Turkey’s Current Account Deficit Widens Past Expectations as Gold and Core Imports Surge

cad november2025

cad november2025

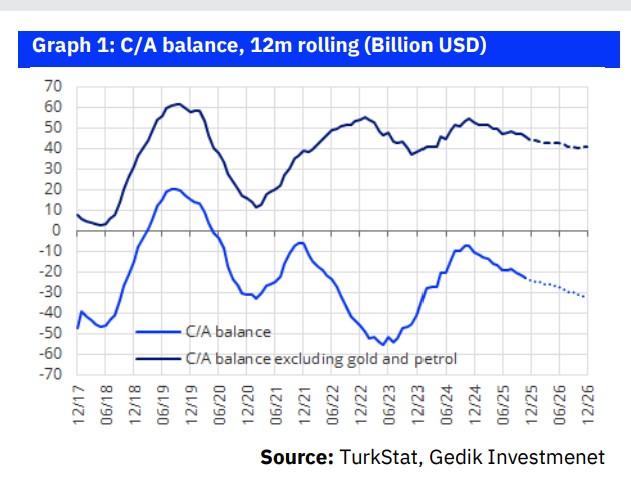

ISTANBUL – Turkey’s current account deficit expanded more sharply than anticipated in November 2025, signaling a rapid deterioration in the country’s external balance following a brief period of improvement during the summer.

Data released for November shows a monthly deficit of USD 4.0 billion, significantly overshooting the market median expectation of USD 3.0 billion. This surge has pushed the 12-month rolling deficit to USD 23.2 billion, equivalent to approximately 1.5% of GDP.

Deteriorating Trends and “Core” Pressure

Analysts note that the “favorable” trend seen in July and August has reversed quickly. According to Akbank Research, the three-month moving average now implies an annualized deficit of USD 42.0 billion if the current momentum persists.

The widening gap is being driven by two primary factors:

-

Gold and Core Imports: A visible acceleration in gold imports and core (non-energy, non-gold) goods suggests that domestic demand remains resilient despite tightening measures.

-

Service & Income Deviations: Lower-than-expected net inflows from services (USD 3.9 billion) and higher primary income outflows (USD 1.6 billion)—which include interest and dividend payments—contributed to the headline miss.

Financing and Reserve Drain

The financing of the deficit remains a point of concern for markets. Official reserves fell by USD 4.8 billion in November alone, exacerbated by a USD 1.9 billion outflow in “net errors and omissions”. For the first eleven months of 2025, cumulative unrecorded outflows (net errors and omissions) reached a staggering USD 18.0 billion.

While the private sector and banks successfully secured USD 3.5 billion in external loans during November, portfolio flows recorded a net outflow of USD 1.0 billion. Although foreign investors purchased USD 1.65 billion in government bonds, these gains were erased by Eurobond redemptions and outward investments by Turkish residents.

2026 Outlook: Risks to the Upside

Both institutions have revised their year-end projections upward. Gedik Yatirim and Akbank now expect the 2025 deficit to finish at approximately USD 24.0 billion, surpassing the government’s Medium-Term Program (OVP) target of USD 22.6 billion.

Looking ahead to 2026, the outlook remains cautious:

-

Gedik Yatirim projects a 2026 deficit of USD 32 billion (1.9% of GDP).

-

Akbank Research forecasts a deficit approaching USD 30 billion (1.6% of GDP), noting that the current policy framework—which prioritizes growth alongside a real appreciation of the Lira—creates strong upside risks to this figure.

Impact on Monetary Policy

The pressure on Central Bank (TCMB) reserves could become a decisive factor in the pace of upcoming interest rate cuts. Akbank analysts emphasize that reserve developments now carry “significant weight” in the TCMB’s reaction function, suggesting that a widening deficit could force a more conservative approach to monetary easing in early 2026.