Turkish Markets Face “Stalling Momentum” as Inflation Expectations Shift

piyasa haftaya bakis

piyasa haftaya bakis

Turkish financial markets are struggling to find direction. With Borsa Istanbul near record levels, gains are increasingly met with profit-taking. The Central Bank of Turkey’s latest inflation report revised 2025 projections sharply higher, raising questions about the pace of interest rate cuts. While selective foreign inflows have returned to Turkish equities and bonds, investors are shifting into a “wait-and-see” mode. The core question for markets now is: what will drive the next upward leg?

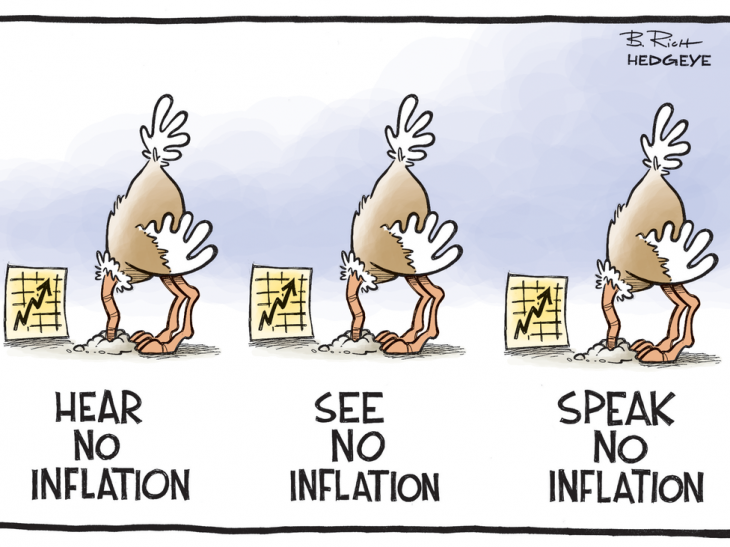

Inflation Revision Breaks the Narrative of a Smooth Disinflation

Until recently, easing inflation was one of the few strong narratives supporting equities.

That changed when the Central Bank of Turkey (CBRT) raised its 2025 inflation forecast from 27% to 32% — a significant revision.

Markets interpreted this as:

-

Confirmation that inflation will stay higher for longer

-

The likely pause in rate cuts after the symbolic 100bps cut in the previous meeting

The revision prompted two critical questions for investors:

-

Why cut rates at all if inflation expectations are rising?

-

What will happen at the December 11 policy meeting?

Current expectation:

➡️ Rate cuts will likely pause, shifting the CBRT into a “wait-and-see” stance.

Equities: Strong Earnings, Weak Momentum

Borsa Istanbul remains close to historic peaks, yet each breakout attempt is met with selling.

-

BIST 100 faces resistance at: 11,000 → 11,300 → 11,550–11,600

-

First supports are at: 10,880 → 10,600 → 10,500

Q3 corporate earnings appear stronger than previous quarters, especially among large industrials and holding companies. Banks — not subject to inflation accounting — continue to deliver strong profitability.

However, a key obstacle remains:

Markets struggle to find a new catalyst that can anchor upside momentum.

Simply being “cheap” is not strong enough to trigger new buying.

As traders put it: “Cheap meat makes thin stew.”

Selective Buying: Trade & Consumer Stocks Lead

Despite index stagnation, capital rotation is visible:

-

BIST Trade Index jumped 2.97% in one week

-

Investors favor companies with:

-

Strong free cash flow

-

Visible earnings

-

Defensive demand

-

Example:

Migros surged 10% in a week.

Investors are shifting from “high beta speculation” to “earnings clarity.”

Foreign Investors Are Returning — Slowly, But Clearly

In the week ending October 31:

| Asset Class | Foreign Flow |

|---|---|

| Equities | +$242M |

| Government bonds (GDDS) | +$486M |

| Eurobonds | +$64M |

This marks the first stock inflow after four weeks of selling.

However, CBRT reserves fluctuated sharply due to gold valuation effects:

-

Gross reserves fell $1.9B to $186B

-

Gold-price swings accounted for $47B of reserve increase since the start of the year

Interest Rates, FX, Gold: Balance Returns

Markets now operate under a stabilizing triad:

| Instrument | Trend |

|---|---|

| FX (USD/TRY) | Stable with mild upward bias |

| Interest rates (TRY deposits) | Real returns low, limiting deposit appetite |

| Gold | Losing momentum |

| Crypto | Cooling off after a hot run |

→ With deposit returns limited and FX quiet, attention shifts back to equities.

What Awaits Turkish Markets?

Short term:

-

Sideways trading with resistance-heavy price action on BIST

-

Foreign flows supportive but not aggressive

-

Policy uncertainty ahead of the December CBRT meeting

Medium term (positive scenario):

-

If inflation decelerates and rate cuts resume gradually:

➤ Equities regain leadership

➤ TL remains relatively stable

➤ Earnings-driven equity rally deepens

Negative risk:

-

If inflation surprises higher, rate cuts may stop entirely.

Bottom Line

➡️ Turkish markets are entering a consolidation zone.

➡️ Equities are no longer rising on narrative — only earnings and selective sectors matter.

➡️ The next major trigger for markets will be the CBRT meeting on December 11.

In this environment:

“Wait and see” has become the dominant strategy.

Sources: Zeynel Balcı, Zeynep Aktaş, Ömer Faruk Bingöl