Turkey’s Inflation Expectations Split Widely: Households, Markets and Industry See Different Futures

food inflation

food inflation

The Central Bank of the Republic of Turkey’s Sectoral Inflation Expectations Report for November 2025 reveals a persistent and widening divergence among financial markets, the real sector, and households regarding the country’s inflation outlook. The three groups continue to project distinctly different inflation levels for the next 12 months, underscoring a lack of consensus on the pace and credibility of disinflation.

According to the report, market participants’ 12-month inflation expectation rose slightly, while the real sector revised its projections downward. Households, however, remain far more pessimistic, maintaining expectations more than double those of market analysts.

Market Expectations Edge Higher

The report shows that financial market participants expect 12-month inflation to be 23.49%, up 0.23 points from October. This slight upward revision suggests that markets perceive a more challenging disinflation path ahead, likely influenced by exchange-rate volatility, sticky service inflation, and uncertainty about domestic demand.

Despite remaining far below household expectations, the market forecast captures a moderate degree of caution, reflecting ongoing concerns about inflation persistence as Turkey transitions through its stabilization cycle.

Real Sector Turns More Optimistic

By contrast, the real sector displays a more constructive tone. Companies and industry representatives revised their 12-month inflation forecast down by 0.60 points to 35.70%.

Although still substantially above market projections, the decrease signals growing confidence in cost stabilization, supply chain normalization, and improved visibility into input prices.

This pattern also suggests that firms may be aligning with the central bank’s tighter monetary stance and anticipating more predictable pricing dynamics moving into 2026.

Households Still Far More Pessimistic

The most striking finding in the report comes from household expectations, which remain dramatically above both market and industry projections. As of November 2025, households expect 12-month inflation at 52.24%, a level that—despite a 2.15-point decline from October—remains exceptionally elevated.

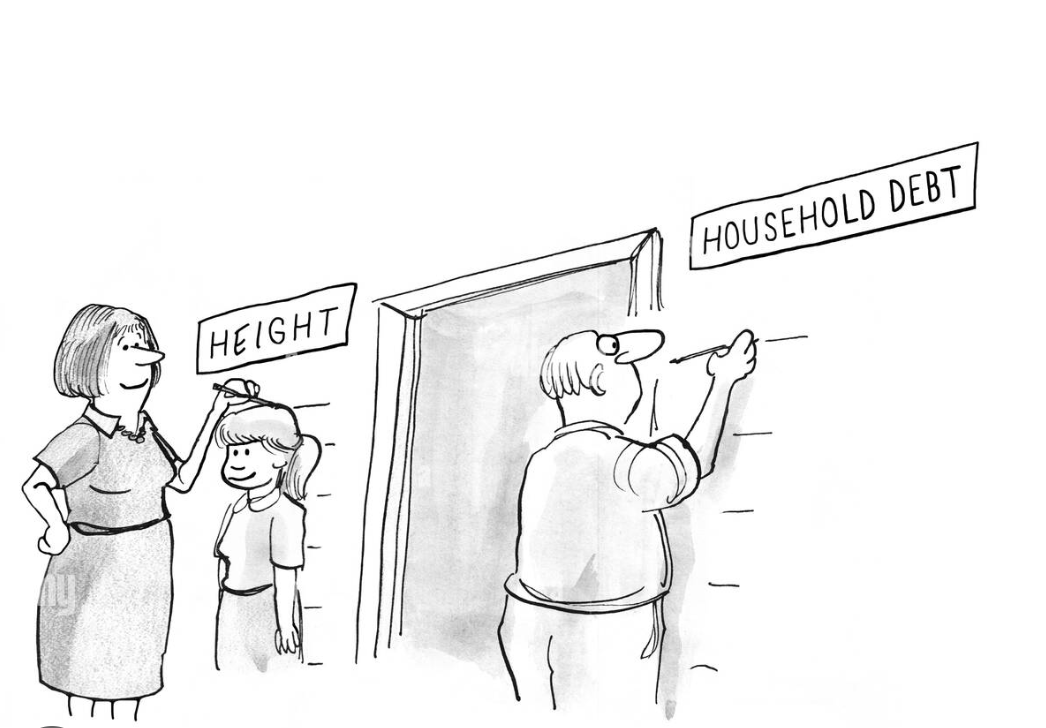

The persistence of such high consumer expectations points toward deep-rooted skepticism about price stability. Households’ everyday experience with food, rent, transport, and energy costs likely shapes a more pessimistic view of the future than that of institutional actors.

This divergence highlights a structural challenge: even as inflation indicators soften, public perception of inflation improves much more slowly, affecting confidence, spending behavior, and long-term planning.

Declining Optimism: Fewer Households Expect Inflation to Fall

Another noteworthy finding is the shrinking share of households that believe inflation will decline over the coming year. In October, 26.50% of respondents expected inflation to fall; by November, this proportion dropped to 24.83%, a 1.67-point decrease.

This reduction illustrates weakening optimism and suggests that disinflation signals have not yet translated into meaningful improvements in household sentiment. Consumer expectations often adjust with considerable lag, and sustained price pressures across essential goods can keep pessimism entrenched.

How Expectations Have Shifted Over a Full Year

The report also compares expectations from November 2024, October 2025, and November 2025, revealing how perceptions have evolved over a 12-month horizon:

-

Market expectations fell by 3.71 points from 27.20% (Nov 2024) to 23.49% (Nov 2025).

-

Real sector expectations dropped more sharply, declining 12.1 points from 47.80% to 35.70%.

-

Household expectations decreased by nearly 12 points as well—from 64.05% to 52.24%—yet remain significantly higher than every other segment.

This annual comparison reinforces a core theme: while all groups now expect lower inflation than a year ago, households remain the least convinced, and their expectations continue to diverge sharply from institutional forecasts.

Why These Gaps Matter for Policy and the Economy

The Central Bank closely monitors expectation gaps because they can influence wage-setting behavior, pricing strategies, and overall inflation inertia. When household expectations stay elevated, disinflation becomes harder to anchor; when businesses adjust expectations downward, it suggests confidence in monetary policy credibility.