Turkey Weighs Pension System Overhaul as Inequality Debate Intensifies

pension raise

pension raise

Turkey’s social security system is facing renewed scrutiny as government-backed improvements to the lowest retirement pensions have unintentionally widened perceptions of inequality among retirees who paid higher premiums for longer periods. Since 2019, successive increases in the minimum pension have narrowed the income gap between low- and high-contribution retirees, prompting policymakers to reconsider the pension system’s overall structure.

In response to mounting criticism, the Ministry of Labor and Social Security has established a dedicated commission to examine the retirement framework and pension calculations. The commission is tasked with evaluating potential revisions to the system and developing policy proposals to address imbalances in pension payments, particularly for retirees with higher contribution records.

Minimum Pension Increases Spark Structural Concerns

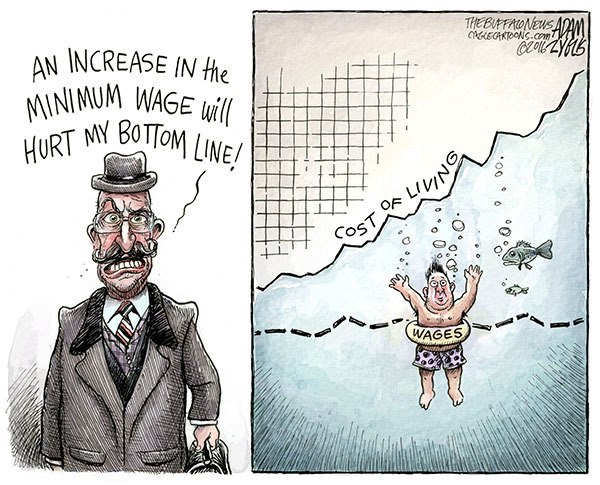

Government regulations that repeatedly raised the minimum pension level were designed to protect low-income retirees against inflation and rising living costs. However, these measures have also had unintended consequences. As minimum pensions increased, the difference between retirees who paid substantial premiums and those with limited contribution histories steadily eroded, intensifying debate over fairness within the system.

Critics argue that this compression effect undermines the contributory principle of social security, where higher payments and longer working lives are expected to translate into proportionally higher pensions. As a result, public discourse around pension reform has gained momentum, particularly within political and bureaucratic circles.

Pension Reform Gains Momentum Within AK Party

Within the ruling AK Party, discussions have increasingly focused on re-evaluating the entire social security structure. Party officials have raised the possibility of comprehensive reforms that would address long-standing structural issues rather than temporary adjustments. These conversations are taking place not only within relevant ministries but also at the party’s central leadership level.

Strategic planning bodies within the AK Party have reportedly conducted internal assessments of the pension system, highlighting the need to restore balance between contribution levels and retirement income. The growing consensus is that incremental increases to the minimum pension alone are no longer sufficient to address systemic distortions.

Five Million Retirees Now Classified as Minimum Pension Earners

One of the most striking outcomes of recent policy decisions is the rapid expansion of the minimum pension category. Following the latest increase, which raised the minimum pension to 20,000 Turkish lira, the number of retirees receiving this amount surged to approximately five million. By comparison, official figures from July 2025 put this number at 3.7 million, underscoring the category’s growth pace.

Government officials acknowledge that each adjustment cycle has contributed to this trend, as more retirees’ calculated pensions fall below the legally mandated minimum and are subsequently topped up by the state. This dynamic has further fueled criticism from retirees who contributed more but now receive payments nearly identical to those with lower lifetime contributions.

Ministry Commission to Explore New Pension Formulas

According to information obtained from government sources, the newly formed commission at the Ministry of Labor and Social Security will focus on developing alternative pension formulas and conducting impact analyses. The goal is to design a framework that preserves social protection for low-income retirees while reestablishing a clearer link between contribution levels and pension outcomes.

Officials stress that any proposed changes must be financially sustainable and compatible with long-term demographic trends. Turkey, like many countries, faces an aging population and rising pension expenditures, making structural reform increasingly urgent.

Party Officials Warn Current Balance Is Unsustainable

Senior AK Party figures have openly acknowledged the growing discontent among retirees. Party insiders note that when the AK Party first came to power, the lowest pension was approximately 1.5 times the minimum wage, a balance that has since deteriorated. Today, restoring that equilibrium has emerged as a top policy priority.

Officials emphasize that retirees’ concerns are legitimate, particularly for those who paid higher premiums yet see their pensions converge toward the minimum level. According to party sources, the narrowing gap between high- and low-contribution pensions “cannot be sustained much longer,” reinforcing the need for a new model supported by detailed economic analysis.

Elitaş Signals Possible July Adjustment

AK Party Deputy Chairman Mustafa Elitaş has also weighed in on the debate, acknowledging that the current minimum pension level remains insufficient for meeting basic living expenses. He noted that pension increases have been implemented with inflation dynamics in mind, but conceded that a 20,000-lira pension does not provide adequate purchasing power.

Elitaş emphasized the importance of long-term stability over short-term relief, noting that sustainable welfare improvements depend on increased state revenues. He added that without stronger fiscal capacity, lasting gains for retirees would be difficult to achieve. Importantly, Elitaş signaled that new pension-related regulations could be placed on the agenda in July, raising expectations of near-term policy action.