Turkish Economy recorded 7.6% of YoY economic growth in Q2. The figure was slightly above of the consensus of 7.5%. QoQ growth soared to 2.1%, which was the 8th quarterly increase in a row. Finance Minister Nurettin Nebati bragged that Turkey recorded the fastest growth rate among G-20 nations. While this may be true, it does little to soothe the dissatisfaction of the people on the street, because labor’s share of the national output declined further, while fast growth was accompanied with 80% inflation, also a the highest among G2-0 nations.

Recent data suggests that growth is tapering off rapidly, while inflation is soaring. The people of Turkey are stepping towards harsh winter, while the administration fools itself by glorious growth figures which fail to trickle down.

WATCH: Turkish Economy Won’t Survive The Winter

Details of Q2 GDP by Yatirim Finans

In last 4 quarters, annual economic growth figure was +8.2% (2021: +11.4%). Additionally, Turkey’s GDP was TRY10.186bn (2021: TRY7.249bn) and USD827.7bn in last 4 quarters (2021: USD807.1bn). Accordingly, GDP per capita was USD9.710 (2021: USD9.592).

Consumption and net exports were the main contributors. In 2Q22, consumption gave the highest positive contribution by 15.8pps. The other highest contribution came from net exports by 3.1pps. This was the 6th positive contribution in a row. In Q2, exports increased by 16.4% YoY whereas imports increased by 5.8% YoY. A 1.2pps of positive contribution came from the investments for the 3th quarter in a row. The main driver was the machinery investments with 2.2pps of positive contribution (this was the 11th positive contribution in a row) whereas construction continued to give negative contribution of 1.1pps (this was the 6th negative contribution in last 7 quarters). Also, government spending contributed slightly positive to the economic growth by 0.3pps in 2Q22. However, the highest negative contribution came from change in stocks by 12.5pps as was in the last 7 quarters.

Service sector leaded the robust growth performance. According to the production approach, highest contributions came from services by 7.1pps (wholesale/retail trade: +4.7pps) and industry by 1.7pps (manufacturing: +1.6pps) in 2Q22. However, agriculture and construction sectors gave negative contributions by 0.1pps and 0.6pps, respectively. Sectoral total contribution (Gross Value Added) was 7.7pps whereas taxes less subsidies gave a negative contribution of 0.1pps. According to the income approach, share of the compensation of employees in Gross Value Added decreased to 25.4% in 2Q22 from 32.6% in 2Q21 (1Q22: 31.2%) whereas share of net operating surplus/mixed volume increased to 54% in 2Q22 from 49.2% in 2Q21 (1Q22: 47.6%).

Economic growth gave a robust outlook in 1H22. In 1H22, domestic consumption and net exports were the key drivers of the economic growth. Backdated demand as a result of the high inflation environment, strong minimum wage increase and solid loan growth played the main roles in the solid contribution of domestic demand.

Alas, the glory is fading

Looking to the future, Yatirim Finans analysts wrote: “On the other hand, some high frequency data and leading indicators have started to give some momentum loss signs in the domestic economic activity. Additionally, ongoing uncertainties and tight financial conditions in global could put a downward pressure on external demand. We should also note that service sector’s performance (especially tourism) and second increase in minimum wage as of Q3 could limit potential slowdown. CBRT’s recent cut in the policy rate could also support economic activity.

August data heralds slow-down

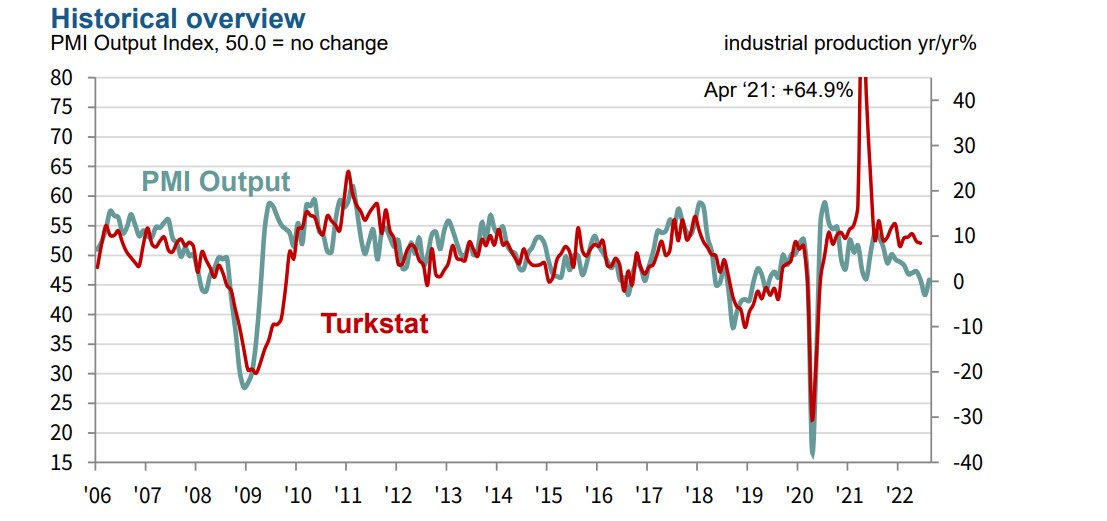

In August, the SP Global-ISO manufacturing PMI stayed below the 50 (expansion level) for the sixth month in a row.

The PMI Report reads: “New orders meanwhile slowed at a sharper pace in

August, with the rate of moderation the fastest since

May 2020. Panelists reported a lack of demand,

price rises and weakness in the global economy.

As such, new export orders also eased, with some reports highlighting a lack of demand from Europe…. “While output moderated to a lesser extent in August,

the trend in new orders was more concerning as

new business slowed to the greatest extent since

the outbreak of the COVID-19 pandemic. Market

conditions are clearly challenging at present, with

weakness in both domestic and export markets.

“One area of respite for firms is that their cost

pressures continued to fade in August. The slowest

rise in input prices in over two-and-a-half years fed

through to a softer rise in charges. Less pronounced

price rises may help to limit the slowdowns in demand

over the months ahead.”

The author Andrew Harker proved wrong, as the government hiked electricity and natural gas prices to industrial users by a whopping 50% as of September. Experts predict more tariff hikes, with allegations of the natural gas monopoly BOTAS being in the red to the tune of TL400 bn.

Both Moody’s and Reuters economists poll reported higher inflation for 2023, from 30% to 40%. This is likely to be an underestimate, because inflation expectations are unmoored with Central Bank expected to lower rates even further in the coming months.

Istanbul inflation announced on 1St of September reached 99.1%, just a smidgeon below what is considered hyperinflation.

Turks have no time to be proud of their naiton2s record breaking GDP growth, they get none of it, while soaring inflation is breaking the backs of even middle class families.

Cuneyt Akman

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/