Brokerages Warn of Accelerating Current Account Deficit, Raise 2026 Forecasts

cad dec2025

cad dec2025

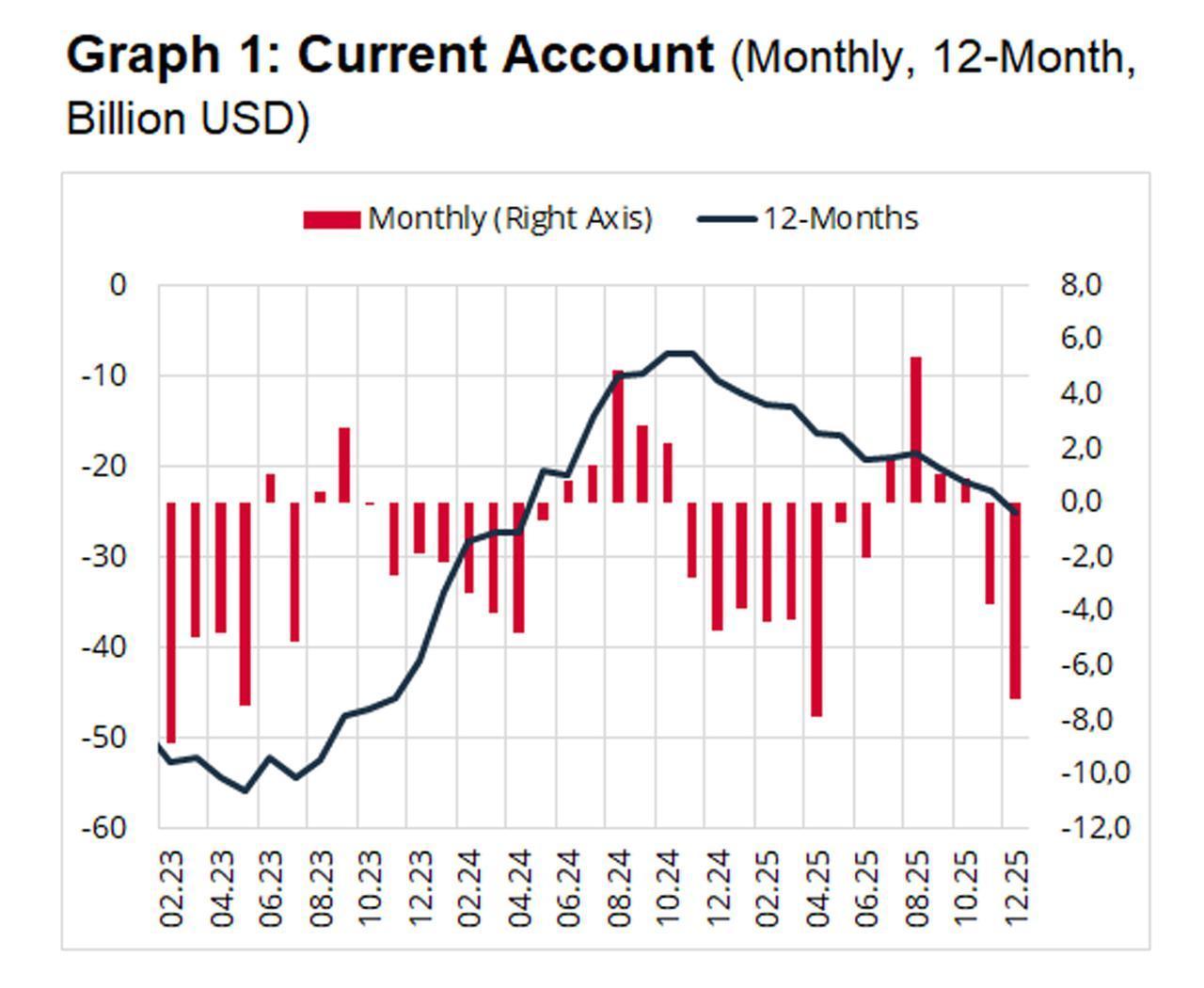

Türkiye’s current account deficit widened more than expected at the end of 2025, prompting major brokerages to revise their outlooks higher for 2026. Akbank highlighted a sharp deterioration in the final quarter, Albaraka Türk pointed to weakening financing quality, and Gedik Yatırım underscored growing pressure from primary income outflows and reserve losses. While the deficit remains manageable as a share of GDP, analysts warn that financing composition and rising import momentum pose increasing risks.

Akbank: Sharp Deterioration in the Final Quarter

Akbank said the December current account deficit came in at $7.3 billion, exceeding both its own forecast of $5.6 billion and the market expectation of $5.4 billion.

The deviation was largely driven by:

-

A wider-than-expected primary income deficit

-

Relatively weak performance in transportation revenues

For 2025 as a whole, the current account deficit reached $25.2 billion, equivalent to 1.6% of GDP — roughly $15 billion higher than in 2024.

According to Akbank, the final quarter showed a marked deterioration. The monthly average deficit reached $3.8 billion, the highest trend since the first quarter of 2023. On an annualized basis, the fourth-quarter pace points to a deficit of $45.4 billion.

