Mahfi Eğilmez Fires Back: “Business World Lost the Right to Criticize”

mahfi-egilmez

mahfi-egilmez

Renowned Turkish economist Mahfi Eğilmez has reignited debate over Turkey’s controversial 2021 interest rate cuts, arguing that segments of the business community who supported the policy at the time have now forfeited their right to complain about today’s economic conditions.

As discussions about inflation, interest rates, and pricing distortions in Turkey intensify, Eğilmez took to social media to remind followers that, when rates were lowered despite rising inflation, many in the business world applauded the move.

His remarks come amid growing criticism from industry leaders about high costs, price imbalances, and declining competitiveness.

“You Applauded Back Then”

In his post, Eğilmez directly addressed business representatives who are now voicing concerns about inflation and economic instability. He recalled that when policymakers began cutting rates in September 2021—even as inflation was climbing—warnings from economists were largely ignored.

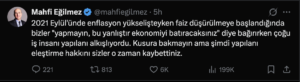

Eğilmez wrote:

“Back in September 2021, when interest rates began to be lowered while inflation was rising, we were shouting, ‘Don’t do this, it is wrong, you will sink the economy,’ while most businesspeople were applauding what was being done. I’m sorry, but you lost the right to criticize what is being done now.”

The statement has quickly circulated across economic and political circles, reopening discussion about the low-interest-rate policy launched in 2021 and its long-term consequences.

Revisiting the 2021 Interest Rate Cuts

In September 2021, Turkey began a series of rate cuts despite already rising inflation. At the time, critics warned that loosening monetary policy under inflationary pressure would weaken the currency and accelerate price increases.

Eğilmez was among those who publicly opposed the policy direction, arguing that lowering interest rates in an inflationary environment contradicted established economic principles. According to his latest remarks, those warnings were overshadowed by public support from various business groups who believed lower borrowing costs would stimulate growth.

Now, with inflation having surged and price distortions becoming more visible, he argues that current criticism lacks consistency.

Business Leaders Push Back on Prices and Costs

Eğilmez’s comments followed recent statements by leading industry representatives highlighting the economic strain caused by high inflation and pricing gaps.

Mustafa Gültepe, President of the Türkiye Exporters Assembly (TİM), recently argued that high inflation combined with a relatively low exchange rate has eroded Turkey’s cost competitiveness.

Gültepe pointed to widening price differences in the ready-to-wear clothing sector, noting that in the past, the price gap between Turkey and Europe stood at around 20 percent. Today, he said, that gap has expanded to 50–60 percent.

He emphasized that countries such as the United Kingdom, Germany, France, and Italy have become cheaper than Turkey for certain products.

Providing a personal example, Gültepe said a coat he examined in Turkey was 20–30 percent cheaper abroad, while another product sold for 6,000 TL overseas but 17,000 TL domestically. He even suggested that in some cases, purchasing goods abroad—including airfare—could be more economical than buying them in Turkey.

Pricing Behavior Under Scrutiny

Similarly, Burhan Özdemir, head of the Independent Industrialists and Businessmen’s Association (MÜSİAD), criticized inconsistencies in domestic pricing.

“A cup of tea costing 500 lira in one place and 5 lira in another is not normal,” Özdemir said, arguing that cost-based pricing mechanisms are not functioning properly in Turkey.

He added that while tight monetary policy had helped eliminate part of the pre-election cost “bubble,” inflation has now become structural. Özdemir emphasized that rent and food prices in particular require long-term structural reforms.

A Broader Debate on Policy Consistency

The renewed exchange highlights a broader debate about policy accountability and economic memory. Eğilmez’s central argument concerns not merely interest rates but consistency in public discourse.

By asserting that segments of the business community supported the 2021 rate cuts when inflation was already rising, he challenges today’s criticism as selective or retrospective. The tension reflects deeper questions about how monetary policy decisions are evaluated over time—and who bears responsibility when outcomes diverge from expectations.

Turkey’s economic trajectory since 2021 has featured significant currency volatility, surging inflation, and evolving monetary tightening. As policymakers attempt to stabilize prices and restore confidence, the debate over past decisions remains politically and economically sensitive.