Treasury Bond Auctions Raise Nearly ₺78 Billion as Investor Demand Remains Strong

treasury

treasury

Turkey’s Treasury and Finance Ministry successfully raised substantial funding through two government bond auctions, underscoring continued investor appetite for domestic debt instruments despite tight financial conditions. According to official data, total sales from the auctions reached ₺36.42 billion, while pre-auction sales of ₺41.4 billion via ROT transactions pushed overall borrowing to ₺77.8247 billion.

The auctions covered two separate instruments: a 12-month zero-coupon Treasury bill and a four-year variable-rate government bond, each attracting robust demand from market participants.

Strong Demand in 12-Month Zero-Coupon Bond Auction

The Treasury’s 12-month (364-day) zero-coupon bond auction generated significant interest. Net sales amounted to ₺27.919 billion, while the nominal sales volume reached ₺38.1498 billion. Investor demand far exceeded supply, with total bids coming in at ₺86.7644 billion, highlighting strong appetite for short-term sovereign paper.

Yield levels reflected prevailing market conditions. In the auction, the compound interest rate ranged from a low of 34.40% to a high of 36.91%, with an average compound yield of 36.64%. The average simple interest rate was also calculated at 36.64%, indicating consistency between pricing metrics.

The bond was issued for the first time in this maturity. Pricing details showed a minimum price of ₺73.041 and an average price of ₺73.182, aligning with the elevated yield environment.

In terms of settlement, the value date was set for Wednesday, January 7, 2026, while the redemption date was announced as January 6, 2027. The one-year maturity makes the instrument particularly attractive for investors seeking relatively short-term exposure amid uncertainty over longer-term rate trajectories.

Variable-Rate Bond Auction Complements Treasury Funding

Alongside the short-term bill, the Treasury also conducted an auction for a four-year (1,456-day) variable-rate government bond with semiannual coupon payments. This auction resulted in net sales of ₺8.5057 billion, while the nominal sales total reached ₺8.915 billion.

Demand again proved strong, as market participants submitted ₺71.905 billion in bids, significantly exceeding the amount offered. The high level of interest suggests continued preference for variable-rate instruments, which can provide some protection against interest rate volatility.

In this auction, the periodic interest rate settled within a narrow range, with the lowest rate at 19.41%, the average at 19.49%, and the highest at 19.53%. The relatively tight spread indicates stable pricing expectations among investors.

Pricing data showed a minimum price of ₺95.140 and an average price of ₺95.406, reflecting market confidence in the longer-term instrument despite its extended maturity.

The bonds sold in this auction will be issued on Wednesday, January 7, 2026, while the redemption date for the reissued bond has been set for January 2, 2030. The longer maturity profile supports the Treasury’s strategy of extending the duration of its domestic debt while managing refinancing risks.

ROT Sales Push Total Borrowing Higher

In addition to the auctions themselves, the Treasury conducted ROT (non-competitive) sales worth ₺41.4 billion prior to the bidding process. When combined with auction results, total borrowing for the day climbed to ₺77.8247 billion, marking one of the more sizable single-day funding operations in recent periods.

ROT sales are often used to meet demand from primary dealers and institutional investors, enhancing liquidity and supporting smooth auction outcomes. Their inclusion significantly boosted overall funding volumes and signaled confidence among major market participants.

What the Results Signal for Markets

The strong bid-to-cover ratios and substantial demand across both auctions suggest that domestic investors remain willing to absorb government debt at current yield levels. High participation reflects expectations that interest rates may remain elevated for some time, making Treasury securities attractive from a return perspective.

At the same time, the mix of short-term zero-coupon bills and longer-term variable-rate bonds illustrates the Treasury’s balanced borrowing strategy. By diversifying maturities and instruments, authorities aim to reduce refinancing pressure while maintaining flexibility in debt management.

Market observers note that continued demand for variable-rate bonds also reflects caution about future inflation and rate dynamics. These instruments allow investors to benefit from adjustments in coupon payments if benchmark rates change, making them a popular hedge in uncertain macroeconomic conditions.

Outlook for Treasury Borrowing

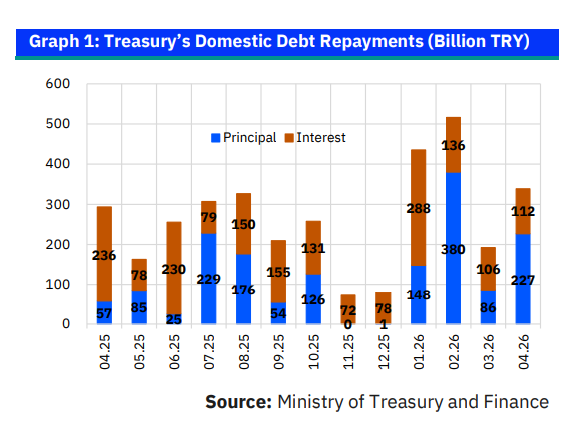

Going forward, analysts expect the Treasury to maintain an active issuance calendar as it manages budget financing needs and rollover obligations. Investor appetite, as demonstrated in this latest round of auctions, provides room for continued domestic borrowing without immediate strain on demand.

However, yield levels remain closely tied to broader inflation trends, monetary policy signals, and global financial conditions. As such, future auctions will be watched carefully for shifts in pricing, demand composition, and maturity preferences.