Weekly Money Flows: CBRT Reserve Growth Draws Investor Attention

dolarizasyon ocak9

dolarizasyon ocak9

Summary:

Turkey’s central bank reserves posted another sharp increase in early January, supported by strong non-resident inflows into government debt, declining FX deposits, and a favorable gold-price effect. While reserve accumulation remains eye-catching, loan growth is slowing and dollarization continues to trend lower, reinforcing the Central Bank of the Republic of Turkey’s ongoing disinflation strategy.

Reserves Surge as Capital Inflows Continue

Turkey’s external position strengthened further in early January, with a sharp rise in central bank reserves and renewed foreign investor interest in local assets.

According to weekly money flow data, the Central Bank of the Republic of Turkey (CBRT) recorded strong reserve accumulation alongside continued non-resident purchases of Turkish government debt securities (GDDS). At the same time, FX deposits declined modestly, while the long-running unwinding of FX-protected deposits (KKM) accelerated toward its final phase.

Market participants say the scale and pace of reserve rebuilding is increasingly difficult to ignore, particularly given the deep negative reserve position Turkey faced as recently as early 2024.

CBRT RESERVE DEVELOPMENTS

In the week of January 9, a USD 7.7 billion increase in net reserves excluding swaps (a USD 5.5 billion increase when adjusted for the gold-price effect), approximately USD 865 million in

GDDS purchases by non-residents, and an approximately USD 520 million decline in FX deposits stood out. In addition, based on the CBRT’a Analytical Balance Sheet data, as of January

14, we estimate a USD 9.4 billion increase in gross reserves and an approximately USD 8.8 billion rise in net reserves excluding swaps. During this period, the gold-price effect was

positive by around USD 3.5 billion. Since the beginning of the year, the increase in gross reserves and net reserves excluding swaps reached USD 22bn and USD 16 billion, respectively,

with the roughly USD 6bn of these coming from the gold price impact. The weekly developments can be summarized as follows:

➢ Parity-adjusted FX deposits declined by a total of USD 520 million, driven by USD 356 million in purchases by households and USD 876 million in sales by corporates. Since the beginning of

2025, FX deposits have increased by a cumulative USD 21.0 billion.

➢ FX-protected deposit (KKM) balances declined by TRY 724 million (approximately USD 17 million) on a weekly basis, falling to TRY 5.8 billion. The cumulative unwinding since the peak

reached in August 2023 has reached TRY 3.4 trillion (USD 136.8 billion). We expect KKM accounts to be fully phased out in the coming days.

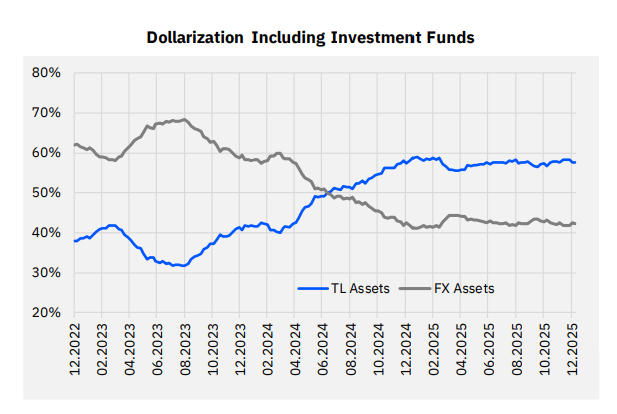

➢ The share of FX deposits + KKM in total deposits stood at 39.6%. This ratio had risen as high as 68.4% in August 2023, when KKM balances peaked.

➢ TRY deposits increased by TRY 5 billion during the week, standing at approximately TRY 16.2 trillion.

➢ FX loans declined by USD 0.4 billion on a weekly basis. Since the end of March 2024, FX loans have expanded by 48%, increasing by roughly USD 65 billion to reach USD 199.3 billion.

➢ Looking at the annualized 13-week average loan growth, commercial loan growth declined from 25.7% to 24.5%, while consumer loan growth decreased from 62.5% to 60.2%.

