January Inflation Shock—Is the “Easy” Disinflation Over?

cpi English

cpi English

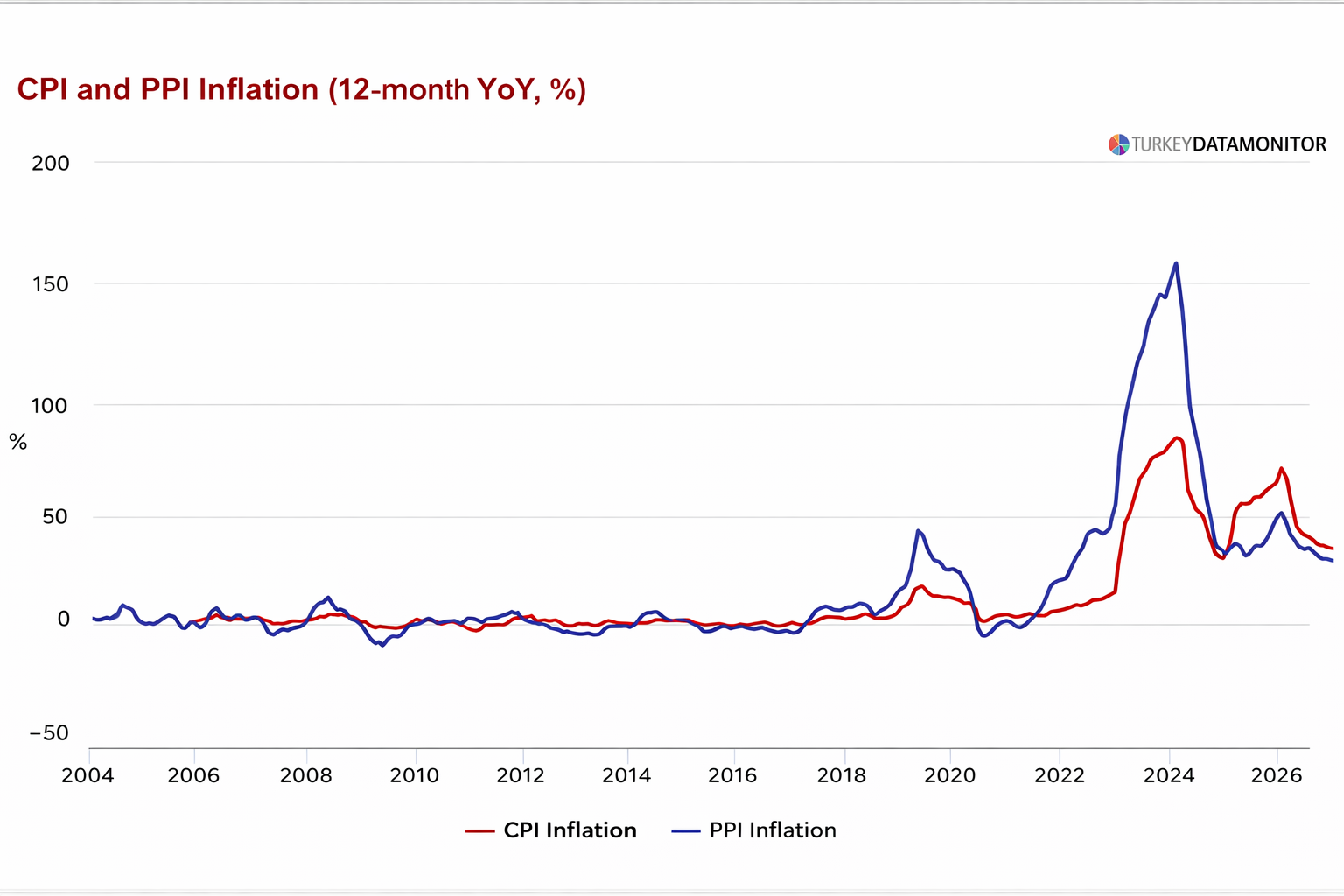

The Turkish Statistical Institute (TurkStat) has released the first inflation data of 2026, delivering a “cold shower” to market expectations. Monthly CPI surged by 4.84% in January, significantly overshooting the Bloomberg consensus of 4.3%. While annual inflation technically nudged down to 30.7% from 30.9%, the internal dynamics of the report suggest that the path toward the Central Bank of the Republic of Turkey’s (CBRT) year-end targets is becoming increasingly treacherous.

