Is There a Surprise in the Inflation Report?

inflation2

inflation2

Türkiye’s statistical authority revised the CPI base year and methodology as of January 2026, mechanically pushing headline inflation higher through changes in expenditure weights—most notably a sharp increase in the weight of services. While the impact is largely technical, attention now turns to the Central Bank of the Republic of Türkiye’s (CBRT) upcoming Inflation Report. A limited upward adjustment in the forecast range appears likely, but the Bank may seek to keep the midpoint below 20% to reinforce its disinflation commitment.

Methodology Shift: New Base Year, New Classification

With the release of January 2026 inflation data, the Turkish Statistical Institute (TÜİK) implemented a comprehensive update to the Consumer Price Index (CPI):

-

The base year was changed from 2023 to 2025=100.

-

The classification system was aligned with COICOP-2018 (Classification of Individual Consumption by Purpose).

-

Expenditure weights were recalculated in line with Eurostat recommendations, using National Accounts Household Final Consumption Expenditure data.

-

The long-term CPI series (2003=100) was re-expressed under the new 2025=100 base to ensure continuity.

While largely technical, these revisions have short-term implications for headline inflation dynamics.

Weight Rebalancing: Services Gain Prominence

The most notable change concerns the weight of the services category—historically the most persistent component of inflation.

-

The weight of services rose from roughly 31.0% to 38.4%, an increase of more than 7 percentage points.

-

The combined weight of durable goods (21.8%) and other core goods (20.8%) declined by about 3.8 percentage points.

-

The energy category saw its weight reduced from 10.2% to 7.0%.

Given that services inflation has exhibited greater rigidity compared to goods prices, the reweighting exerts upward pressure on the headline figure.

January Inflation: Largely a Technical Effect

Under the updated weights, January inflation is estimated at 4.88%, compared with the officially reported 4.84%.

This suggests that the deviation from prior expectations stems primarily from the methodological revision rather than a significant shift in underlying price dynamics.

The new weight structure is estimated to add approximately 0.8 percentage points to the 2026 year-end inflation forecast. The CBRT, in a recent blog post, also indicated that the impact would be around 1 percentage point.

CBRT Strategy: Commitment to the Target Band

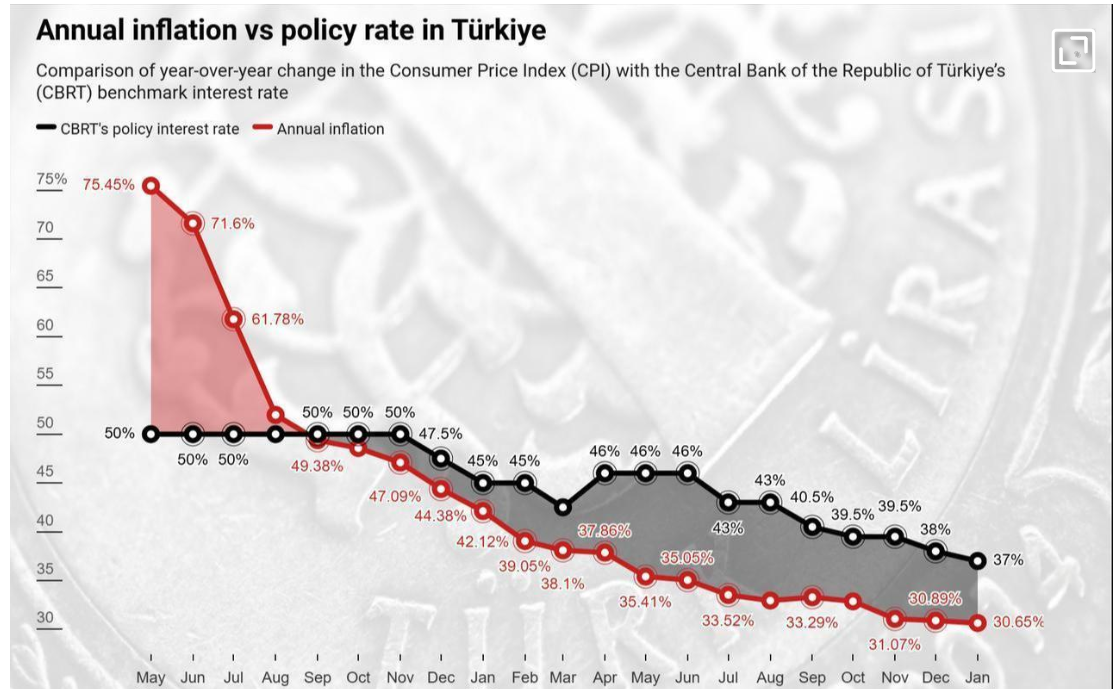

At its January 22 Monetary Policy Committee meeting, the CBRT cut the policy rate by 100 basis points—less than the 150 basis points expected by some analysts.

This move was widely interpreted as a signal of the Bank’s determination to remain within its 19% upper bound for end-2026 inflation.

In its previous Inflation Report, the CBRT had set:

-

A midpoint forecast of 16%,

-

Within a range of 13–19%.

That framework suggested a reluctance to revise projections upward. However, given that the weight adjustment alone adds nearly one percentage point to headline inflation, a technical upward shift of around 1 percentage point in the forecast range appears plausible.

Scope for Revision: Likely Limited

Beyond technical adjustments, any additional revision is unlikely to exceed 1.5–2.0 percentage points.

The CBRT may prefer to hold its central projection steady to project policy resolve and influence inflation expectations. However, several challenges complicate this approach:

-

A sizable gap already exists between market inflation expectations and the CBRT’s forecast.

-

With February inflation included, cumulative two-month inflation could approach 8%, increasing scrutiny over official projections.

In this context, the Bank may opt for a modest upward revision in the forecast range—while keeping the midpoint below 20%, potentially around 19%.

Such a move would balance technical realities with the desire to maintain credibility and reinforce its disinflation narrative.

Output Gap and Demand Conditions in Focus

The CBRT has emphasized that domestic demand continues to support disinflation, albeit with diminishing strength.

Key variables influencing any revision include:

-

The projected output gap,

-

The trajectory of domestic demand,

-

The persistence of services inflation.

Overall, rather than signaling a major policy shift, the forthcoming Inflation Report is expected to reflect measured technical adjustments stemming from the statistical update.

The broader message is likely to remain unchanged: the central bank is committed to its disinflation path, even as short-term data volatility and methodological shifts complicate the outlook.

By Serkan Gonencler, Chief Economist, Gedik Invest