Turkey’s White Goods Sector Loses a Decade of Export Gains as Volumes Fall Back to 2017 Levels

beyaz esya2

beyaz esya2

Summary:

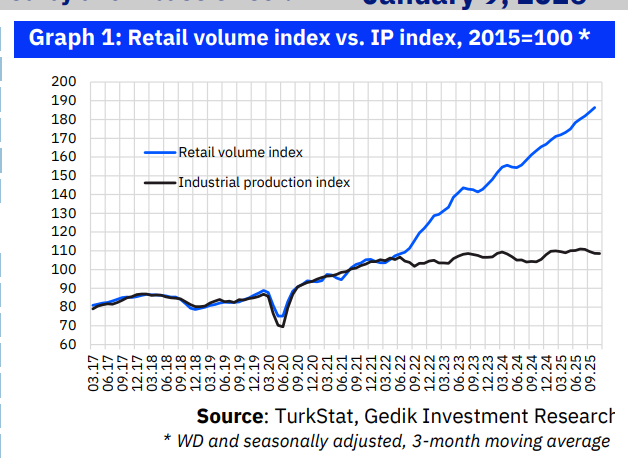

Türkiye’s white goods industry suffered a sharp setback in 2025, with domestic sales, exports and production all declining. Industry data shows export volumes have fallen back to 2017 levels, effectively erasing a decade of gains, as rising costs, weak demand and trade policy uncertainty weigh heavily on competitiveness.

Sales, Exports and Production Decline in 2025

Türkiye’s white goods sector recorded a broad-based contraction in 2025, according to data released by the Turkish Home Appliances Manufacturers Association (TÜRKBESD).

Domestic sales across six main product categories declined 3% year-on-year, with total sales falling to 9.9 million units. Export volumes dropped more sharply, falling by 2.2 million units, or 10%, compared with the previous year.

The prolonged weakness in exports fed directly into production figures, with total output down 9% year-on-year in 2025.

“Exports Have Fallen Back to 2017 Levels”

TÜRKBESD Chairman Alper Şengül said the sector’s export volume fell to 20.2 million units, returning to levels last seen in 2017, despite an annual production capacity of around 29 million units.

“This means that the gains achieved over the past 10 years are now at risk of being lost,” Şengül said.

The white goods industry first exceeded 20 million units in exports in 2017, before reaching a record 26 million units in 2021. Since then, export volumes have steadily declined, with cumulative losses over the past four years reaching 22%.

Competitiveness Under Growing Pressure

With roughly 70% of total production destined for export markets, Şengül stressed that preventing these losses from becoming permanent is critical for the sector.

He warned that rising input, energy and financing costs, combined with uncertainty in global trade policies, have made the industry’s competitive position increasingly fragile.

Additional pressure is coming from Far Eastern manufacturers, which are gaining market share through lower-cost production structures. Şengül noted that competition has intensified particularly in key markets such as the European Union, where Asian producers are becoming more prominent.

Weak Domestic Demand Raises Long-Term Risks

Şengül also cautioned that the downturn in production could become structural if domestic demand fails to recover.

“Reviving the domestic market in a sustainable way is more important than ever,” he said. “White goods are essential household products, and expanding installment options and improving access to financing for consumers would help support healthy domestic demand.”

Input Costs and Anti-Dumping Concerns

TÜRKBESD Vice Chairman Mehmet Yavuz highlighted risks related to an ongoing anti-dumping investigation into flat steel products, which account for roughly 17% of the sector’s input costs.

Yavuz said it is vital that the investigation be concluded without restrictive measures, taking into account both industry needs and the broader national economic interest. He emphasized that not all flat steel demand can be met by domestic production.

“Keeping input costs at reasonable and predictable levels is essential for protecting competitiveness, exports and employment,” he said.

GEKAP Charges Add to Cost Burden

TÜRKBESD Board Member Benay Bakışkan said increases in GEKAP (Recycling Contribution Fees) have become a major cost burden for manufacturers.

She noted that GEKAP unit fees introduced in 2020 had risen by 1,550% to 1,666.7% by December 2025, pushing the sector’s annual GEKAP burden close to TRY 3 billion. Total GEKAP revenue collected from the white goods industry between 2020 and 2025 reached approximately $250 million, she said.

Another board member, Semir Kuseyri, called for a comprehensive action plan to accelerate the adoption of energy-efficient appliances, arguing that such measures could support both competitiveness and sustainability goals.

Sector Faces a Critical Juncture

Industry representatives warn that without targeted support for exports, predictable cost structures and measures to stimulate domestic demand, Türkiye’s white goods sector risks losing its hard-won position in global markets.

The 2025 data, they say, marks a turning point that will shape the industry’s trajectory in the coming decade.

Source: Ekonomim