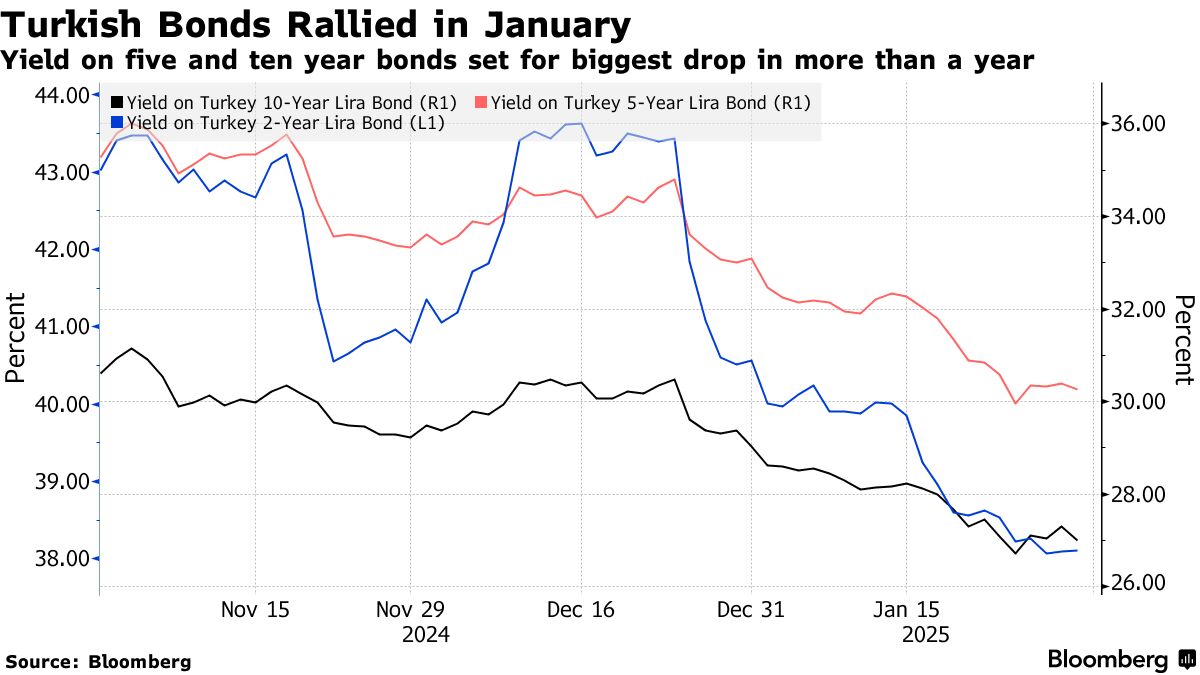

➢ In the week ending January 9, non-residents recorded USD 865 million in net purchases of GDDS, pushing the stock value to approximately USD 18.6 billion. Between mid-March and endApril, GDDS experienced cumulative outflows of USD 9.3 billion, while from early May onwards, cumulative inflows have reached approximately USD 9.8 billion. In equities, non-residents

recorded USD 238 million in net purchases, pushing the stock value above USD 36.3 billion. On the Treasury Eurobond side, approximately USD 79 million in net purchases were recorded,

raising the stock value to around USD 82.6 billion.

➢ In the week of January 9, gross international reserves increased by approximately USD 7.0 billion, rising from USD 189.0 billion to USD 196.0 billion. Over the same period, net reserves

increased by USD 6.3 billion to USD 82.9 billion. Net reserves excluding swaps also increased by approximately USD 7.7 billion (USD 5.5 billion increase when adjusted for the gold-price

effect), reaching USD 70.0 billion. The lowest level of net reserves excluding swaps was USD –65.5 billion at end-March 2024, while the peak was USD 71 billion on February 14, 2025. Based

on the CBRT’s Analytical Balance Sheet, as of January 14 (covering the first three business days of the week), we estimate a USD 9.4 billion increase in gross reserves, an approximately USD

9.3 billion increase in net reserves, and an approximately USD 8.8 billion rise in net reserves excluding swaps. During this period, the gold-price effect was positive by around USD 3.5 billion.

Accordingly, when adjusted for the gold-price effect, net reserves excluding swaps increased by roughly USD 5.2 billion. Since the beginning of the year, the increase in gross reserves and

net reserves excluding swaps reached USD 22bn and USD 16 billion, respectively, with the roughly USD 6bn of these coming from the gold price impact.

➢ The size of the Money Market Fund (MMF) declined by approximately TRY 42 billion in the week of January 9, falling below TRY 1.5 trillion. Under the Free Umbrella Fund, MMF assets

increased by approximately TRY 71 billion, rising to TRY 1.2 trillion. The total active size of FX-denominated mutual funds increased by approximately USD 53 million, reaching USD 79.0

billion. This figure stood at USD 25 billion at the beginning of 2024 and around USD 50 billion at the beginning of 2025. Including investment funds, the dollarization ratio remained unchanged

at 42.4% in the week of January 9. This ratio had reached as high as 70% in mid-2023.

Source: Gedik Invest

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/***