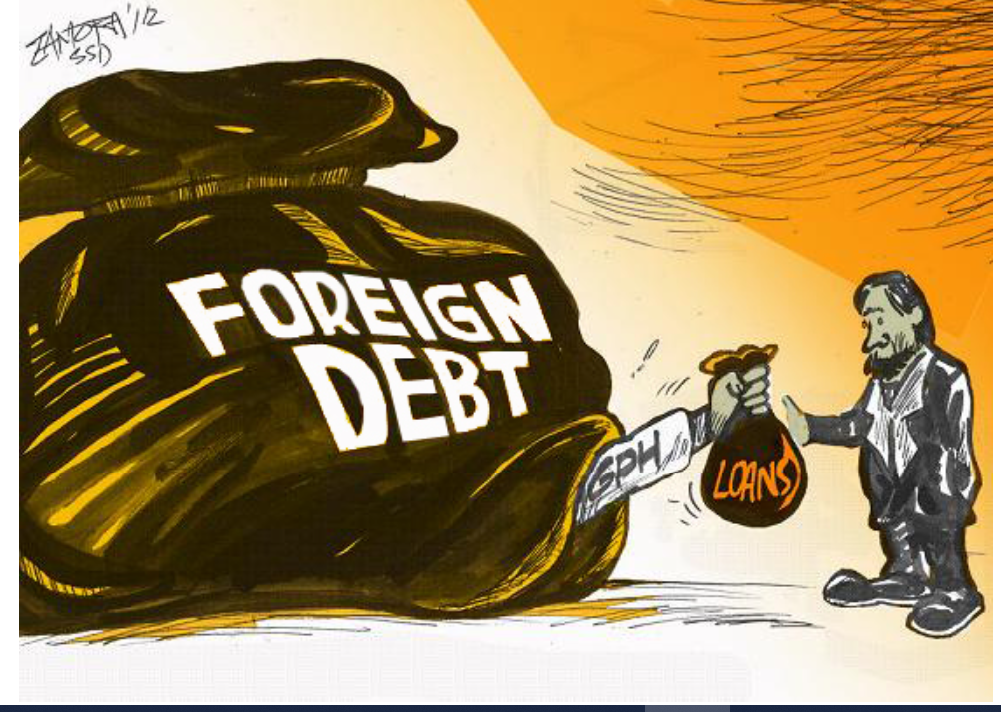

A perfect storm of economic forces threatens to swamp developing countries with inflation, rising interest rates, and unsustainable debt.

The portents of disaster were on display during the recent turmoil in Sri Lanka, where epic government mismanagement sent the country into a thirty-five-billion-dollar debt default amid severe food-and-fuel shortages. While Sri Lanka waits for China, Japan, and commercial lenders—which together represent two-thirds of the country’s debt—to restructure its loans, markets worry that other low- and middle-income countries soon won’t be able to meet their obligations either.

The human cost is becoming all too clear: The rapid rise of food and fuel prices, along with those of other key commodities, is taking a toll upon the most world’s most vulnerable, as several United Nations agencies have highlighted in recent weeks. Hunger is growing and millions are at risk of falling into extreme poverty.

Worse still, the international community doesn’t seem prepared to do much about it.

When they met last week in Indonesia, for instance, the Group of Twenty (G20) finance ministers failed to even to issue a communiqué. With Russian officials participating, divisions within the group over the invasion of Ukraine were at the heart of the discord. At a challenging moment for the global economy, international cooperation was absent from the negotiations.

To get ahead of emerging market defaults, it’s essential that governments focus on devising a road map for debt restructuring that ends the pattern of delaying negotiations by two key creditors—China and commercial lenders—and ensures that there is adequate money to help debtors to fund essential services before restructuring agreements are in place.

A limited debt-crisis toolbox

The advanced economies’ policy of battling the pandemic with loose monetary policy and increased spending has run its course in the face of the supply disruptions and commodity inflation that followed the Ukraine invasion. As a result, central bank tightening in response to inflation in the United States and Europe is causing an exodus of capital from developing countries. The Institute of International Finance calculates that net capital outflows from emerging-market stocks and bonds over the past four months have totaled $20.7 billion—a figure that likely understates the full extent of the capital flight. It’s a trend likely to continue as interest rates continue to rise and investors seek safer harbors.

