ANALYSIS: 2025 Budget Performance A “Pleasant Surprise”

budget-december2025

budget-december2025

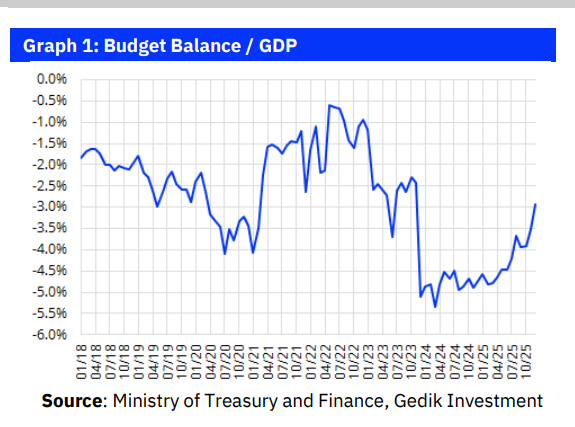

As the final figures for Turkey’s 2025 Central Government Budget emerge, international investors and local analysts are processing what many describe as a “pleasant surprise.” Despite a year characterized by aggressive monetary tightening and a transition toward fiscal consolidation, the budget deficit has landed significantly below official targets. With the deficit-to-GDP ratio falling below the critical 3% threshold, the data suggests that fiscal policy is finally acting as a powerful tailwind to the Central Bank’s disinflation program.

Below is an in-depth breakdown of the 2025 budget through the lenses of three major Turkish financial institutions.

1. Gedik Investment: Outperforming the Medium-Term Program (MTP)

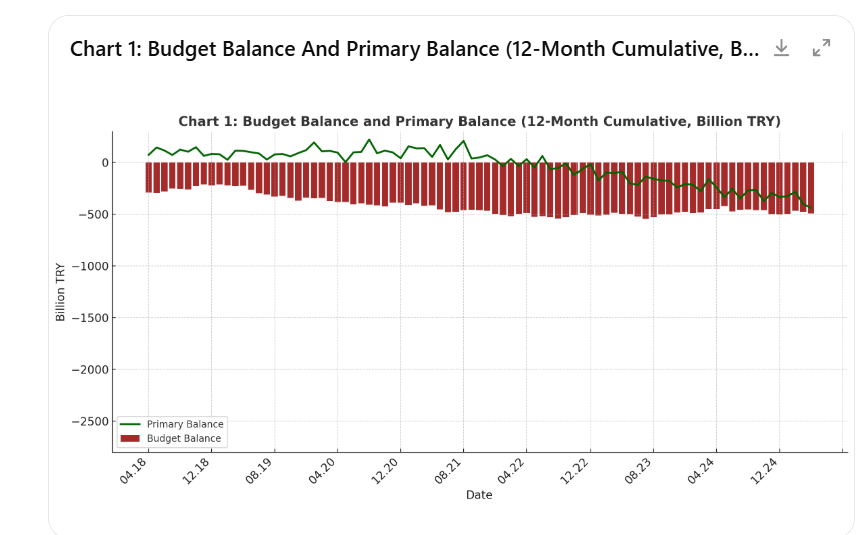

Gedik Investment highlights that the 2025 budget deficit concluded at 1.8 trillion TRY, a figure that stands in stark contrast to the original target of 1.93 trillion TRY and the revised Medium-Term Program (MTP) projection of 2.2 trillion TRY. This performance marks a massive improvement from 2024, where the deficit-to-GDP ratio stood at 4.7%.

The Revenue Engine: Consumption and Tax Efficiency

Gedik’s analysis points to a surprisingly robust revenue stream. Despite expectations of a slowdown, Value Added Tax (VAT) and Special Consumption Tax (SCT) collections exceeded forecasts. This suggests that domestic consumption remained resilient, likely pushing GDP growth beyond the MTP’s 3.3% forecast.

-

Income Tax Pivot: While corporate tax revenues fell 413 billion TRY short of targets, this gap was more than compensated for by personal income tax. With the support of increased withholding tax rates on investment instruments, income tax collections surged 683 billion TRY above initial goals.

Spending Discipline and the “Real” Decline

On the expenditure side, Gedik identifies a significant trend of “real” contraction. While nominal primary expenditures (excluding interest) rose by 32% year-on-year, when adjusted for inflation, they actually decreased by 2% in real terms. This fiscal restraint was driven by lower-than-expected transfers to social security institutions and State Economic Enterprises (SEEs).

The Interest Burden: A Persistent “Weak Link”

However, the report warns that interest payments remain the budget’s Achilles’ heel. Interest expenditures nearly doubled from 2024 levels, reaching 2.05 trillion TRY. The ratio of interest payments to total tax revenues has climbed from 12% a few years ago to over 18%, limiting the government’s fiscal maneuvering room.

2. İşbank Economic Research: The Clash of Accrual vs. Cash

İşbank’s Economic Research department focuses on the synergy between tax revenues and moderate spending. They calculate that the budget deficit ended the year below 3% of GDP, providing a much-needed anchor for the economy. However, they introduce a critical technical nuance: the “Cash Balance” vs. “Accrual Balance.”

The 2026 Liquidity Overhang

İşbank notes that the Treasury’s cash deficit reached 2.1 trillion TRY, which is higher than the 1.8 trillion TRY accrual-based budget deficit. This discrepancy is largely attributed to the delayed utilization of earthquake-related reconstruction funds.

-

The Outlook: The bank warns that this “cash lag” will be a decisive factor in 2026. The timing of these cash outflows will dictate how much liquidity remains in the system, potentially influencing the Central Bank’s ability to maintain a tight monetary stance.

3. Şeker Investment: Strengthening the Policy Coordination

Şeker Investment offers an optimistic take, asserting that the “core indicators” of the Turkish budget remain healthy. They emphasize that the primary balance (the budget balance excluding interest) yielded a surplus of 255 billion TRY in 2025—a massive turnaround from the 836 billion TRY primary deficit recorded in 2024.

The Path to Normalization

According to Şeker Investment, the current pressure on the budget is largely a legacy of previous monetary policy choices and high borrowing costs. As the disinflation process takes hold and market interest rates begin to decline, the interest burden on the public purse will naturally ease.

-

Synergy is Key: The firm underscores that the transition to a fiscal policy coordinated with monetary tightening is essential for medium-term price stability. They advocate for continued efficiency in tax collection and further restraints on public spending to ensure the sustainability of this fiscal discipline.

Conclusion: A Foundation for 2026

The consensus across these three brokerages is clear: Turkey’s fiscal house is in better shape than anticipated. The 2025 performance proves that the government is willing to utilize “fiscal space” to support the fight against inflation. While interest expenses remain a heavy load and the 2026 cash balance poses a technical risk, the primary surplus of 255 billion TRY is a monumental achievement in a post-earthquake recovery era.

For foreign investors, these figures represent a lower sovereign risk profile. If Turkey can maintain this discipline through 2026, the path toward a “single-digit inflation” era becomes significantly more credible.