Turkish Industrial Output Flashes Mixed Signals: Annual Growth Holds Firm, But Quarterly Contraction Triggers Alarms

sanayi uretimi eylul ingilizce

sanayi uretimi eylul ingilizce

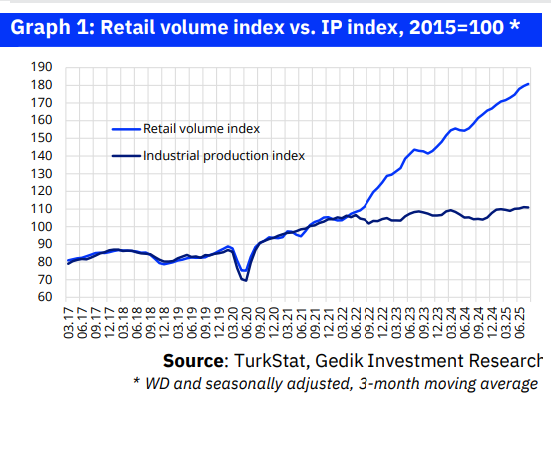

Turkey’s industrial output, a key barometer of its economy, is sending conflicting signals following the release of third-quarter data. Detailed analyses from major financial institutions—Akbank and Gedik Investment—confirm that while annual growth continues to demonstrate resilience, a concerning quarterly contraction suggests critical weaknesses are emerging, driven by high financing costs and global demand slowdown.

Data from the Turkish Statistical Institute (TÜİK) on the Industrial Production Index (IPI) has illuminated a complex phase for Turkish industry. The detailed reports from Akbank and Gedik Investment confirm that the economy is navigating a period of stark divergence.

Q3 Weakness Confirmed: Momentum is Waning

According to the Akbank report, the IPI (seasonally and calendar-adjusted) experienced a significant 2.2% month-on-month contraction in September. Although the year-on-year growth remained robust at 6.0% (unadjusted), the calendar-adjusted annual growth slowed to 2.9%, marking the lowest value in the last six months.

This trend resulted in a 0.6% quarterly contraction (seasonally adjusted) for the IPI in Q3, following three consecutive quarters of growth. Year-on-year, the growth stood at 5.4%.

The Gedik Investment analysis corroborates this slowdown: “Industrial production contracted by 2.2% month-on-month in September, while annual growth was 2.9%… The September data confirmed our expectation of a month-on-month contraction, although the strong annual growth reflected the low base effect.”

Analysts point out that while the IPI surged to 5.5% in Q2 from a mere 0.7% in Q1, the subsequent loss of momentum in Q3 is an inevitable consequence of the tight monetary policy, high financing costs, and cooling domestic demand .

Sectoral Decoupling: Winners and Losers Emerge

The observed imbalance within industrial production is most pronounced when examining specific sub-sectors, revealing which parts of Turkish industry are most sensitive to the new macroeconomic environment.

🟢 The Growth Engine: Investment, Defense, and Energy

The reports emphasize that the driving force behind industrial production continues to be capital goods and specialized sectors.

- Capital Goods: The contribution of capital goods to the IPI continued into Q3, achieving a 1.9% quarter-on-quarter increase. Gedik Investment data shows that the manufacture of capital goods led the way, with an annual growth rate of 12.2% (calendar-adjusted).

- Strategic Sectors: While sectors like apparel, food, and textiles acted as a drag, those posting strong growth included fabricated metals, electricity generation, other transport equipment, basic metals, and non-metallic mineral products. Akbank notes this aligns with previous assessments that the defense industry, construction-related sectors, and the energy sector are decoupling positively from the broader economy. The energy sector, for example, grew by 11.3% year-on-year.

When excluding capital goods, the quarterly contraction was a sharper 1.3%, illustrating how narrowly focused the underlying growth has become.

🔴 Sectors Under Pressure: Labor-Intensive and Consumption-Driven

The direct impact of the tight financial environment is most severe on labor-intensive and consumption-driven manufacturing sectors.

- Apparel and Textiles Sound the Alarm: The apparel sector continues its steep decline, with monthly contraction holding strong at 3.0%, leading to a cumulative six-month drop of 18.3%. Gedik Investment reported that apparel manufacturing recorded the sharpest annual contraction at 22.9%. Textile product manufacturing also saw an 8.7% annual decline. These figures highlight the intense pressure on labor-intensive industries facing loss of competitiveness and shrinking global export demand.

- Machinery and Durables: The manufacturing of machinery and equipment contracted by 9.5% annually, while durable consumer goods saw a sharp 7.5% annual decline. Monthly decreases in both durable (3.1%) and non-durable (3.4%) consumer goods reflect the dampening effect of the tight policy on domestic consumption.

Leading Indicators Point to Continued Headwinds

Both reports cite key leading indicators suggesting that the monthly weakness in industrial output is likely to persist in the coming period.

- Manufacturing PMI: The Manufacturing Purchasing Managers’ Index (PMI) has remained below the crucial 50-point threshold (indicating contraction) for an extended period. The index’s descent from 47.3 in August to 46.7 in September, and further to 46.5 in October, strongly indicates that manufacturing activity is intensifying its contraction.

- Capacity Utilization Rate (CUR): Weakness observed in food, apparel, and machinery manufacturing is also reflected in the CUR data, underscoring systemic softness in these key areas.

⚠️ Risks and Future Outlook

While Akbank’s forecast—that the 5.4% annual IPI growth in Q3 suggests a Q3 GDP growth of around 4.5%—offers a glimmer of momentum, the risks remain heavily skewed to the downside. Gedik Investment emphasizes the following threats:

- Global Demand Uncertainty: The weak outlook in export markets, particularly in Europe and the US, continues to pose a risk to industrial production and is a primary driver of the contraction in export-dependent sectors.

- High Financing Costs: The elevated cost of credit, a direct result of the strict monetary policy, remains a significant drag on production and investment decisions for most businesses.

In conclusion, Turkish industry has successfully maintained a robust annual growth figure in Q3, but this growth is increasingly confined to a narrow scope of strategic sectors. The sharp declines in consumption and labor-intensive sectors, coupled with negative leading indicators, are raising serious alarms regarding future employment and economic stability, indicating that the nation’s economic resilience is being severely tested by the disinflation process.