Weekly Money Stats: Gold Boost Helps CBRT Continue Reserve Build-Up

reserves 18feb

reserves 18feb

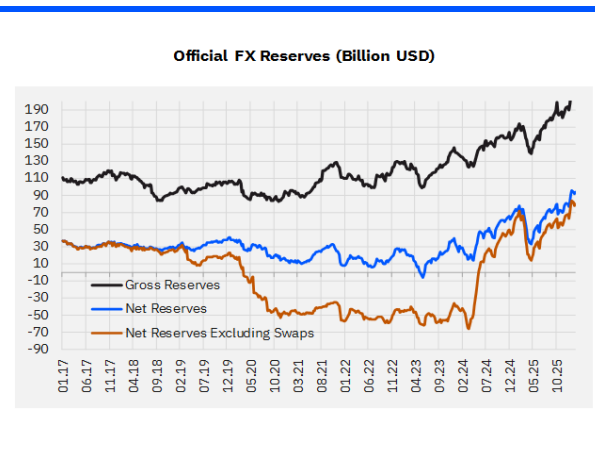

Türkiye’s central bank extended its reserve accumulation in mid-February, with gross and net reserves rising sharply over the year-to-date. However, much of the improvement reflects higher gold prices rather than fresh hard-currency inflows, while recent analytical balance sheet data suggest some pullback in underlying net reserves when adjusted for gold effects.

According to the latest weekly data for the period ending February 13, the Central Bank of the Republic of Türkiye (CBRT) recorded a $4.3 billion increase in gross international reserves, lifting the total from $207.5 billion to $211.8 billion.

Net reserves rose by $2.3 billion to $93.6 billion, while net reserves excluding swaps increased by $1.4 billion to $79.3 billion.

However, the gold-price effect accounted for a significant portion of the improvement. For the week, the gold contribution was calculated at $3.6 billion. Excluding gold, gross reserves are estimated to have risen by just $0.7 billion, while net reserves would have declined by $1.3 billion and net reserves excluding swaps by $2.2 billion.

Gold Driving Year-to-Date Gains

Since the beginning of 2026, gross reserves have increased by approximately $16.9 billion, while net reserves excluding swaps have climbed by around $13.7 billion.

Yet roughly $18.6 billion of this cumulative improvement stems from the rise in global gold prices, underscoring the extent to which valuation effects — rather than sustained FX inflows — are shaping the headline figures.

For context, the lowest level of net reserves excluding swaps was recorded at minus $65.5 billion at end-March 2024. The series reached a recent peak of $71 billion on February 14, 2025.

Analytical Balance Sheet Signals Pressure

Based on the CBRT’s analytical balance sheet data covering the first three business days through February 18, reserves appear to have softened.

Estimates point to a $5.8 billion decline in gross reserves, a $3.5 billion drop in net reserves and a $3.3 billion fall in net reserves excluding swaps.

During that same period, the gold-price effect contributed positively by roughly $0.9 billion. When adjusted for gold, net reserves excluding swaps are estimated to have declined by around $4.2 billion.

The divergence between weekly official data and analytical balance sheet estimates suggests underlying volatility in reserve dynamics.

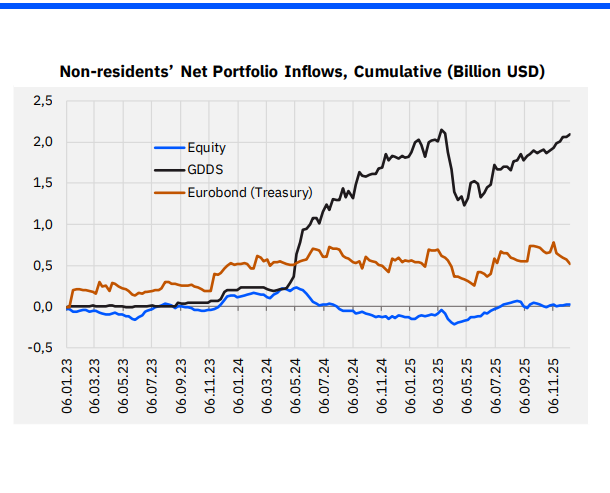

Strong Foreign Inflows into Bonds and Equities

Non-residents remained active in Turkish assets.

In the week ending February 13:

-

Foreign investors recorded $1.3 billion in net purchases of local government bonds (GDDS), bringing the total stock to $23.3 billion.

-

Year-to-date inflows into GDDS reached $5.8 billion.

-

In equities, foreigners posted $322 million in net purchases, lifting the total stock to $44 billion.

-

Equity inflows have continued for 11 consecutive weeks, totaling $2.8 billion over that period.

-

On the Treasury Eurobond side, net purchases reached approximately $1.4 billion, pushing the stock to around $88 billion.

The sustained portfolio inflows have supported reserve accumulation and improved sentiment toward Turkish assets.

FX Deposits and Dollarization Trends

Parity-adjusted FX deposits declined by approximately $1.0 billion during the week, driven by $122 million in sales by households and $910 million by corporates.

Despite the weekly decline, FX deposits have increased cumulatively by $24 billion since the start of 2025.

The share of FX deposits plus FX-protected deposits (KKM) in total deposits stood at 41.1%, significantly below the peak of 68.4% recorded in August 2023 when KKM balances were at their highest.

KKM balances have declined by more than TRY 3.4 trillion (roughly $136.9 billion) from their August 2023 peak, leaving only a limited residual balance after the termination of renewals and new openings for retail clients.

Including investment funds, the broader dollarization ratio declined slightly from 43.8% to 43.4% in the week of February 13. This compares with nearly 70% in mid-2023.

Credit Growth Moderates

Loan dynamics showed mixed signals:

-

FX loans increased by $0.6 billion during the week.

-

Since end-March 2024, FX loans have expanded by 52%, rising by roughly $70 billion to reach $204.2 billion.

-

On an annualized 13-week average basis, commercial loan growth slowed from 29.8% to 29.4%.

-

Consumer loan growth decelerated more sharply, from 51.6% to 47.0%.

The moderation in consumer credit growth aligns with tighter macroprudential policies and elevated borrowing costs.

TRY Deposits and Money Market Funds

TRY deposits rose by TRY 333 billion on a weekly basis, reaching TRY 16.4 trillion.

Money Market Fund (MMF) assets increased by TRY 67.6 billion to TRY 1.6 trillion. However, under the Free Umbrella Fund category, MMF assets declined by TRY 13 billion to TRY 1.2 trillion.

The total active size of FX-denominated mutual funds fell to $79.4 billion. This figure had stood at $25 billion at the beginning of 2024 and around $50 billion at the start of 2025, indicating rapid expansion before the recent pullback.

A Gold-Led Reserve Story

While headline reserve numbers continue to improve, the data suggest that valuation gains from higher gold prices account for a substantial portion of the increase.

Underlying net reserves — when stripped of gold effects — show more modest improvements and, in recent days, some retracement.

The sustainability of reserve accumulation will likely depend on continued foreign portfolio inflows, stable domestic deposit behavior and the trajectory of gold prices in global markets.

Source: Gedik Invest weekly report

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/