Türkiye’s Financial Outlook Faces a Longer Tunnel Than Expected

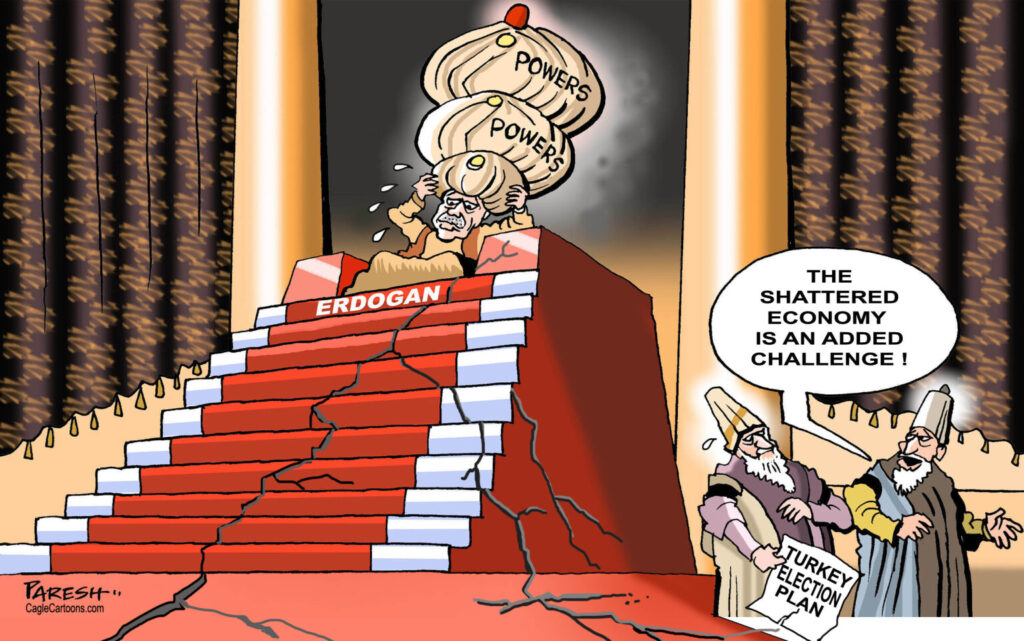

erdogan economy

erdogan economy

Türkiye İş Bankası General Manager Hakan Aran has delivered a notable reality check on the nation’s financial trajectory, underscoring that the path toward easier credit conditions remains longer than many anticipated. Speaking at the Altın Gençler Awards Ceremony, Aran emphasized that although Türkiye’s anti-inflation program is progressing, a critical policy threshold has yet to be crossed. This means businesses and households waiting for relief in borrowing costs will need to remain patient.

Aran underlined that the economic team’s commitment to disinflation is firm, and the banking sector is aligned with this agenda. However, tightening measures—designed to curb price growth and control domestic demand—will not be rolled back in the near term. His comments point to a sustained period of restrictive financial conditions, reflecting policymakers’ cautious stance as inflation continues its descent from elevated levels.

Credit Constraints Expected to Persist Until Late 2026

A key concern for investors, businesses, and consumers is when credit channels will reopen after more than a year of deliberate tightening. According to reporting by Dünya Gazetesi, Aran was explicit: meaningful improvement is unlikely before the second half of 2026.

He stated that “Kredi kısıtlarının gevşemesi ve finansmana erişimin ucuzlamasını ancak gelecek yılın ikinci yarısında konuşabileceğiz.” This unchanged quote serves as the clearest signal yet that credit affordability and availability will remain constrained through much of the coming year. For companies dependent on lending for operational expansion and investment cycles, this prolonged timeline reinforces the need for careful liquidity planning.

Aran’s perspective aligns with broader expectations across Türkiye’s financial sector, where institutions anticipate only gradual loosening once confidence in the disinflation path becomes stronger. Until then, banks are expected to maintain tight lending standards to support monetary stability and prevent renewed inflationary pressure.

How the New TÜİK Inflation Basket May Affect Expectations

Looking ahead to 2026, one notable structural change involves TÜİK’s updated inflation calculation methodology, which will introduce modified weightings in the consumer basket. Aran addressed this adjustment, explaining that while new weight distributions may influence the official inflation reading, the practical impact on medium-term economic expectations is limited.

He noted that households and financial institutions typically rely on broader trend indicators and internal models that are not drastically altered by such technical revisions. Nevertheless, Aran expressed optimism that the update could enhance transparency, reinforcing trust in Türkiye’s statistical reporting processes. Improved clarity in inflation metrics is often viewed positively by markets, especially during periods of policy tightening.

Currency Policy Expected to Stay Consistent as Reserves Strengthen

Questions on exchange-rate management remain central to financial assessments of Türkiye. Aran reiterated that the Turkish lira’s stability is a critical element of the country’s fight against inflation. He emphasized that he does not foresee a significant departure from the current currency policy, describing it as a managed and measured approach aimed at reducing volatility.

According to Aran, the Central Bank of the Republic of Türkiye (TCMB) is acting decisively to fortify its reserve position, a key factor that supports currency confidence. Stronger reserves not only help buffer external shocks but also provide credibility to the monetary tightening framework that has been implemented over the past year. Aran added that the central bank has not encountered difficulty in sustaining its strategy, suggesting alignment between monetary authorities and the broader financial sector.

A Longer Adjustment Period for Borrowers and Markets

Taken together, Aran’s remarks highlight a financial environment in which policy discipline outweighs political pressure for rapid easing. While inflation has retreated from its peak, authorities appear intent on ensuring that disinflation becomes durable and expectations become anchored before easing credit controls.

For market participants, the message is clear:

-

Credit costs will stay elevated,

-

Access to loans will remain selective,

-

Exchange-rate management will stay cautious,

-

Structural transparency measures are underway,

-

A sustainable recovery is prioritized over short-term relief.

This prolonged adjustment period underscores the government’s and banking sector’s shared belief that Türkiye’s long-term economic resilience depends on maintaining strict financial discipline through 2026.