Private Forecaster Predicts Inflation Bump in January

enflasyon5

enflasyon5

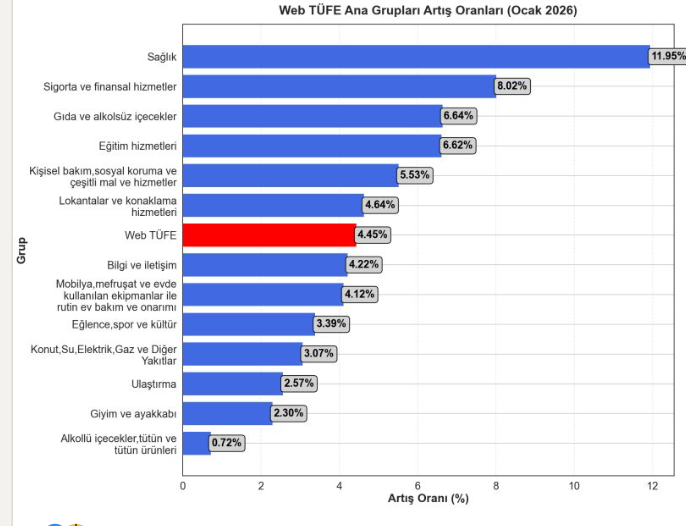

According to a new inflation measurement tool developed by a team of independent economists and data scientists, Turkish consumer prices experienced a historic surge in the first month of 2026. The WebCPI (WebTÜFE), which utilizes real-time web-scraping technology to track millions of price points across digital platforms, reported a monthly increase of 4.45% for January, marking the highest monthly climb since the index’s inception.

On an annual basis, the WebCPI recorded an inflation rate of 32.24%. Analysts note that these figures are currently provisional, as the index awaits the official 2026 basket weightings for final revision.

Food Inflation Hits Record Highs

The most alarming data point in the January bulletin was the surge in food and non-alcoholic beverages, which rose by 6.64% month-on-month. This represents the sharpest monthly increase ever measured by the tool.

-

The “Vegetable Shock”: Fresh vegetable prices skyrocketed by 37.81%, contributing a staggering 4.53 percentage points to the overall food inflation figure.

-

Unprocessed vs. Processed: Unprocessed food items jumped by 10.67%, largely driven by the vegetable surge and a continued, though decelerating, rise in red meat prices. Processed food saw a broader but comparatively lower increase of 3.44%.

Services and Rents Face January Adjustments

Service-sector inflation remained “sticky” due to seasonal price setting and wage-related adjustments, rising 6.99% in January.

-

Rent Hikes: Monthly rental inflation hit 7.31%, as January typically sees a high concentration of contract renewals.

-

Hospitality: Hotels and restaurants saw a 4.64% increase, influenced by New Year price revisions and minimum wage adjustments. Despite the monthly jump, the annual service inflation rate saw a base-effect drop, falling from 49.1% to 43.07%.

Energy and Core Trends

The energy group remained the only stabilizing factor, with a limited monthly increase of 0.60%. This was primarily due to managed price caps and a 0.94% decline in gasoline prices.

However, core inflation indicators—the “B” and “C” indices—both rose by 3.34% on a seasonally adjusted basis. This suggests that while energy prices are being suppressed by government policy, the underlying inflationary pressure (the “core”) is still intensifying, with the trend accelerating from 1.93% to 2.87%.

About the WebCPI Index

The WebCPI (webtufe.com) has become a critical alternative benchmark for the Turkish economy. By scraping daily price data from thousands of e-commerce sites, it provides a “high-frequency” look at inflation trends long before official government figures are released. For the Central Bank (CBRT) and global investors, this tool serves as an early warning system for price volatility, particularly in fast-moving categories like food and household goods.