Week ahead: Turkish Markets Show Cautious Optimism Amid Political Stability

borsa4

borsa4

Istanbul, Turkey — Investors in Turkish markets are displaying cautious optimism as the country’s risk premium (CDS) falls to its lowest level in five years. This reduction could pave the way for a future credit rating upgrade and attract short-term capital inflows, but analysts say the primary driver of confidence is the ongoing political stability. Foreign investors, however, are likely to remain on the sidelines until after October 24.

By Zeynel Balci, Hurriyet Daily

The positive sentiment is also being fueled by a continued interest rate reduction cycle. While the Borsa Istanbul has seen a choppy rally, interest rates and foreign exchange (forex) markets remain calm. The Turkish Lira’s climb against the dollar has been weak, while government bond yields are trending downward.

Political Developments Steer Market Momentum

A recent decision on September 15 to postpone a key court case for the main opposition CHP party injected a sense of relief into the markets. This political “breather” until October 24 spurred a strong rally on the BIST100, which saw a surge in trading volume. Despite subsequent profit-taking, the market has absorbed the selling pressure.

When political tensions recede, markets tend to revert to economic fundamentals. This dynamic has led to a “buy the fear, sell the euphoria” mentality among traders, who have used political jitters as buying opportunities.

Borsa Istanbul’s Performance Lags

The BIST100 Index is currently hovering around its July 2024 peak. However, when viewed in dollar terms, the index is trading roughly 20% below that same peak. The BIST100 has gained around 13% year-to-date, a performance that significantly lags behind inflation and other investment assets.

The BIST100’s performance has been held back by political tensions, even with the Central Bank of Turkey (TCMB) cutting interest rates in response to falling inflation. The recent political detente has had a positive effect on the stock market, with bond yields declining and the Turkish Lira continuing its slow upward trend.

What’s Holding Back the Lira?

The Lira has not seen a sharp rise, largely due to a flight to safety amid political uncertainty. However, several factors prevent a more dramatic surge:

- The TCMB’s foreign exchange reserves are strong and high.

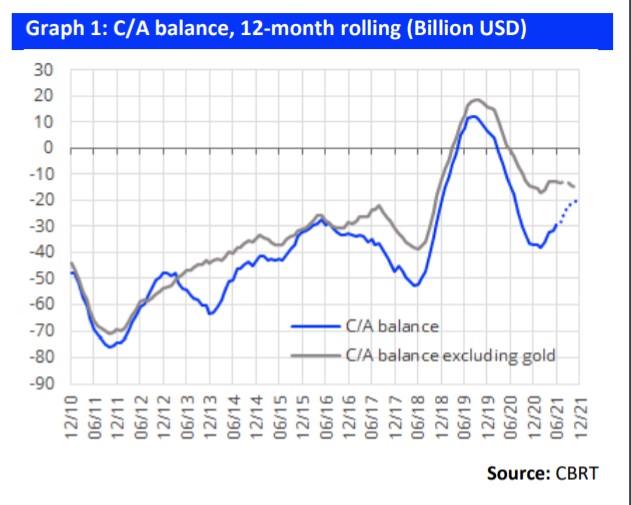

- The country’s current account deficit is shrinking and recently turned into a monthly surplus.

- The CDS spread is at a five-year low, raising the possibility of a credit rating upgrade and foreign capital inflows in the long term.

Still, foreign investors are expected to remain cautious until after the October 24 political deadline.

A Look at Recent Investor Activity

Data from the TCMB for the week ending September 12 shows that foreign investors sold off $164 million in equities but purchased $587 million in bonds.

Meanwhile, the TCMB’s gross reserves fell by $2.2 billion to $177 billion, as domestic residents’ forex deposits rose by $2.7 billion to $201 billion. This indicates that while foreign investors are showing some interest in bonds, domestic residents are still opting for forex, putting pressure on reserves.

Technical Outlook for Borsa Istanbul

The BIST100 is expected to continue its volatile upward trend. The key support level is at 11,000, and the index needs to hold above it for the rally to continue. The first resistance levels are at 11,300 and the more significant 11,600, which represents the previous peak. A sustained break above 11,600 would be necessary to signal a new all-time high.