Turkey’s 2025 Budget Ends With ₺1.8 Trillion Deficit as December Spending Surges

Budget Deficit of Turkey

Budget Deficit of Turkey

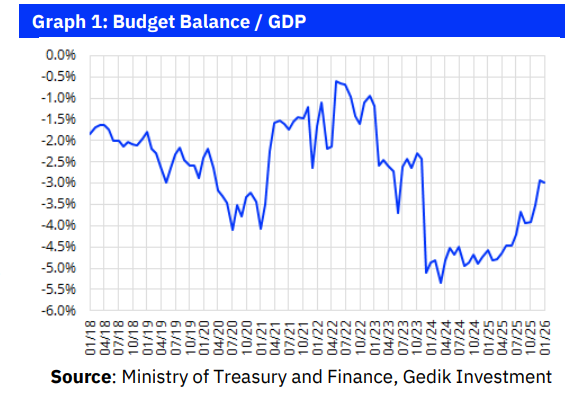

Turkey’s Ministry of Treasury and Finance has released the central government budget implementation results for December 2025, offering a comprehensive snapshot of the country’s fiscal position at year-end. The data shows that while revenues remained strong, a sharp rise in expenditures pushed the budget back into deficit in December, bringing the full-year budget shortfall to ₺1.8 trillion.

The figures provide important insight into the balance between public spending, revenue performance, and debt dynamics at a time when economic policy remains focused on stabilization and disinflation.

December Budget Returns to Deficit After November Surplus

According to the ministry’s statement, the central government budget posted a deficit of ₺528.139 billion in December 2025. This marked a significant reversal from November, when the budget recorded a surplus of ₺169.5 billion.

In December alone, budget expenditures reached ₺1.792 trillion, while budget revenues totaled ₺1.2639 trillion. The gap between spending and income explains the sharp deterioration in the monthly balance, a pattern often observed toward year-end due to accelerated public payments and deferred expenditures.

Despite the monthly deficit, the revenue side continued to show resilience, reflecting the government’s ability to mobilize both tax and non-tax income streams.

Tax Revenues Remain the Backbone of Budget Income

A closer look at December revenues highlights the dominant role of taxation in public finances. Tax revenues amounted to ₺1.047 trillion, accounting for the majority of total income during the month.

In addition, non-tax revenues within the general budget reached ₺216.428 billion, contributing a meaningful supplementary source of funding. These include fees, charges, dividends from state-owned enterprises, and other non-recurring income.

The composition of revenues suggests that while taxation continues to anchor fiscal capacity, non-tax revenues play an increasingly important role in supporting overall budget performance.

Primary Balance Deteriorates in December

Beyond the headline deficit, the data also sheds light on the primary balance, which excludes interest payments and is closely monitored by economists as an indicator of fiscal discipline.

In December, primary (non-interest) expenditures climbed to ₺1.675 trillion, resulting in a primary deficit of ₺411.5 billion for the month. This deterioration reflects the scale of end-of-year spending commitments, including transfers, social expenditures, and operational costs.

While a monthly primary deficit is not uncommon in December, its size underscores the pressure placed on public finances during the final weeks of the fiscal year.

Full-Year 2025 Budget: Spending Outpaces Revenues

When assessed over the full year, the fiscal picture becomes clearer. In 2025 as a whole, the central government:

Total expenditures reached ₺14.6347 trillion

Total revenues amounted to ₺12.8355 trillion

As a result, the annual budget deficit stood at ₺1.8 trillion, confirming the scale of fiscal imbalance accumulated throughout the year.

Although revenues expanded significantly, expenditure growth remained faster, reflecting increased public sector commitments, investment needs, and social spending pressures.

Annual Revenue Performance: Taxes Lead, Non-Tax Income Supports

The ministry’s data shows that total tax revenues in 2025 reached ₺11.049 trillion, highlighting the strong contribution of economic activity and inflation-adjusted tax bases to public income.

At the same time, non-tax revenues totaled ₺1.786 trillion, reinforcing the budget’s income side and partially offsetting spending pressures. This diversified revenue structure helped limit the deficit from widening further, despite elevated expenditure levels.

Primary Surplus Achieved on a Yearly Basis

One of the most notable aspects of the 2025 budget performance is the positive primary balance achieved over the full year, despite the headline deficit.

Total primary expenditures for 2025 amounted to ₺12.5802 trillion, and by year-end, the budget recorded a primary surplus of ₺225.2 billion.

This outcome indicates that, excluding interest payments on public debt, the government generated more revenue than it spent. From a fiscal sustainability perspective, a primary surplus is often viewed as a stabilizing factor, as it helps contain debt dynamics even when overall deficits persist.

What the Numbers Signal for Fiscal Policy

The 2025 budget results illustrate a dual reality in Turkey’s public finances. On one hand, strong revenue performance—particularly in tax collection—demonstrates the state’s capacity to generate income. On the other hand, high expenditure levels continue to exert pressure on the overall balance.

The return to a large deficit in December highlights the seasonal concentration of spending, while the annual figures underscore the challenge of aligning expenditure growth with long-term fiscal discipline.

At the same time, the achievement of a yearly primary surplus sends a cautiously positive signal to markets and policymakers. It suggests that, despite elevated interest costs and spending needs, the core fiscal stance retains some control.