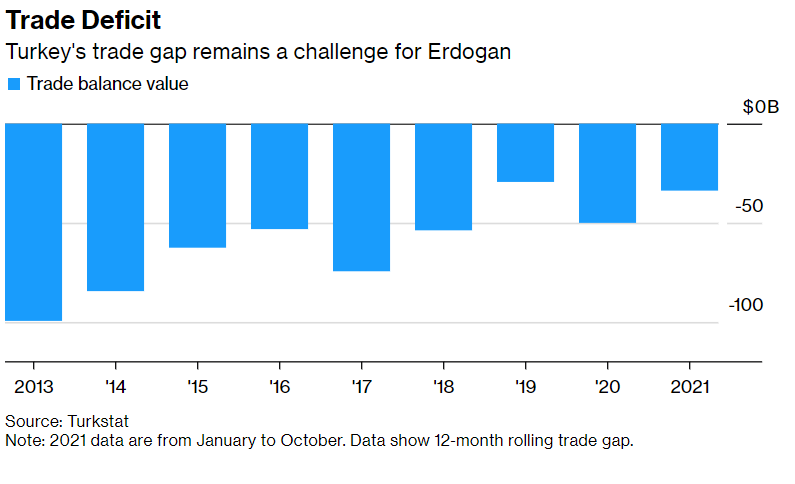

The analysis highlights that Turkey being among the Fragile Five owes to elevated inflation, a gaping current account deficit and currency pressures dating back to 2013. With his new vision, Erdogan is betting cheaper credit and a weaker lira will boost manufacturing and exports, cut labor costs, and increase hiring, reducing the market’s hold on the Turkish economy.

Bloomberg notes however that although such a recipe has transformed some Asian economies, Erdoğan does not have time until the elections to deliver results which are 18 months down the road.

This is how Bloomberg lists Erdogan’s new approach could work and the obstacles he’ll face:

- Mind the Gap: A shift to a weak lira policy could help close that gap as Turkish products become cheaper abroad, earning dollars and euros and drawing foreign direct investment in the real economy. The flip side is that overseas investors have fled Turkish bond and currency markets as yields tumble, while the cost of imports has risen sharply, fueling inflation and putting items such as mobile phones and computers beyond the reach of many.

-

Cheap Tricks: Erdogan is expecting the declining cost of labor as the lira weakens to help Anatolian manufacturers capture a larger share of European markets. Erdogan is also betting that a Black Sea gas discovery will come online as early as 2023, reducing Turkey’s energy deficit and saving precious hard currency now allocated to fuel imports.

-

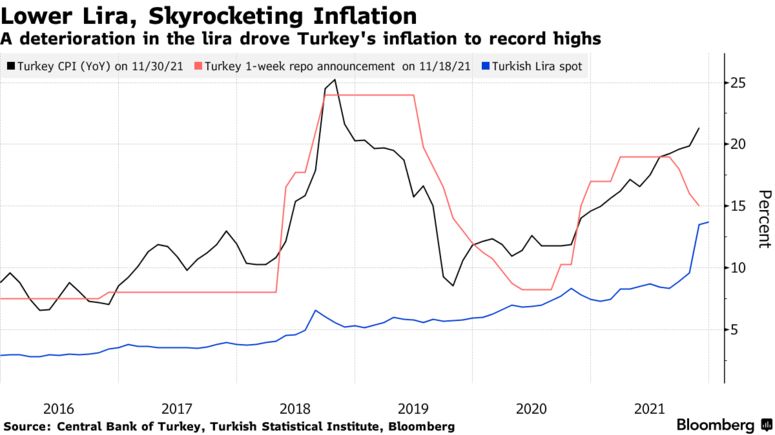

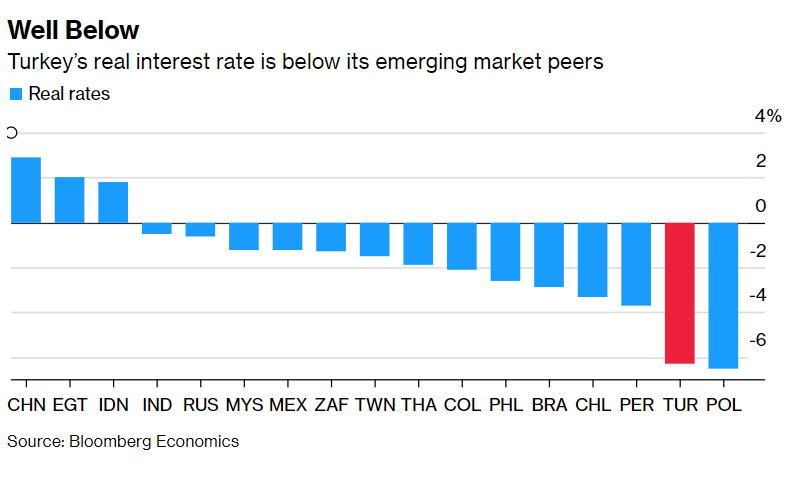

A Real Low: The CPI inflation rising above 21% versus the policy rate of 15% in November pushed Turkey’s real yield further into negative territory and well below emerging market peers. Bloomberg adds that has already prompted foreign investors to ditch Turkish bonds and the lira in favor of higher returns elsewhere leaving Turkey in a worse position when the U.S. and other major economies eventually tighten monetary policy. Erdogan claims that’s a price he’s willing to pay to break the hold of markets on monetary policy.

-

Anti-Market: Erdogan’s rhetoric that has struck an increasingly populist and anti-market tone blaming the TL turbulence on “interest lobbies and foreign powers,” invoking Islamic teachings in arguing for reduced borrowing costs and firing officials who disagree keep investors away from the TL.

-

Economic Misery: Bloomberg reminds that in contrast to Erdoğan’s calls with TL losing almost 40% of its value against the dollar this year CPI inflation surged to a 3-year high, while producer prices rose to their highest level since the start of Erdogan’s 19-year rule. Hence Turkey’s Misery Index, a measure of joblessness combined with cost of living, has been rising since the pandemic and climbed sharply even as the economy rebounded this year.

Pls. click here for the full article.