Weekly Monetary Aggregates Report

reserves 12nov 2025

reserves 12nov 2025

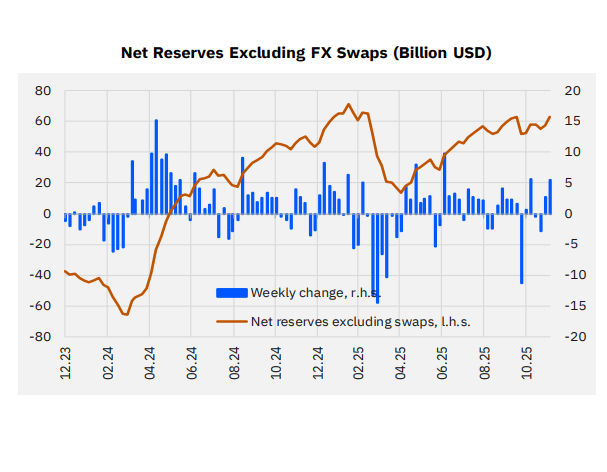

In the week of December 5, a USD 5.5 billion increase in net reserves excluding swaps (a USD 3.4 billion increase when adjusted for the gold-price effect), approximately USD 24 million sales of GDDS by non-residents, and a USD 2 billion decline in FX deposits stood out. Additionally, according to the CBRT’s Analytical Balance Sheet data, as of December 10, we estimate a decrease of approximately USD 1.3 billion in net reserves excluding swaps (a USD 0.7 billion decline when adjusted for the gold-price effect). The weekly developments can be summarized as follows:

➢ Parity-adjusted FX deposits decreased by a total of USD 2,042 million, driven by USD 122 million purchases by households and USD 2,165 million sales by corporates. Since the beginning of the year, FX deposits have increased by a total of USD 17.8 billion.

➢ FX-protected deposit (KKM) balances decreased by TRY 3.9 billion (approximately USD 0.1 billion) during the week, falling to TRY 12.9 billion. The cumulative unwinding from the peak reached in August 2023 has reached TRY 3.4 trillion (USD 136.7 billion). We may expect KKM accounts to be fully phased out in the coming days.

➢ The share of FX deposits + KKM in total deposits stood at 39.5%. This ratio had risen to as high as 68.4% in August 2023, when KKM balances peaked.

➢ TRY deposits decreased by TRY 316 billion during the week, standing at approximately TRY 15.5 trillion.

➢ FX loans increased by USD 1.4 billion on a weekly basis. Since the end of March 2024, they have grown by 46%, reaching USD 196.8 billion.

➢ Looking at the annualized 13-week average loan growth, commercial loans increased from 21.7% to 22.4%, while consumer loans declined from 51.2% to 50.5%.

➢ In the week ending December 5, non-residents made USD 24 million in net sales in GDDS, raising the stock to around USD 16.8 billion. Between mid-March and the end of April, GDDS saw a total outflow of USD 9.3 billion, while from early May onwards, there has been a cumulative inflow of about USD 8.4 billion. In equities, non-residents made USD 154 million in net purchases

during the week, raising the stock to around USD 32 billion. On the Eurobond side, approximately USD 219 million in net sales were recorded, reducing the stock to around USD 82 billion.

➢ In the week of December 5, gross international reserves increased from USD 183.2 billion by approximately USD 3.2 billion to USD 186.4 billion. In the same week, net reserves increased from USD 72.1 billion by USD 5.5 billion to USD 77.6 billion. Net reserves excluding swaps also increased by approximately USD 5.5 billion (a USD 3.4 billion increase when adjusted for the gold-price effect), rising to USD 63.2 billion. The lowest level of net reserves ex-swaps was USD –65.5 billion at end-March 2024, while the peak was USD 71 billion on February 14, 2025. It is worth noting that rising gold prices had an estimated positive impact of roughly USD 2 billion on reserves during the week.

➢ Based on the CBRT’s Analytical Balance Sheet, as of December 10 (covering the first three business days of the week), we estimate an increase of USD 1 billion in gross reserves, a decrease of approximately USD 1.1 billion in net reserves, and a decrease of approximately USD 1.3 billion in net reserves excluding swaps. However, during the same period, the gold-price effect was negative by USD 0.6 billion. Accordingly, excluding the gold-price impact, net reserves ex-swaps indicate a decline of about USD 0.7 billion.

➢ The size of the Money Market Fund (MMF) decreased by approximately TRY 63 billion in the week of December 5, falling to around TRY 1.4 trillion. Under the Free Umbrella Fund, MMF assets increased by approximately TRY 53 billion during the week, rising to TRY 1.2 trillion. The total active size of FX-denominated mutual funds increased by approximately USD 445 million, reaching USD 77.6 billion. This level stood at USD 25 billion at the beginning of 2024 and around USD 50 billion at the beginning of 2025. Including investment funds, the dollarization ratio increased from 42.1% to 42.5% in the week of December 5. This ratio had reached as high as 70% in mid-2023.

Source: Gedik Invest