OECD Growth Outlook: Turkey Among European Economies Set to Expand the Fastest

yaris

yaris

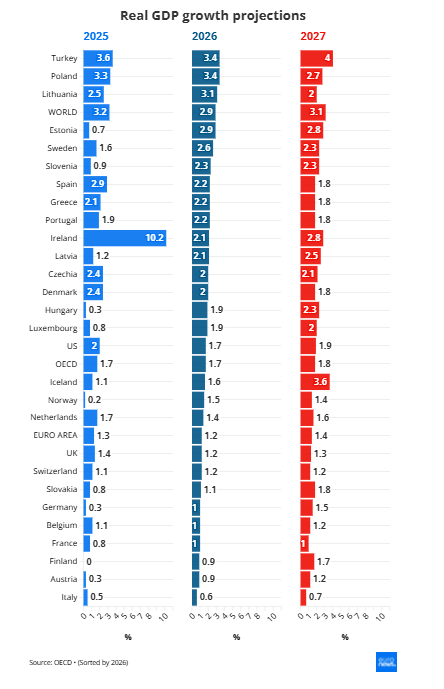

According to the OECD’s latest Economic Outlook, Europe is emerging from a prolonged period of weak growth driven by high inflation and restrictive monetary policy. While the euro zone is expected to lag the United States and China in overall growth, significant divergence is forecast among European economies through 2026 and 2027. Ireland stands out in 2025 due to exceptional export dynamics, while Poland, Türkiye and Lithuania are projected to lead growth in the medium term.

A Shifting Global Growth Landscape

The global economic outlook has been shaped in 2025 by political uncertainty, trade tensions and evolving monetary policy. Following a post-pandemic rebound in 2021 and a subsequent slowdown, the current year has been marked by tariff disputes, tighter financial conditions and weakening consumer confidence in several advanced economies.

The OECD expects global growth to benefit in the coming years from technological advances — particularly in artificial intelligence — and improving financial conditions. However, risks remain elevated, including labour-market softening, geopolitical uncertainty and uneven fiscal capacity across countries.

Within this environment, growth prospects vary widely across Europe, reflecting differences in economic structure, exposure to global trade, and access to investment funding.

Euro Zone Growth Lags Global Leaders

OECD forecasts show euro-area real GDP growth trailing that of the world’s two largest economies — the United States and China — in 2025. While inflationary pressures have eased, growth remains constrained by weak domestic demand and lingering effects of past monetary tightening.

The outlook improves modestly in subsequent years, though at a gradual pace, with fiscal support and easing financial conditions expected to offset trade-related headwinds.

2025: Ireland Leads, Finland Struggles

By the end of 2025, Ireland is projected to post the strongest growth among OECD economies, with real GDP expanding by 10.2%, according to the OECD’s December 2025 Economic Outlook.

The organisation attributes this exceptional performance primarily to front-loaded pharmaceutical exports, as companies accelerate shipments ahead of potential U.S. tariffs. U.S. President Donald Trump has announced tariffs of up to 100% on imported pharmaceuticals starting October 1, while offering exemptions to firms that establish production facilities in the United States. The European Union maintains that its exports remain protected under a prior trade agreement capping U.S. tariffs at 15%.

The OECD cautions, however, that Ireland’s GDP figures can be misleading due to the country’s economic structure. Low corporate tax rates have attracted large multinational corporations that book significant profits locally, distorting headline GDP data relative to domestic economic activity.

Outside Ireland, the fastest-growing OECD economies in 2025 are projected to be Türkiye (3.6%) and Poland (3.3%).

At the opposite end of the spectrum, Finland is expected to record zero growth in 2025. The OECD cites weak consumer confidence and a sharp contraction in housing construction following years of oversupply as key drags on activity.

Euro Zone Outlook for 2026 and 2027

The OECD projects euro-area real GDP growth to slow slightly from 1.3% in 2025 to 1.2% in 2026, before accelerating to 1.4% in 2027.

Increased trade frictions are expected to persist, but their impact is forecast to be offset by improved financial conditions, ongoing capital spending funded through the EU’s Recovery and Resilience Facility (RRF), and relatively resilient labour markets.

The RRF remains a central pillar of Europe’s post-pandemic recovery strategy, providing funding for structural reforms and large-scale investment projects financed through EU-issued bonds.

2026: Poland, Türkiye and Lithuania Outperform

Among 27 European economies, real GDP growth in 2026 is expected to range from 0.6% in Italy to 3.4% in both Poland and Türkiye, with Lithuania close behind at 3.1%.

These three countries are the only European economies projected to exceed the OECD’s estimated global average growth rate of 2.9% in 2026.

At the lower end of the distribution, Italy (0.6%), Austria (0.9%) and Finland (0.9%) are forecast to post growth below 1%, reflecting fiscal consolidation, weak productivity gains and subdued domestic demand.

Spain Leads Among Europe’s Largest Economies

Within Europe’s five largest economies, Spain is expected to post the strongest growth in 2026, with real GDP expanding by 2.2%, well ahead of the United Kingdom (1.2%).

The OECD attributes Spain’s relative strength to robust job creation, rising real wages and continued investment linked to the country’s Recovery, Transformation and Resilience Plan. Spain’s limited exposure to U.S. tariffs — with goods exports to the United States accounting for just 1.1% of GDP — also supports the outlook.

Germany and France are each projected to grow by 1%, while Italy is forecast to lag with growth of 0.6%.

The OECD notes that fiscal expansion in Germany, driven by higher defence and infrastructure spending, should support activity. By contrast, planned fiscal consolidation in France and Italy is expected to weigh on growth.

2027: Türkiye Tops European Growth Rankings

In 2027, the OECD projects Türkiye to achieve the fastest growth among European economies, with real GDP expanding by 4%.

While higher tariffs are expected to weigh on exports, the OECD anticipates the impact will be relatively modest and short-lived. Improving financial conditions, easing inflation and stronger private consumption and investment are forecast to support growth.

Among Europe’s largest economies in 2027, Spain is again expected to lead with growth of 1.8%, followed by Germany at 1.5%. France is projected to remain at 1%, while the UK and Italy are expected to record only marginal improvements from 2026 levels.

Finland’s Gradual Recovery

After stagnation in 2025, Finland is expected to see a gradual recovery, with GDP growth of 0.9% in 2026 and 1.7% in 2027.

The OECD cites lower interest rates, a stabilising housing market, rising defence spending and improved growth among key trading partners as factors supporting the rebound. Nonetheless, U.S. tariffs, global uncertainty and domestic fiscal consolidation remain headwinds.

Source: Euronews

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/***