As a result, countries and companies are watching their bills soar, especially for those whose debts are affected by changes in interest rates. The International Monetary Fund (IMF) estimates that 30 percent of emerging market countries and 60 percent of low-income countries already are in or nearing debt distress.

Capital outflows have a pernicious impact on balance sheets. First, countries need to replace that money by borrowing offshore at higher rates, which only becomes more expensive as more investors leave. Second, the soaring dollar, currently at a twenty-year high, hits sovereign and corporate borrowers by increasing interest and principal repayments in local currency terms. Corporate borrowers with inadequately hedged dollar exposure could suffer the consequences, as happened to many companies during the 1997-98 Asian financial crisis. Rating agency S&P Global warned this month that “[a]s rates increase, we think currency risk will feature more into… the ability and willingness of companies to fund in U.S. dollars and into distressed situations.”

The problem is that the principal vehicles for global cooperation—the Group of Seven (G7) and G20, along with the IMF—have limited tools to deal with a global debt crisis. This difficulty has only become more complex as global economic power has shifted over the past two decades from the West toward China. Similarly, the role of bondholders and other commercial lenders has increased in importance since the 2008 global financial crisis.

The international community has struggled to devise a comprehensive mechanism to deal with sovereign defaults. But the COVID-19 crisis—which hit the poorest developing countries hardest—forced the G20 to jury-rig a combination of a debt-service moratorium (which ended last year) and a restructuring process called the Common Framework, which is built around “creditor committees” of government lenders.

But that process has been exceedingly slow to get off the ground in the first three countries to seek restructuring—Chad, Ethiopia, and Zambia—in large part because Beijing is resistant to debt reductions (as opposed to delayed payments).

Private-sector lenders have done little to contribute to a solution to the debt problem since the pandemic hit. Despite holding a large proportion of developing-country debt, they refused to join the debt-service moratorium and often oppose debt reduction. In Chad, for example, the giant Swiss commodities trader Glencore, which holds over one-half of the country’s debt, has refused to agree to a debt reduction.

Delays in the debt-restructuring process are costly for the affected countries: The IMF requires creditors to provide “financing assurances” of debt restructuring or refinancing in order to proceed with its own loans. When it was just G7 governments hammering out deals through the Paris Club of sovereign lenders, the process often could be completed in weeks; now it’s taking months—resulting in deeper pain among those most exposed to the human impact of a default, as has occurred in Sri Lanka. Ironically, Beijing was rebuffed by the IMF when it called for a Zambia lending program to proceed before a debt agreement had been reached.

A stumbling block in Beijing

To its credit, the international community has taken steps to free up resources to assist countries facing severe economic difficulties. Last year, the IMF approved the issuance of $650 billion in reserve assets to member countries, with wealthy countries slowly starting to make their shares of the issuance available to poorer nations. But even a process as unwieldy—and so far ineffective—as the G20 Common Framework is only available to the poorest countries. There is no systematic path forward for emerging-market countries like Sri Lanka and others that may yet default.

The key stumbling block is China, which—despite its professed commitment to international standards—is likely to remain resistant to international rules that affect its massive exposure as a sovereign lender. There have been recent examples of effective debt workouts for middle-income countries: Ecuador in 2020, for instance, and Suriname last year. The lessons of those two restructurings, which involved Chinese loans, need to be closely examined. Otherwise, more countries like Sri Lanka will be left without recourse.

One immediate need is to consider a return to temporary suspension of interest payments—for both poor and middle-income countries—to give countries breathing room, and to introduce some form of bridge financing if financial assurances to the IMF are not forthcoming in a timely fashion. The “chair’s summary” issued at the conclusion of the finance ministers in Indonesia meeting (in lieu of the absent communiqué) makes clear that the debt issues received attention. But there appears to be little political stamina to take on these weighty issues.

With interest rates and inflation soaring and the winds of crisis building across the globe, world leaders soon will have little choice but to return to these issues in order to avoid a catastrophe.

Vasuki Shastry, formerly with the IMF, Monetary Authority of Singapore, and Standard Chartered Bank, is the author of “Has Asia Lost It? Dynamic Past, Turbulent Future.” Follow him on Twitter: @vshastry.

Jeremy Mark is a senior fellow with the Atlantic Council’s Geoeconomics Center. He previously worked for the IMF and the Asian Wall Street Journal.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/