Türkiye Posts ₺235 Billion Budget Surplus in May Despite Rising Expenditures

TL

TL

In May 2025, Türkiye’s central government budget recorded a ₺235.2 billion surplus, driven by a notable increase in budget revenues that reached ₺1.325 trillion, compared to expenditures of ₺1.089 trillion, according to a statement released by the Treasury and Finance Ministry.

The non-interest budget surplus also surged to ₺346.4 billion, while non-interest expenditures amounted to ₺978.6 billion.

In comparison, May 2024 saw a budget surplus of ₺219.4 billion and a primary surplus (excluding interest payments) of ₺330 billion, signaling a fiscal performance improvement year-over-year.

Sharp Rise in Expenditures and Interest Payments

The total budget expenditures in May rose by 38.3% year-on-year, climbing from ₺787.7 billion in May 2024 to ₺1.089 trillion. Of this, ₺111.2 billion was allocated to interest payments, while the rest—₺978.6 billion—represented non-interest expenditures, which jumped by 44.5% compared to the same month last year.

As of May, the government used 7.4% of the full-year budget allocation of ₺14.73 trillion, slightly higher than the 7.1% utilization rate in May 2024. Non-interest expenditures accounted for 7.7% of their annual allocation, up from 6.9% the previous year.

Revenue Performance Boosted by Tax Collection

Budget revenues in May hit ₺1.325 trillion, marking a 31.6% increase compared to the same month in 2024, when revenues stood at ₺1.007 trillion.

Tax revenues soared by 33.2%, totaling ₺1.196 trillion, while non-tax revenues under the general budget amounted to ₺105.7 billion.

Despite strong gains, realization ratios slightly declined: the revenue realization rate was 10.4% in 2025, down from 11.9% in 2024. For tax revenues, the rate stood at 10.7%, also down from 12.1% a year earlier.

Conclusion

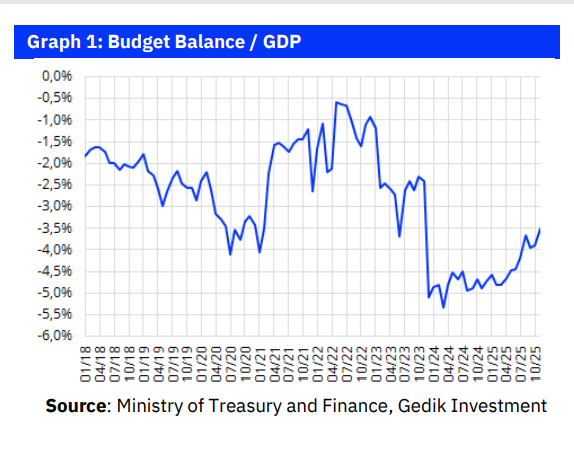

With both tax and non-tax revenues rising sharply, Türkiye’s budget balance in May 2025 presents a strong fiscal outcome, despite increased public spending and interest costs. The primary surplus and solid tax collection offer breathing room for economic policymakers amid broader macroeconomic challenges.