Turkey’s Cash Budget Posts TL 56 Billion Surplus in November as Spending Growth Slows

cash budget nov2025

cash budget nov2025

Summary:

Turkey’s Treasury and Finance Ministry reported a TL 56 billion cash budget surplus in November, reversing the TL 62 billion deficit seen a year earlier. Slower expenditure growth relative to revenues supported fiscal performance, while analysts expect the government to meet its year-end budget targets under the Medium-Term Program.

Budget balance improves sharply on annual basis

According to cash-based budget data released by the Treasury, November posted a TL 56 billion surplus, compared with a TL 62 billion deficit in November 2024.

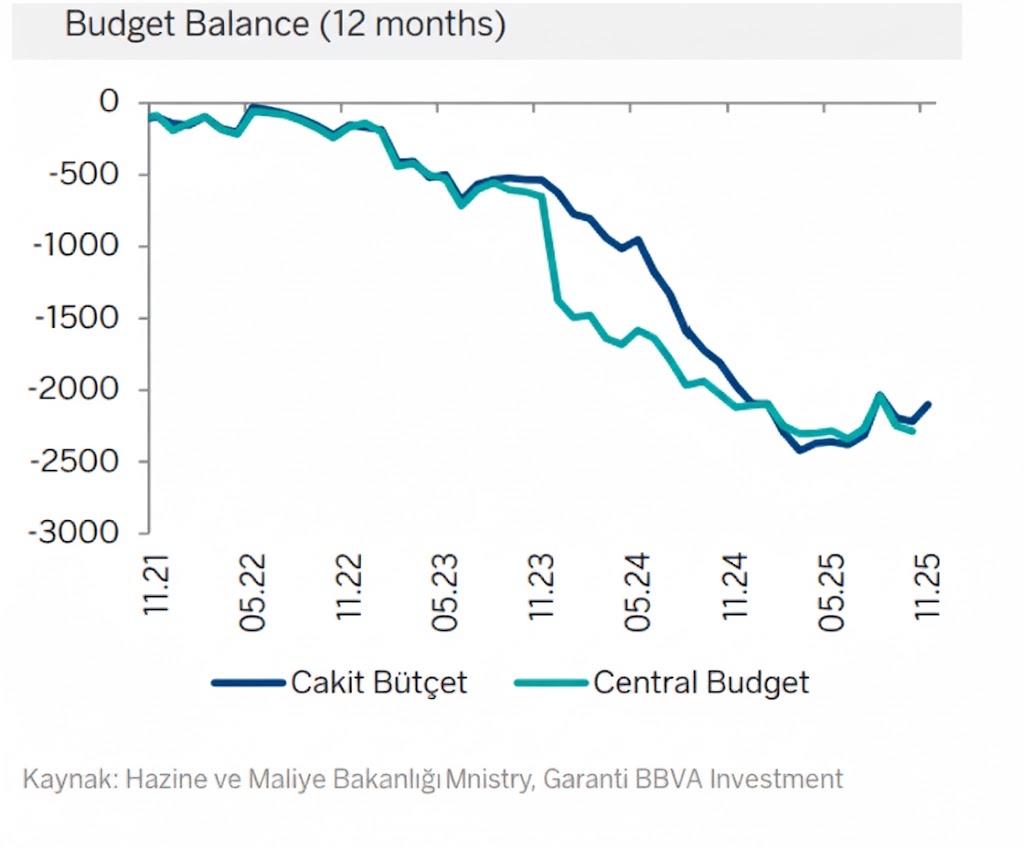

The 12-month rolling deficit narrowed by TL 119 billion from the previous month to TL 2.101 trillion.

Over January–November 2025, the cash budget deficit was broadly unchanged from last year.

Under the Medium-Term Program (MTP), the central government budget deficit is projected to reach TL 2.208 trillion by year-end.

Assuming cash and central government budget balances broadly align, the December deficit would need to rise less than 33% for the annual target to be met. Based on year-to-date trends, analysts expect the government to hit its 2025 budget goal.

The MTP projects a budget-to-GDP ratio of 3.6% for 2025 and 3.5% for 2026.

Revenues outpace expenditures

-

Over the past three months, cash revenues rose 37% year-on-year,

while expenditures increased 33%. -

Within total expenditures, non-interest spending increased 34%,

and interest payments rose 27%.

Borrowing dynamics: High rollover in November, light payments in December

The domestic debt rollover ratio reached 150% in November, exceeding the Treasury’s program targets.

The 12-month average ratio eased slightly from 137% to 136%.

According to the Treasury’s financing plan, the domestic rollover ratio for Dec 2025 – Feb 2026 is expected to remain at 94%, well below the 2026 full-year forecast of 106%.

Cash position improves slightly

Central Bank data indicate:

-

Public-sector FX deposits decreased by TL 2 billion (USD 0.1 bn).

-

TL deposits increased by TL 10 billion in November.

-

The Treasury ended the month with TL 1.166 trillion in total cash reserves,

including approximately USD 11.3 billion in FX deposits.

December borrowing burden remains light

Domestic debt

-

December domestic debt service stands at TL 110 billion,

well below the 12-month average. -

Heavy repayment months lie ahead: January, February, April, June, July and August,

with the Treasury scheduled to repay TL 590 billion in both January and February — the largest monthly amounts of 2026.

Markets also await the Central Bank’s annual report in late December, which will clarify the 2026 government bond purchase program.

The share of non-lira domestic debt remained stable at 20% as of October 2025.

External debt

-

December external debt service is USD 0.4 billion, below the 12-month average.

-

Heavy repayment months ahead include

January (USD 3 bn), February (USD 2.6 bn), April (USD 2.1 bn), June (USD 2.9 bn), and October (USD 3.6 bn).

Turkey’s total international borrowing in 2025 reached USD 13 billion, surpassing the USD 11 billion program target. For 2026, the Treasury plans to borrow another USD 13 billion from global markets.

Source: Garanti BBVA

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English-language YouTube channel REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: https://twitter.com/AtillaEng

Facebook: https://www.facebook.com/realturkeychannel/