Markets Price in 150-Basis-Point Rate Cut from Turkey’s Central Bank

tcmb-istanbul

tcmb-istanbul

Summary:

Markets expect the Central Bank of the Republic of Türkiye (TCMB) to cut its policy rate by 150 basis points at its January meeting, according to a Bloomberg HT survey. Most economists anticipate a continued, cautious easing cycle, with policy rates seen falling toward 29% by the end of 2026.

Survey Points to January Rate Cut

Markets are increasingly confident that the Central Bank of the Republic of Türkiye will deliver another interest rate cut this month. According to a January survey conducted by Bloomberg HT, economists expect a 150-basis-point reduction at the TCMB’s policy meeting scheduled for January 22.

The median forecast of the 20 institutions participating in the survey points to a cut in the one-week repo rate to 36.5% from the current level of 38%.

Range of Expectations Remains Wide

Survey results show some dispersion in expectations, though the consensus remains firmly tilted toward easing. The lowest forecast for the January policy rate stands at 36%, while the most hawkish participants see the rate unchanged at 38%.

Only two of the 20 institutions surveyed expect the central bank to keep rates on hold in January, highlighting the market’s broad expectation that the easing cycle will continue.

Longer-Term Outlook: Gradual Easing

Beyond the January decision, participants also shared expectations for the medium-term policy path. The median forecast for the policy rate by the end of 2026 stands at 29%, signaling expectations of gradual but sustained monetary easing.

For end-2026, the most optimistic projection among respondents points to a policy rate as low as 24%, while the highest estimate stands at 32%, reflecting uncertainty over inflation dynamics, fiscal discipline and political factors.

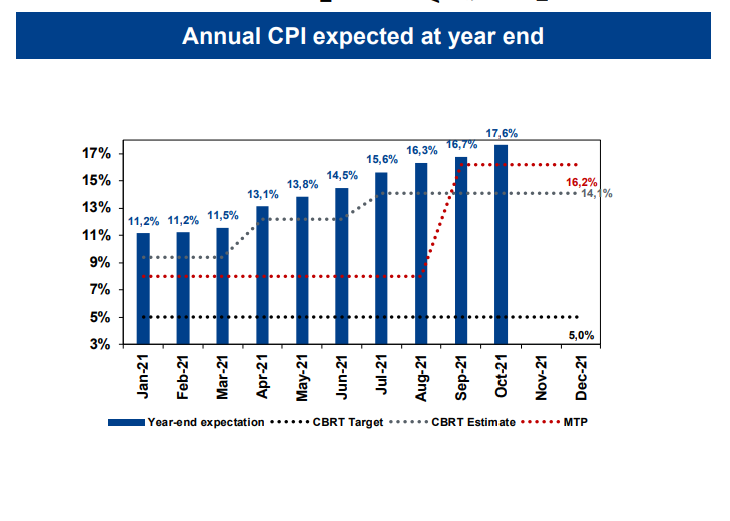

Markets Watch Inflation and Credibility

Investors remain focused on whether disinflation continues at a pace that allows the TCMB to cut rates without reigniting price pressures. While inflation has eased from its peaks, policymakers are still navigating a delicate balance between supporting growth and maintaining monetary credibility.

The January decision is expected to offer fresh guidance on how quickly and how far the central bank is prepared to go in easing financial conditions.

Source: Bloomberg HT

***PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/***

Keywords: Turkey central bank, TCMB rate decision, interest rates Türkiye, Bloomberg HT survey, monetary policy outlook, inflation expectations