Atilla Yeşilada’s View: A Reality Check for the CBRT

Economy czar blamed soaring inflation on “Seasonal food price effects”, while VP Cevdet Yılmaz wowed to pursue disinflationary policies, without specifying what these may. On Wednesday, Turkstat will release “trend CPI” which guides monetary policy decisions, which could be as high as 3%. Turkey’s indifference to soaring inflation is frightening. The government issues boilerplate declamations, but no promise of tighter fiscal policy. The reports we cite below, too, mostly blame high January figures on seasonal or single item surprises, claiming the data will not deter monetary easing.

In my professional estimation, we have officially exited the “honeymoon phase” of disinflation. The easy gains—driven by high base effects from the previous year—are now behind us.

-

Will inflation continue to fall? While the headline annual figure might drift lower due to mathematics, the monthly momentum is alarming. With the Ramadan effect looming in February and ongoing service price rigidity, a rapid descent is unlikely.

-

Will the CBRT cut rates in March? The Central Bank is trapped. While there is immense pressure to ease, cutting rates on March 12th after such a massive upside surprise would be a gamble with the bank’s remaining credibility. I suspect the “wait-and-see” camp within the Monetary Policy Committee (MPC) just gained a lot of leverage.

Market Commentary: Strategists and Brokerage Houses Weigh In

Coex Partners: The End of “Easy” Disinflation

Henrik Gullberg, Macro Strategist at Coex Partners, provided a sobering assessment of the new data.

“The period of easy disinflation may now be behind us. If inflation does not slow at the pace seen in previous months, it will be much harder for the Central Bank to convince markets of its 16% year-end target. Moving forward, the CBRT may pivot away from traditional interest rate cuts and toward alternative tools, such as reserve requirements for foreign exchange or measures to encourage long-term corporate loans.”

MUFG Bank: Measured Response Due to Transparency

Onur İlgen, Head of Treasury at MUFG Bank Istanbul, noted that the market’s reaction remained relatively contained thanks to the CBRT’s proactive communication.

“The CBRT’s previous warnings about potential risks to the disinflation path and its more cautious approach to rate cuts limited the pressure on the markets. Thanks to this transparency, we saw limited sell-offs in long-term bonds and no significant volatility in the exchange rate.”

İş Yatırım: Misleading “Clothing” Deflation

İş Yatırım highlighted that despite the high headline, some core indicators showed resilience, though seasonal factors were distorting.

“The positive surprise in the data came from the highly volatile clothing and footwear group. However, annual service and core goods inflation (excluding energy and food) remain stagnant at 44% and 20%. We maintain our 24% year-end inflation forecast and still anticipate a 150-basis point rate cut in the upcoming cycle.”

Kuveyt Türk Yatırım: Temporary Blip?

Kuveyt Türk remains optimistic that the January spike is an outlier driven by one-off factors.

“Despite the monthly figure exceeding expectations, we believe this is largely due to January-specific adjustments. We expect the CBRT to continue its easing process on March 12th with a moderate 100-basis point cut, bringing the policy rate to 36%.”

Alnus Yatırım: CBRT’s Hand is Weakened

Alnus took a more skeptical tone, suggesting the CBRT may be forced to pause.

“The high CPI figures have significantly weakened the CBRT’s position for the March 12th meeting. Only if February figures show a dramatic decline and the annual rate drops by more than 1 percentage point will a March rate cut remain a viable possibility.”

ANALYSIS: Istanbul Inflation Jumps in January – Identifying the Drivers of the “New Year Shock”

İş Bankası: Ramadan and Persistent Food Risks

The Economic Research team at İş Bankası focused on the immediate future and the psychological impact on expectations.

“The upward trend in food prices is likely to persist in February due to the Ramadan effect. While service inflation might moderate, the impact of this upside surprise on future inflation expectations will be the primary concern for policymakers in the coming weeks.”