Turkey’s Manufacturing Weakness Persists as Capacity Utilization Falls to 5-Year Low

tuneli ucunda isik

tuneli ucunda isik

Summary:

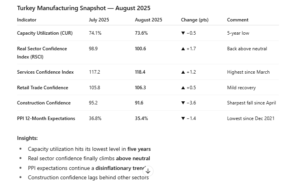

Turkey’s Central Bank (CBRT) August 2025 data shows that the slowdown in the manufacturing sector continued, with the seasonally adjusted capacity utilization rate (CUR) falling 0.5 points to 73.6%, marking its lowest level in five years. While temporary production halts in the automotive sector contributed to the decline, excluding these effects, the overall trend remained broadly stable. Meanwhile, business confidence showed a slight recovery, but investment appetite and employment trends weakened further.

Capacity Utilization at Its Lowest Since 2020

According to the CBRT, Turkey’s seasonally adjusted capacity utilization rate (CUR) dropped to 73.6% in August, the lowest reading in five years.

The monthly decline was largely driven by planned temporary production halts in the automotive sector. Excluding this impact, the CUR showed a flat trajectory, indicating underlying stabilization despite weak demand conditions.

However, the survey also revealed a decline in investment appetite and employment expectations, while price and cost expectations for the next three months increased.

Business Confidence Recovers but Remains Fragile

The Real Sector Confidence Index (RSCI) rose by 1.7 points in August to reach 100.6, climbing above the neutral threshold of 100 for the first time in three months.

-

The recovery was driven by improved overall sentiment regarding the business outlook

-

And higher export order expectations for the next three months

Despite the uptick, the index remains below its historical average, signaling that the manufacturing sector continues to operate under fragile conditions.

Sectoral Confidence Indices Show Mixed Signals

Sectoral confidence trends were uneven across industries:

-

Services sector confidence: Up 1.2 points, reaching its highest level since March 2025, supported by stronger demand expectations.

-

Retail trade confidence: Posted a mild improvement but failed to recover losses from the previous two months.

-

Construction sector confidence: Dropped sharply by 3.6 points, hitting its lowest level since April 2025.

Overall, all three major indices — services, retail, and construction — remain below their long-term averages.

Domestic and External Orders Recovering Gradually

Manufacturing firms reported a partial recovery in foreign order expectations for the second consecutive month, while domestic order expectations rose for the third straight month.

-

Strongest recovery in foreign demand: Non-durable consumer goods

-

Highest domestic order gains: Non-durable consumer goods and capital goods

Despite the recent improvements, both domestic and export order levels remain below their long-term averages.

Producer Price Inflation (PPI) Expectations Hit Lowest Since 2021

The survey also highlighted improving sentiment on producer price inflation:

-

12-month PPI expectations fell by 1.4 points to 35.4%

-

Marking the lowest level since December 2021

However, expectations remain well above the current annual PPI, which stands at 24.2%.

Investment and Employment Outlook Weakens

-

Employment trends: Declined slightly in August, with job creation slowing across most firm sizes except mid-sized manufacturers.

-

Investment appetite: Fell after two consecutive months of improvement, with declines spread across all firm sizes and product groups.

-

Durable consumer goods: Recorded the strongest employment gains, contrasting with weakness in other segments.

Outlook: Recovery Fragile but Sentiment Improving

CBRT’s August data highlights a continued slowdown in manufacturing activity, with capacity utilization at a five-year low and investment trends under pressure.

However, the simultaneous improvement in business confidence, export orders, and PPI expectations signals emerging optimism about Turkey’s disinflation outlook heading into 2026.

Analysts note that achieving a sustainable recovery will require stable monetary policy, controlled fiscal spending, and improved external demand conditions.

IMPORTANT DISCLOSURE:

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the views of our editorial board or constitute endorsement.

Follow our English-language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/