TURKEY 2026 Market Strategy

borsa boga

borsa boga

Falling CDS and Inflation Lay the Groundwork for Bonds and Equities in Türkiye

As Türkiye heads into 2026, a sharp decline in sovereign risk premia, resilient portfolio inflows, and a monetary policy anchored to controlled real appreciation of the Turkish lira are reshaping the macro-financial landscape. While disinflation is progressing more slowly than initially expected, the compression in CDS spreads has yet to be fully reflected in domestic bond yields — creating a potential repricing opportunity across government bonds, banks, and select equity sectors.

Improving Risk Perception, Incomplete Market Pricing

Entering 2026, Türkiye’s outlook is increasingly defined by a pronounced improvement in country risk metrics. The 5-year sovereign CDS has fallen below 210 basis points, approaching levels last seen before 2018, narrowing the gap with the emerging market average. This improvement reflects sustained carry-trade inflows, a relatively weak US dollar, and expectations of monetary easing in advanced economies.

Despite this progress, domestic financial markets — particularly long-dated government bonds — have not fully priced in the improved risk backdrop. This disconnect between CDS compression and bond yields forms the core of the 2026 investment thesis.

Capital Flows and the CDS–Bond Disconnect

Portfolio flows remain the primary transmission channel of improving investor sentiment. Following temporary outflows between March and May, carry-trade positions rebounded sharply, with estimated volumes now exceeding USD 50 billion. Net portfolio inflows since April 2024 have surpassed USD 80 billion.

Foreign participation in the domestic government bond (DIBS) market, however, remains well below historical norms. While foreign holdings peaked near USD 70 billion in 2013 (around 30% of outstanding stock), they fell below USD 1 billion during 2021–2023. Renewed interest since 2024 has lifted foreign ownership to roughly 7% — still inconsistent with current CDS levels. This gap suggests further room for repricing in bond markets as foreign participation normalizes.

Government Bonds: Case for Lower Long-Term Yields

Although short-term yields have declined meaningfully since early 2025, the long end of the yield curve has shown limited adjustment. We estimate that renewed foreign inflows into the DIBS market could reach levels similar to 2024 (around USD 16 billion) during 2026, with a significant portion occurring in the first half of the year.

Under this scenario, 10-year government bond yields — currently around 30% — could fall toward the 25–26% range. Such a move would represent a delayed but rational alignment of domestic yields with improved sovereign risk pricing.

Currency, Inflation, and Monetary Policy Outlook

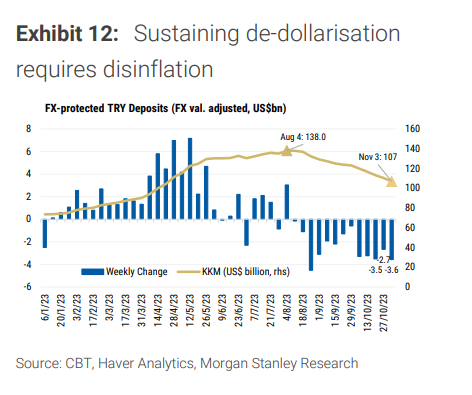

The disinflation strategy of the Central Bank of the Republic of Turkey continues to rely heavily on real appreciation of the Turkish lira. Following a slowdown in nominal depreciation in late 2025, exchange rate stability remains central to containing core goods inflation.

Baseline projections for end-2026:

-

USD/TRY: 52.5

-

CPI inflation (end-year): 24.5%

-

Average CPI inflation (2026): ~27%

Inflation could ease toward the 26–27% range by mid-2026. However, sustained real appreciation raises risks to external competitiveness, particularly in labor-intensive sectors, making the current policy mix effective in the short term but increasingly difficult to sustain over the medium term.

We expect a cautious and gradual easing cycle in 2026, with the policy rate declining to 30% by year-end. Rate cuts are likely to proceed in 100–150 bp steps, with 500–600 bp of easing potentially front-loaded by mid-year. Macroprudential measures are expected to limit the transmission of easing to credit conditions, especially in the first half.

Growth, External Balance, and Fiscal Constraints

Growth dynamics continue to show a divergence between consumption and production. Services and construction support headline GDP growth, while industrial production lags due to tight financial conditions, high real rates, weak external demand, and an appreciated real exchange rate. GDP growth is expected at around 3.7% in 2025 and 3.5% in 2026.

The current account deficit is projected to remain manageable — around USD 22.5 billion (1.5% of GDP) in 2025, widening modestly to about 2% of GDP in 2026.

On the fiscal front, strong nominal revenue growth has improved the primary balance, but rising interest expenditures continue to weigh on overall fiscal performance. Earthquake-related spending exceeding TRY 600 billion and a heavy domestic debt redemption schedule (TRY 5.5–6.0 trillion in 2026) will constrain budget flexibility.

Equities: Earnings Trough Likely Behind Us

Since the start of the year, the BIST 100 Index has fallen 4.4% in USD terms while gaining 10% in local currency, underperforming the MSCI Emerging Markets Index by 27%. Adjusted for inflation, real returns remain negative.

However, corporate earnings data suggest the worst is likely behind. After sharp contractions in net income and EBITDA through 2024 and early 2025, profitability trends improved notably by mid-year. Over the first nine months, EBITDA returned to growth while net income contraction eased substantially.

Looking ahead to 2026, both operating profit and net income are expected to grow, with projected net income growth of around 30% in banking and industrial sectors, and EBITDA growth close to 16%. Medium-term sector preferences include banking, food retail, healthcare, food, selective contracting, and telecommunications.

Final Assessment

Türkiye enters 2026 with a significantly improved risk profile and strong portfolio inflows. Yet, the transmission of CDS compression into domestic bond yields remains incomplete. This lag creates a compelling case for lower long-term rates and supports a constructive outlook for government bonds, banks, and select equity segments. The convergence between sovereign risk pricing and domestic yields is set to be the defining macro-financial theme of 2026.

By Serkan Gönençler, Chief Economist, Gedik Invest

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/