Turkey Sees Strong Reserve Build-Up as Foreign Inflows Accelerate, Domestic Dollarization Persists

fof 30jan

fof 30jan

As foreign financial investment trickles in, the CBRT continues to build up FX reserves, which could eventually lead to a virtuous cycle of higher reserves and de-dollarization. During the week, Bloomberg and Anadolu Agency reported that BlackRock’s EM fund and Norway’s sovereign wealth fund began building equity positions in Turkey. Ziraat Bank and İşbank, respectively, raised $1 billion and $500 million in bond markets, attesting to rising appetite for Turkish risk.

As foreign funds and lenders begin taking a more positive approach to the Turkey story, domestic investors remain sceptical, continuing to add to their FX deposit positions.

Nevertheless, the CBRT appears to believe that FX inflows have reached a level that could threaten financial stability, prompting higher required reserves for swap-like transactions and the announcement of new credit caps. Below is a recap of weekly fund flows, courtesy of Gedik Invest.

Recap of flow of funds

Turkey’s foreign exchange reserves continued to rise sharply in late January, supported by strong portfolio inflows, rising non-resident bond and equity purchases, and valuation gains from gold. While foreign investors show growing confidence in Turkish assets, domestic investors remain cautious, increasing foreign currency deposits. Recent macroprudential tightening by the central bank suggests policymakers are increasingly concerned about the pace and composition of capital inflows.

Foreign Interest Strengthens, Reserves Surge

Turkey’s Central Bank (CBRT) posted another significant improvement in its reserve position in the week ending January 23, driven by foreign portfolio inflows, valuation effects, and continued normalization of monetary conditions.

According to calculations based on CBRT and Gedik Invest data, net reserves excluding swaps rose by approximately USD 5.0 billion during the week, although this figure translates into a USD 3.4 billion decline when adjusted for the gold price effect. Gross reserves increased by around USD 10.4 billion, reaching USD 215.6 billion, while net reserves climbed to USD 95.5 billion.

Preliminary CBRT Analytical Balance Sheet data covering the first three business days of the following week (as of January 28) point to a further USD 8.9 billion increase in gross reserves and a USD 6.5 billion rise in net reserves excluding swaps, largely driven by a strong positive gold price impact of around USD 10 billion.

Since the beginning of the year, gross reserves have increased by approximately USD 35.4 billion, while net reserves excluding swaps have risen by USD 27.5 billion, with nearly USD 21.7 billion attributable to gold valuation gains.

Domestic Dollarization Continues Despite Policy Tightening

Despite rising foreign confidence, domestic residents continue to increase foreign currency holdings. Parity-adjusted FX deposits rose by approximately USD 1.8 billion during the week, driven primarily by USD 1.6 billion in household purchases and USD 168 million in corporate purchases.

Since the start of 2025, cumulative FX deposit growth has reached USD 23.3 billion, highlighting persistent domestic caution toward the Turkish lira.

The combined share of FX deposits and FX-protected deposits (KKM) in total deposits stood at 40.1%, down sharply from a peak of 68.4% in August 2023, when KKM balances were at their highest.

KKM balances have declined by more than TRY 3.4 trillion (USD 136.9 billion) since their August 2023 peak, following the termination of renewals and new openings for retail customers. Only a limited residual balance remains in the system.

Meanwhile, TRY-denominated deposits increased by TRY 31 billion on a weekly basis, bringing the total to approximately TRY 16.7 trillion.

Credit Growth Moderates, FX Loans Expand

FX-denominated loans increased by approximately USD 1.7 billion during the week. Since the end of March 2024, FX loan volumes have expanded by 48.8%, rising by nearly USD 66.7 billion to reach USD 201.1 billion.

On a 13-week annualized basis, loan growth continued to ease. Commercial loan growth slowed from 26.7% to 25.3%, while consumer loan growth declined from 52.7% to 51.9%, reflecting the cumulative impact of tighter monetary and macroprudential policies.

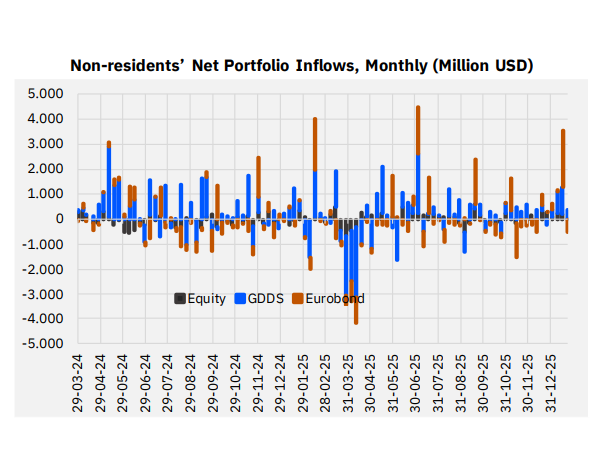

Portfolio Inflows Remain Supportive

Foreign investor activity remained constructive across Turkish assets.

In the week ending January 23, non-residents recorded USD 340 million in net purchases of local government bonds (GDDS), lifting the total stock to USD 17.8 billion. Year-to-date inflows into the GDDS market reached USD 2.6 billion.

Equity markets also saw continued foreign interest. Non-residents posted USD 26 million in net equity purchases, bringing the total stock value to USD 33.1 billion. Foreign inflows into Turkish equities have now continued uninterrupted for eight consecutive weeks, totaling USD 1.38 billion over this period.

By contrast, the Treasury Eurobond market recorded approximately USD 500 million in net foreign sales, reducing the outstanding stock to around USD 81.8 billion.

Money Market Funds and Dollarization Metrics

Money market fund (MMF) assets increased by approximately TRY 58 billion during the week, reaching TRY 1.56 trillion. Within the Free Umbrella Fund category, MMF assets rose by TRY 30.8 billion to TRY 1.22 trillion.

FX-denominated mutual fund assets increased by approximately USD 846 million, reaching USD 80.5 billion. This compares with USD 25 billion at the start of 2024 and roughly USD 50 billion at the beginning of 2025, underscoring the rapid pace of financial dollarization in investment products.

Including investment funds, Turkey’s overall dollarization ratio increased from 42.1% to 42.7% during the week. The ratio had peaked at nearly 70% in mid-2023.

Policy Signals: Inflows Welcome, Excesses Not

While reserve accumulation has strengthened Turkey’s external position and improved market confidence, recent policy moves by the CBRT suggest concern that inflows may be becoming excessive or destabilizing.

By tightening reserve requirements on swap-like transactions and introducing new credit caps, policymakers appear intent on managing the quality and pace of capital inflows, rather than allowing an uncontrolled surge in leverage or liquidity.

The data underline a key tension in Turkey’s current macro framework: foreign investors are returning rapidly, while domestic savers remain cautious. Whether rising reserves can ultimately trigger sustained de-dollarization will depend on the durability of policy credibility and continued macroeconomic discipline.

Source: Gedik Invest, CBRT