ANALYSIS: Industrial Production Posts Strong Monthly Rebound, More Strenght Expected

ip retail december

ip retail december

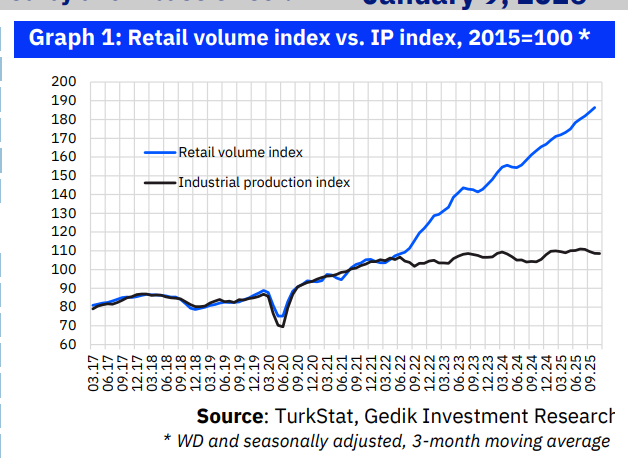

Türkiye’s industrial production recorded a robust recovery in November, rising by 2.5% month-on-month (MoM) on a seasonally and calendar-adjusted basis, according to data released by TurkStat. This marked a sharp reversal from the contractions seen in previous months, following a 0.8% MoM decline in October and a 2.2% contraction in September.

On an annual basis, industrial output increased by 2.4% year-on-year (YoY), while the unadjusted figure showed a marginal decline of 0.5%. Over the January–November period, calendar-adjusted industrial production expanded by a solid 3.5% YoY, underscoring a gradual but uneven recovery trend.

Data Align With Prior Expectations

The November figures broadly confirmed earlier projections based on leading indicators. Monthly growth exceeding 2% had been anticipated, while annual growth was expected to remain modestly positive due to favorable base effects. Both expectations materialized, with the strong monthly rebound validating the outlook and the 2.4% YoY increase aligning closely with projected trends.

Industrial production growth has shown a notable acceleration over the course of the year. After expanding by just 0.7% YoY in the first quarter, growth strengthened to 5.6% in the second quarter and remained elevated at 5.1% in the third quarter, before moderating toward year-end.

Capital Goods and Autos Lead Sectoral Performance

Divergences across industrial sub-sectors remained pronounced in November. On a calendar-adjusted annual basis, capital goods manufacturing stood out with a strong 10.9% increase. Several other branches also posted robust gains, including fabricated metal products excluding machinery and equipment (9.1%), non-metallic mineral products (13.8%), motor vehicles (15.3%), basic metals (6.4%), intermediate goods (4.6%), chemical products (6.9%), electrical equipment (12.7%), and plastics and rubber products (2.8%).

Overall manufacturing output rose by 2.7% YoY in November, while mining and quarrying recorded a more modest increase of 0.2%.

Consumption-Oriented Sectors Remain Under Pressure

In contrast, weakness persisted across several consumption-related industries. Durable consumer goods contracted by 3.2% YoY, while apparel output plunged by 25.9%. Machinery and equipment production fell by 5.2%, textiles by 7.7%, and food products by 3.7%. Energy-related utilities also posted declines, with electricity, gas, and water supply down 2% and energy production falling by 1% YoY.

These figures highlight the ongoing fragility in domestic demand-driven segments of the industrial sector, despite the broader recovery.

January–November Data Show Uneven Recovery

Looking at the first eleven months of the year, the recovery appears more moderate and highly uneven. Capital goods manufacturing expanded by 10.8%, while fabricated metal products rose by 12%. Energy output increased by 5.9%, basic metals by 4.7%, and non-metallic mineral products by 7.2%.

Food products (3.9%), chemical products (2.3%), electrical equipment (3.1%), and motor vehicles (3.2%) also managed to post gains. However, machinery and equipment production declined by 5.8%, apparel by 11.4%, textiles by 4.5%, and durable consumer goods by 3.4%. Non-durable consumer goods (–0.6%) and plastics and rubber products (–0.1%) remained marginally negative.

PMI and Electricity Data Signal Near-Term Momentum

Leading indicators continue to point to positive short-term momentum in industrial activity. The manufacturing Purchasing Managers’ Index (PMI), although still below the 50 threshold that separates expansion from contraction, has shown steady improvement. After rising from 46.5 in October to 48.0 in November, the index accelerated further to 48.9 in December.

Electricity consumption data reinforce this trend. In December, electricity usage increased by 2.3% YoY and surged by 13% MoM, suggesting a pickup in industrial activity toward year-end. Together with anecdotal indicators, PMI and electricity data imply that industrial production could expand by around 2% MoM in the near term.

Outlook: Supportive but Fragile

Overall, industrial production growth during the first eleven months of the year has been driven primarily by investment- and energy-oriented sectors, while consumption-related segments continue to struggle. This composition suggests that industrial activity is still contributing to economic growth, albeit with uneven momentum across sectors.

Looking ahead, a potential easing in domestic credit conditions could provide some support to production. However, uncertainties surrounding global demand, weak export market conditions, and persistently high financing costs remain key downside risks for Türkiye’s industrial outlook.

Author: Gedik Yatırım