Gold Smashes 5,000 Dollars as 2026 Commodity Shockwaves Rattle Global Markets

gold-price-soars

gold-price-soars

The global economy has entered 2026 under intense pressure, with commodity markets delivering shockwaves that few investors anticipated this early in the year. Levels that many international investment banks had penciled in as end-2026 targets have already been surpassed before January even draws to a close. Escalating trade tensions driven by the Trump administration and rising military activity in the Middle East have pushed investors decisively toward precious metals as the ultimate safe haven, reshaping expectations across global markets.

What was once viewed as a gradual upward trend has rapidly transformed into a historic rally, forcing analysts to reassess both price models and risk assumptions.

Gold Breaks Forecasts With a $5,110 All-Time High

According to NTV, spot gold prices surged 1.9% in a single session, propelling the metal to an unprecedented $5,110 per ounce and marking a new all-time high.

This level had previously been cited by major global banks as a milestone unlikely to be reached before the end of 2026. Instead, it was breached within the first weeks of the year.

In early trading today, gold prices stabilized around $5,070, suggesting consolidation rather than exhaustion. Market analysts caution that the rally may still be in its early stages, noting that demand for hard assets continues to strengthen amid global uncertainty.

Gram Gold Ignites the Domestic Market

The international gold rally has had an immediate and powerful impact on Turkey’s domestic market. With the global ounce price climbing and currency dynamics amplifying the move, gram gold prices surged past 7,100 TL for the first time in history. The record-breaking level triggered heavy interest from local investors seeking protection against volatility.

As of this morning, gram gold is trading around 7,105 TL, holding near its peak. Traders report sustained demand from both retail investors and long-term holders, signaling that confidence in precious metals remains strong despite elevated prices.

Silver Enters a Parabolic Phase

While gold has dominated headlines, silver has emerged as the fastest-rising commodity so far this year. Known for its higher volatility, silver crossed the psychological $ 100-per-ounce threshold on Friday and continued its ascent, reaching $114 per ounce, another historic high.

Since January 1, silver’s performance has been striking. On an ounce basis, prices have risen by more than 50%, while gram-based returns have exceeded 54%. This sharp move has reinforced silver’s reputation as a leveraged play on both safe-haven demand and expectations for industrial use.

Why Precious Metals Are the Only Game in Town

Market participants point to three dominant forces fueling what many describe as an “unstoppable” surge in precious metals.

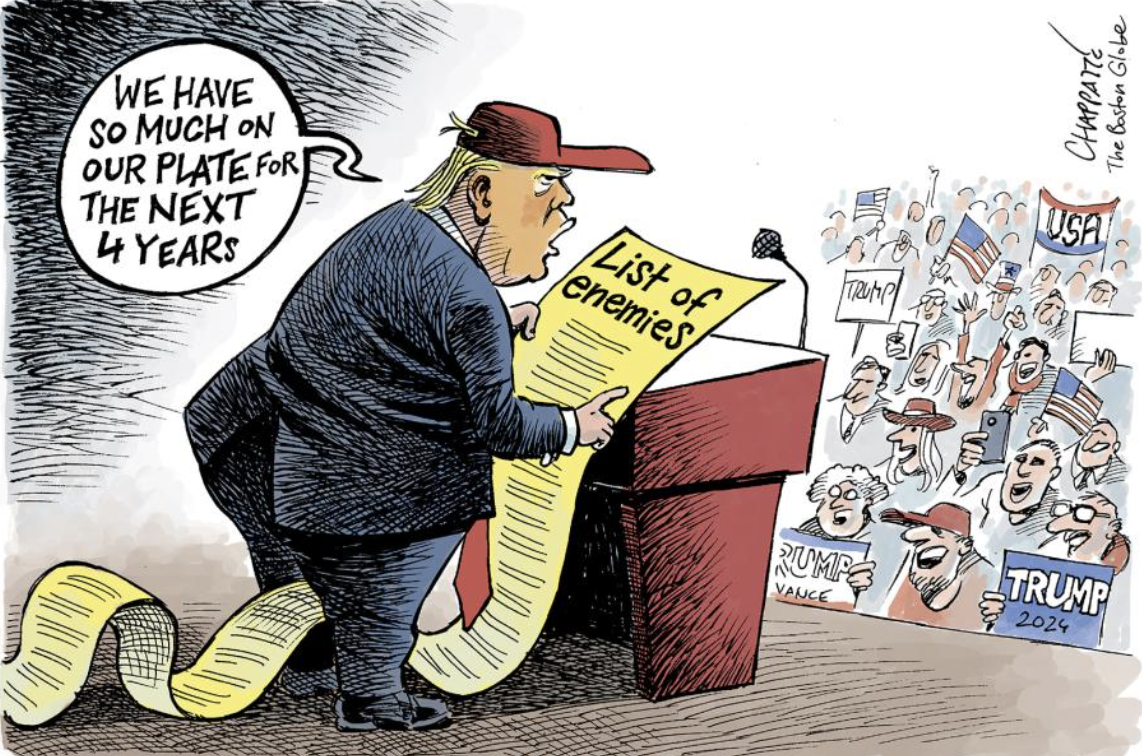

Trump’s Tariff Shock

US President Donald Trump’s latest trade warning has reignited fears of a new global trade war. Trump announced that if China reaches a trade agreement with the United States, Canada would face tariffs of up to 100%. This unexpected stance has amplified uncertainty across global supply chains, pushing investors away from risk assets and into commodities perceived as politically neutral stores of value.

Political Pressure on the Federal Reserve

The upcoming Federal Reserve meeting is widely expected to keep interest rates unchanged, yet political pressure is mounting. The White House’s growing calls for Fed Chair Jerome Powell to cut rates have unsettled markets, raising concerns about central bank independence and the future credibility of monetary policy. Such uncertainty traditionally boosts demand for gold and silver as hedges against policy-driven volatility.

Geopolitical Tensions Escalate

Ongoing military activity across the Middle East and the Pacific region continues to weigh heavily on investor sentiment. Heightened geopolitical risk has accelerated capital outflows from equity markets, redirecting funds toward commodities, particularly precious metals, which are seen as a form of protection during periods of conflict and instability.

Forecasts Upended, Strategies Rewritten

The speed and scale of the current rally have forced analysts to revise long-held assumptions. Price targets that once seemed ambitious are now outdated, while portfolio strategies built around gradual normalization are being reassessed. For many investors, gold and silver are no longer just diversification tools—they have become core defensive assets.

Some strategists argue that as long as trade tensions persist, geopolitical risks remain unresolved, and monetary policy signals stay clouded, precious metals could continue attracting capital well beyond current levels.

A Defining Start to 2026

The opening weeks of 2026 have already delivered one of the most dramatic commodity surges in recent history. Gold breaking above $5,000 and silver entering triple-digit territory have redefined what investors consider “extreme” pricing. More importantly, they reflect a deeper shift in global risk perception.

Whether this marks the beginning of a prolonged supercycle or a sharp repricing driven by exceptional circumstances remains open to debate. What is clear, however, is that precious metals have reasserted themselves as the primary refuge in a world shaped by political friction, monetary uncertainty, and geopolitical strain.