Even after adjusting for what the bank considers temporary movements in income balances, the underlying trend remains above $40 billion — significantly weaker than the prevailing annual figure and indicative of continued upward pressure.

2026 Outlook

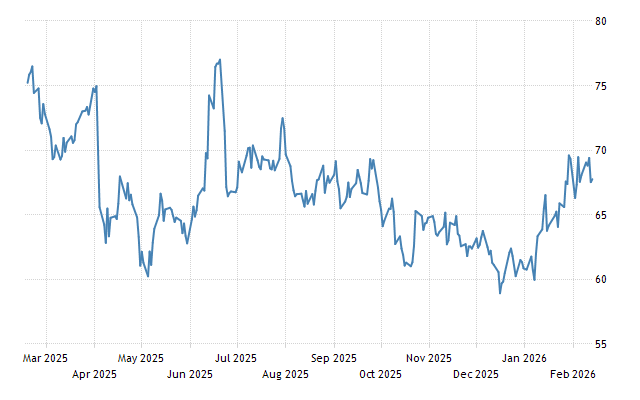

Akbank raised its 2026 current account deficit forecast to $36 billion (2.0% of GDP), based on assumptions of:

-

4.0% economic growth

-

Brent oil at $65 per barrel

-

Moderate real appreciation of the Turkish lira

-

No strong rebound in global growth

The bank sees upside risks stemming from domestic demand and global growth dynamics, while oil prices present balanced risks.

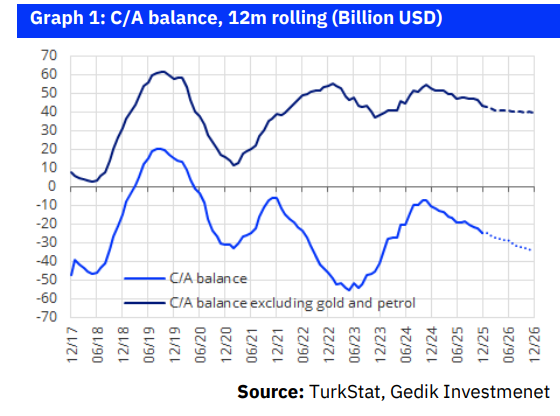

Albaraka Türk: Financing Quality Weakens

Albaraka Türk focused on the financing side of the deficit, noting a deterioration in capital inflows.

By the end of 2025:

-

Net foreign direct investment (FDI) fell 35.5% year-on-year to $3.2 billion — the lowest level in 20 years.

-

Portfolio investments recorded a modest monthly inflow of $73 million.

-

Non-residents invested $12.3 billion domestically, while residents invested $14.0 billion abroad.

As a result, the year closed with a net capital outflow of $1.73 billion, compared with a $11.97 billion net inflow at the end of 2024.

The data suggest that although the headline deficit remains contained, the quality and sustainability of financing have weakened.

Gedik Yatırım: Pressure from Services and Income Accounts

Gedik Yatırım said December’s deviation was primarily driven by weaker services income and a sharper deterioration in the primary income balance.

-

Net services income reached $2.65 billion, below the $3.2 billion forecast, mainly due to non-tourism services.

-

The primary income deficit widened to $2.4 billion, compared with an expected $1.4 billion.

A key factor was $1.23 billion in interest payments by the real sector, well above recent averages.

Reserve Decline and Capital Flows

Foreign exchange reserves continued to decline in December, falling by $4.1 billion. For 2025 as a whole:

-

The net errors and omissions item recorded a $16.6 billion outflow.

-

Total reserves declined by $22.0 billion.

Portfolio Investments

Although gross portfolio inflows reached $1.8 billion in December — supported by equity, government bond, and Eurobond inflows — increased outward investments limited the net contribution to just $0.1 billion.

For 2025, portfolio inflows totaled $12.3 billion, but outward investments of $14.0 billion resulted in a net $1.7 billion outflow.

Foreign Direct Investment

Despite $13.1 billion in gross FDI inflows during 2025, outward investments of $9.8 billion limited net FDI to $3.3 billion.

Private Sector Borrowing

Private sector borrowing remained the primary financing channel. In 2025:

-

Banks borrowed $22 billion.

-

Corporates borrowed $21 billion.

Total long-term borrowing reached $43 billion.

Revised 2026 Forecast

Gedik Yatırım revised its 2026 current account deficit forecast upward from $32 billion to $35 billion (2.3% of GDP).

The brokerage cited accelerating imports, deterioration in the trade balance, and increasing contributions from non-trade items. While energy, gold, and commodity prices remain key uncertainties, risks to the forecast appear skewed to the upside.

Common Themes Across Brokerages

All three institutions point to:

-

A clear acceleration in the deficit in late 2025

-

Weaker financing quality

-

Limited FDI inflows

-

Reserve losses

-

Upward revisions to 2026 forecasts

Although the deficit-to-GDP ratio remains moderate, its composition — particularly reliance on credit financing and declining reserve buffers — raises vulnerability concerns.

With global financial conditions tight and commodity prices volatile, Türkiye’s external balance trajectory in 2026 will depend heavily on growth dynamics, energy costs, and capital flow stability.

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng, @paturkey

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/