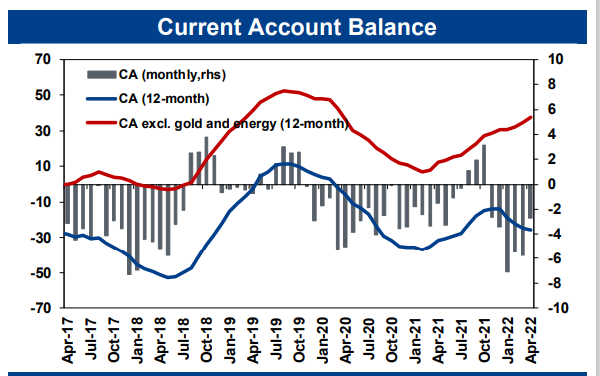

In April, Current Account (CA) posted a monthly deficit of USD2.7bn (Cons.: USD -3.1bn) vs USD1.5bn in the same month of the previous year. The main driver of a USD1.2bn of YoY deterioration in the current account was USD1.7bn of rise on the foreign trade deficit (USD 4.4bn). Also, net primary and secondary deficit deteriorated by USD 991mn to USD -1bn. On the other hand, a USD 1.2bn improvement in net service revenues (USD 2.7bn) limited the monthly deficit. After a bump in May, CA is expected to flatline or even turn into a small surplus over summer months. Because of soaring energy and agri-commodity prices, Turkey’s CA deficit could hover around USD40-45 in the next 12 months, which according to Turkish economists will be tough to finance Turkey’s 5 year CDS premium reached 820 points on Monday, a 15 year high.

Turkey’s Slow-Motion Currency Crash

YF Securities’ comments on the CA are as follows: Net gold exports gave a deficit (USD428mn) for the 4th month in a row (Apr.21: USD +14mn). Additionally, net energy deficit increased by USD3.7bn YoY to USD6.3bn. This was the key driver of the YoY deterioration in the headline figure. As a result, core figures (excluding gold and energy) indicated a USD4bn surplus (Apr.21: USD+1.1bn). In 4M22, CA deficit was USD 21.1bn (4M21: USD -9.1bn) whereas core surplus was USD 9.6bn (4M21: USD +2.7bn).

Erdogan’s Lethal Economic Legacy

As of April 2022, 12-month CA deficit increased to USD 25.7bn (2021: USD -13.7bn) and 12-month core surplus increased to USD 37.4bn (2021: USD 30.5bn).

Net portfolio outflows continued for 7th month. FDI recorded a net inflow of USD 323mn whereas portfolio investments recorded a net outflow of USD 606mn. Non-residents were net buyers in equities by USD 139mn, but net sellers in GDDS by USD 136mn, respectively. Regarding the bond issues in international capital markets, banks reported net repayment of USD 606mn, with central government net borrowing of USD 305mn.

Other investments recorded a net inflow of USD 1.7bn. Banks’ currency and deposits within their foreign correspondent banks decreased by USD 1.5bn and nonresident banks’ deposits held within domestic banks increased by USD 1.1bn.

Regarding the loans provided from overseas banks, government and other sectors realized net borrowing of USD 280mn, USD 34mn and USD 248mn, respectively. Net errors-omissions recorded an inflow of USD4.5bn. Official reserves increased by USD 3.2bn.

Leading indicators suggest 12-month CA deficit continued to increase in May. In addition to the weakness of the Lira currency, increasing trend on commodity prices, especially in energy, lead to significant deterioration in current account figures. This trend is expected to continue in May.

According to temporary figures of the Ministry of Trade, trade deficit was USD10.7bn in May (Apr.22: USD-6.1bn, May.21: -4.2bn). Contribution from the tourism sector in the summer period has a crucial importance on the current account outlook. Our year-end CA deficit to GDP ratio estimate is at 5.3% and upside risks dominate our estimate. BoP figures of May to be announced on July 8.

EROL GÜRCAN – CHIEF ECONOMIST

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/