CPI inflation at 4.81% exceeds median expectation in February and rises to 54.4% in YoY terms

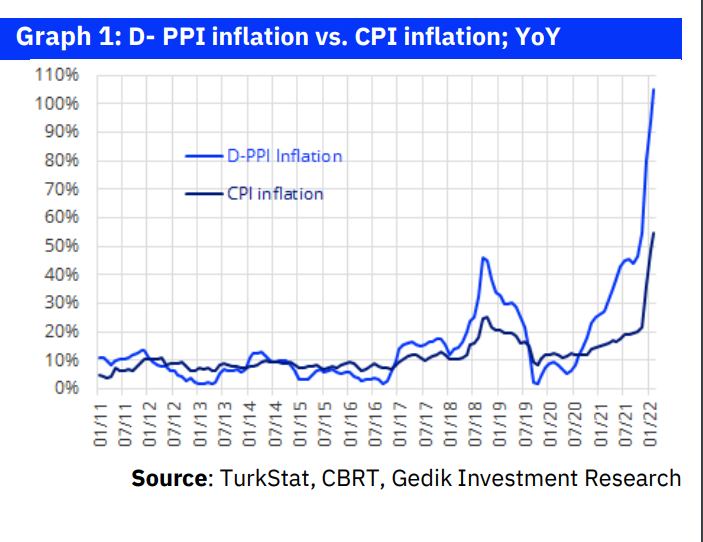

TurkStat revealed February CPI inflation at 4.81%, exceeding the 3.8% median market expectation and our 3.9% estimate. With this result, YoY CPI inflation increased further to 54.4% from 48.7% (36.1% at end- 2021, 21.3% in Nov-21). Core CPI inflation (group C) was 3.75% (vs. our 3.5% expectation), leading to a rise in YoY terms to 44.1% from last month’s 39.5% (31.9% at end-2021, 17.6% in Nov-21). D-PPI inflation was 7.22%, leading to a further rise to 105.0% from last month’s 93.5%.

Prof Turalay Kenç: Turkey’s unorthodox monetary policy

Food inflation remains very high despite the VAT cut in addition to an extended FX passthrough

Despite the VAT cut decision on food products (from 8% to 1%) taken mid-month, food inflation turned out to be 8.4%, which largely explains the deviation in our headline CPI inflation estimate, as we had projected a 5.5-6.0% rise in the food component. Energy inflation at 4.0% was another driver for the February inflation, but it was in line with expectations. Finally, traces of FX passthrough lingered into February (though to a lesser extent), as evident in the 3.3%% rise in durable goods prices and 6.8% rise in other core goods (largely consists of fast consumer products) prices.

Fed Interest Rate Hikes Will Hurt Turkish Economy (And Other Emerging Markets) Badly

Furthermore, services inflation was 3.6% MoM, which is also a reflection of the TL depreciation and deterioration in pricing behaviour with the rise in general price levels.

Energy (and other commodities) price shock will pose further upside pressure on inflation forcing us to revise our forecasts

Escalating tension at the Russia-Ukraine debacle has led to a swift rise in energy and other commodity prices, which will surely pose further (significant) upside on inflation. Analytical models actually suggest that each 10% rise in Brent oil price (in TL terms) leads to some 1.5% rise in inflation with indirect impacts. Yet, this impact may actually turn out to be higher at the current inflation levels. This combined with the surge in other commodity prices, such as metals and cereals, etc. requires a revision in inflation forecasts.

As such, with an optimistic approach, we now expect that CPI inflation may peak at around 60-65% by April/May, average at about 55% (or probably above) in 2022 and may end-up at 35-40% by end-2022. In case Brent oil price rises further to let’s say USD150/bbl, these figures will need to be revised further. Conversely, a potential retreat in energy prices (e.g.: to below USD100/bbl for Brent oil) due to an easing in the Russia-Ukraine debacle and/or slowdown in Global growth, should lead to an improvement in these forecasts.

Serkan Gonencler, Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng