Matriks Research: Where Are Turkish Stocks, FX and Interest Rates Headed in 2026?

matriks

matriks

Editor’s Note: This is the firsat of its kind when it comes to a domestic institution compiling consensus numbers on a wide variety of market and economic forecasts

Summary:

A broad review of 2026 strategy reports by Turkish banks and brokerage houses points to a consensus of cautious optimism for Türkiye’s financial markets. While the disinflation trend is expected to continue, institutions stress that global geopolitical risks, tariffs and financial volatility call for a selective and disciplined investment approach.

Cautious Optimism Dominates 2026 Outlooks

According to a comprehensive study by Matriks Haber, based on 2026 strategy reports from 18 banks and brokerage firms, the dominant scenario assumes continued disinflation alongside gradual monetary easing. However, analysts underline that global risks—from geopolitics to trade policy uncertainty—require investors to remain flexible and opportunity-focused rather than outright bullish.

The review covers reports from institutions including Garanti BBVA, Yapı Kredi Yatırım, QNB, ING, OYAK Yatırım, Gedik Yatırım, Deniz Yatırım and Ünlü & Co, among others.

Borsa Istanbul: Upside Potential Remains

Expectations for Turkish equities are shaped by improving macro stability, positive real interest rates and the prospect of gradual rate cuts. Under this framework, TL-denominated assets are seen as retaining upside potential.

Among the 13 institutions that provided year-end forecasts for the BIST-100 index, the average target stands at 16,043 points. The highest forecast is 16,680, while the lowest is 15,200. Median projections cluster around 16,100, implying more than 30% upside from current levels.

The prevailing view is that Turkish equities could reprice higher in 2026, provided disinflation remains on track and financial stability is preserved.

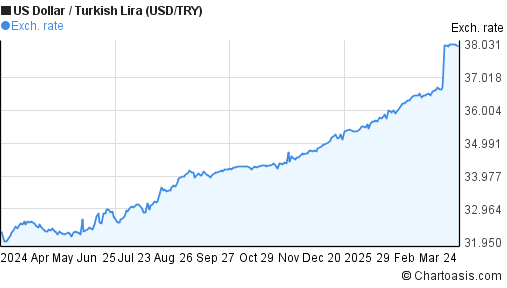

FX Outlook: Dollar, Euro and Parity Expectations

For foreign exchange markets, institutions expect continued depreciation in the Turkish lira, albeit in a more orderly fashion:

-

USD/TRY (end-2026): Median forecast of 51.28 (14 institutions)

-

EUR/TRY (end-2026): Median forecast of 60.85 (9 institutions)

Average expectations for 2026 are 47.70 for USD/TRY and 55.93 for EUR/TRY.

On the euro-dollar front, the median year-end forecast for EUR/USD is 1.20, with the annual average estimated at 1.1989.

Gold and Bond Market Projections

Gold remains a favored hedge in strategy reports. The four institutions providing gold forecasts see spot gold reaching $4,975 per ounce by the end of 2026.

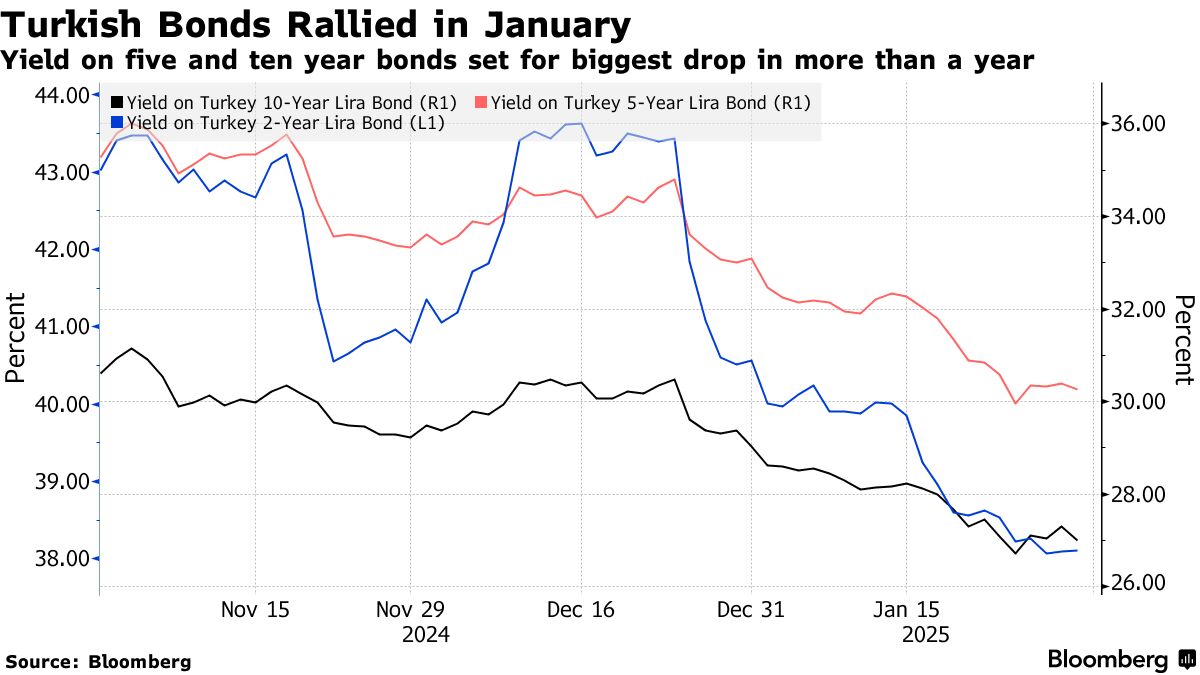

In fixed income markets:

-

2-year government bond yield: Median end-2026 forecast of 27.30%

-

10-year government bond yield: End-2026 expectation of 23.90%

The downward slope in yields reflects expectations of easing monetary conditions alongside declining inflation.

Inflation, Policy Rates and Growth

Macroeconomic projections suggest a gradual normalization process:

-

End-2026 median inflation forecast: 23.45%

-

End-2027 inflation forecast: 18.15%

-

Average CPI inflation in 2026: 26.20%

Core inflation is expected to decline to 23.25% by end-2026, with an annual average of 24.36%.

For monetary policy, 14 institutions expect the Türkiye Cumhuriyet Merkez Bankası policy rate to fall to 28.75% by the end of 2026, with further easing to 22.75% projected for 2027.

Growth, Budget Balance and Current Account

Türkiye’s economic growth is expected to remain resilient:

-

2025: 3.7%

-

2026: 4.0%

-

2027: 4.5%

On public finances, nine institutions estimate the budget deficit-to-GDP ratio at 3.6% in 2025 and 3.5% in 2026. The primary balance is forecast to post a modest deficit of 0.3% in 2025 and 0.1% in 2026.

For the external balance, 12 institutions project the current account deficit at 1.45% of GDP in 2025 and 1.65% in 2026, corresponding to deficits of $22.5 billion and $25.2 billion, respectively.

Bottom Line

Matriks Haber’s compilation shows that while Türkiye’s markets face ongoing global and domestic risks, expectations for 2026 remain broadly constructive. Equity markets, in particular, are seen as offering meaningful upside if macro stability and disinflation are maintained.

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/