Property Market Paradox: Tax Bills Triple While Real Prices Stagnate

real estae tax

real estae tax

Homeowners across Turkey are facing a fiscal “sticker shock” this year as property tax assessments see unprecedented increases, in some cases tripling overnight. This sharp rise in the tax burden comes at a paradoxical moment for the real estate sector, as data shows real property prices are struggling to keep pace with inflation.

The Property Tax Surge: A Three-Fold Increase

As the new year began, property owners were met with a drastic revision in the “rayiç bedel” (market valuation assessments) determined by local municipalities. These valuations serve as the basis for calculating annual property taxes, and the 2026 updates have hit budgets hard, particularly in major metropolitan areas like Istanbul.

According to reports from Cumhuriyet, the tax burden has escalated rapidly. For instance, a taxpayer in Istanbul who paid 3,300 TL in 2023 saw their bill jump to 9,900 TL in 2024—a staggering 200% increase. Real estate expert Mustafa Hakan Özelmacıklı confirmed that these spikes are not isolated incidents, noting that tax amounts in many districts have effectively tripled compared to the previous year.

The burden is even heavier for landowners. In Küçükçekmece, a taxpayer with two non-zoned (unplanned) plots of land saw their tax liability soar from 33,058 TL last year to 99,237 TL. Experts highlight that land is taxed at roughly three times the rate of residential buildings, and if a plot has zoning rights but construction has not yet commenced, the tax penalties are severe.

High Valuations Stalling the Market

Beyond the annual tax bill, these high municipal valuations are creating a secondary crisis in the sales market. Because deed transfer fees (tapu harcı) are calculated based on these official valuations, the cost of buying and selling property has spiked. Industry insiders report that these inflated costs are bringing property transactions to a virtual standstill in some districts, as the gap between the official valuation and the actual transaction price narrows or, in some cases, flips.

The Silver Lining: Who is Exempt?

Despite the widespread increases, certain groups remain protected under Turkish law. Homeowners who own only one residence—not exceeding 200 square meters—are exempt from property tax if they fall into the following categories:

-

Retirees

-

Relatives of martyrs and veterans

-

Widows and orphans receiving state pensions

Real Estate Market Outlook: Real Prices in Negative Territory

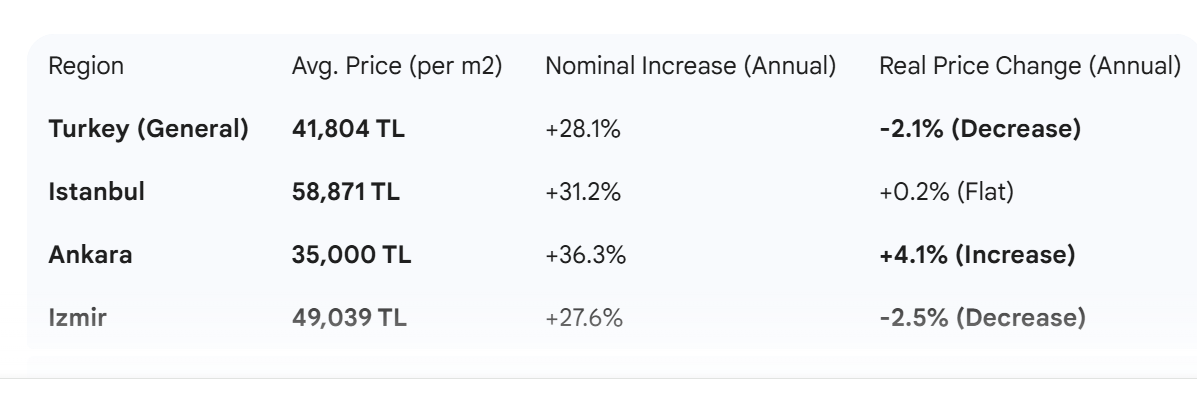

While tax bills are climbing, the actual investment value of Turkish real estate is showing signs of cooling when adjusted for inflation. According to the sahibindex Sale Housing Market Outlook for January 2026, the annual change in real housing prices remains in negative territory for much of the country.

Key Market Statistics (January 2026):

While nominal (current) prices continue to rise—with Istanbul leading the way at nearly 59,000 TL per square meter—the “real” value (inflation-adjusted) has dropped by 2.1% nationwide. Izmir saw the sharpest real decline at 2.5%, while Ankara remains an outlier with a 4.1% real increase, signaling continued strong demand in the capital.

Demand and Market Velocity

Interestingly, the Housing Demand Index rose by 7.2% in December 2025, suggesting that buyers are still looking for opportunities despite the tax hurdles. However, the time it takes to sell a property (listing age) has increased nationwide, except in Istanbul, where the market remains slightly more liquid.

For property owners, the current environment presents a “pincer movement”: rising maintenance and tax costs on one side, and stagnating real asset values on the other.

Price data: Courtesy of sahibinden.com