Şimşek Defends Budget: “Turkey Doesn’t Have a Bad Deficit”

mehmet-simsek

mehmet-simsek

Finance and Treasury Minister Mehmet Şimşek defended his government’s medium-term economic program during the 2026 budget discussions at Parliament’s Planning and Budget Commission, saying that Turkey’s fiscal balance remains sound despite earthquake-related spending.

“Turkey doesn’t have a bad budget deficit. The program is working,” Şimşek told lawmakers.

The session, chaired by AK Party MP Mehmet Muş, focused on key issues including earthquake spending, taxation, borrowing, inflation, and the current account deficit.

“Earthquake Spending Has Reached 3.6 Trillion Lira”

Responding to criticism over reconstruction costs, Şimşek said the devastating February 2023 earthquakes had imposed an enormous fiscal burden on the government:

“At current prices, earthquake-related spending will reach 3.6 trillion lira by the end of 2025. No country in the world could easily overcome such a disaster without disrupting its macroeconomic balances,” he said.

He added that the force majeure status in the earthquake zone had expired and that extending it further would require a legal amendment.

Tax Amnesty Off the Table

On questions about new tax amnesties or restructuring, Şimşek gave a firm answer:

“Restructuring undermines compliance. If a taxpayer is genuinely in difficulty, we allow installment payments — but there is no plan for a general tax amnesty.”

He also reminded MPs that previous arrangements did not reduce the main tax debt, but only updated interest and penalties.

Support for Labor-Intensive Industries

Addressing concerns from the textile, furniture, garment, and leather sectors suffering from weak demand and job losses, Şimşek outlined ongoing support measures:

-

A 2,500 TL monthly KOSGEB grant per employee for struggling firms,

-

Export loan interest subsidies raised to 50%,

-

Over 700 billion TL in credit was extended in the first nine months of the year, with a daily loan limit of 4.5 billion TL.

“We know these sectors are under strain,” Şimşek said. “We’ll take additional measures. We’ll continue to support production and employment as strongly as possible.”

“Turkey Doesn’t Have a Bad Budget Deficit”

Şimşek rejected opposition claims that the fiscal outlook is deteriorating, saying that despite the earthquake costs, the deficit is narrowing:

“Last year we reduced the budget deficit from 5.1% to 4.7% of GDP. This year it will likely fall to around 3.5%. The program is working.”

| Indicator | Turkey (2025 est.) | Emerging Market Average |

|---|---|---|

| Budget Deficit / GDP | 3.5% | Over 5% |

| Public Debt / GDP | 24.5–25% | 74% |

Interest Costs: “The Rise Is Temporary”

Şimşek said higher interest spending was mainly due to post-earthquake borrowing needs, but that this trend will ease:

“The ratio of interest payments to national income will start to decline from 2027 onward,” he noted.

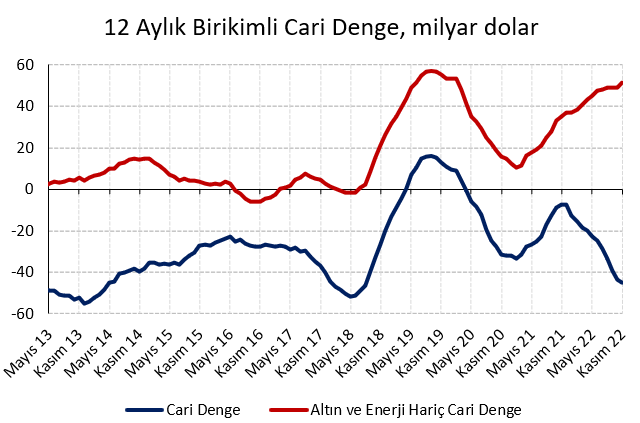

Current Account: “Not Fully Solved, But Under Control”

Discussing Turkey’s external balance, Şimşek struck a cautiously optimistic tone:

“I’m not saying the problem is completely solved, but it’s manageable. Excluding gold, we posted a current account surplus last year,” he said.

He added that a sustainable current account gap for Turkey would be around 2% to 2.5% of GDP.

Inflation: “Off Target, But Falling”

Şimşek acknowledged deviations from inflation targets but emphasized ongoing progress:

“Inflation was 64% in 2023 and has now fallen to around 32–33%. The decline will continue,” he said.

He attributed the gap between targets and reality to temporary supply shocks and extraordinary food price increases, saying:

“We are responsible for meeting the target. But even approaching it is a success.”

Şimşek also defended the government’s controlled exchange-rate policy, arguing that without it, Turkey could face hyperinflation risks due to currency volatility linked to the KKM (FX-protected deposits) scheme.

“The Program Works — Ratings Prove It”

Concluding his remarks, Şimşek pointed to recent credit rating upgrades as proof that the government’s fiscal and monetary policies are credible:

“If our program weren’t working, our ratings wouldn’t have been upgraded,” he said. “Despite multiple shocks this year, the resilience of the Turkish economy has been proven.”