Morgan Stanley Forecasts Inflation to Fall to 30% in Turkey by End-2025

Morgan Stanley

Morgan Stanley

Investment banking powerhouse Morgan Stanley has released its latest outlook on the Turkish economy, projecting continued progress in the country’s disinflation process over the next two years. According to the report, inflation in Turkey is expected to ease to 30% by the end of 2025 and further down to 21% by the end of 2026, signaling a gradual but steady decline from current levels.

The bank highlighted that the effects of Turkey’s tight monetary policy and recent structural economic steps will become increasingly visible in the coming years. Analysts believe these measures will strengthen the fight against inflation and pave the way toward greater price stability.

Inflation Expected to Ease Gradually

One of the most striking forecasts in the report centers on inflation dynamics. Morgan Stanley predicts that consumer price growth, which has been persistently high, will begin to lose momentum.

-

2025 year-end inflation forecast: 30%

-

2026 year-end inflation forecast: 21%

The report stresses that while inflation will not fall overnight, the projected trend suggests a controlled and sustainable path downward, marking significant progress compared to recent years.

Policy Rate Forecasts Point to Gradual Cuts

Morgan Stanley also detailed its projections for Turkey’s policy interest rate, managed by the Central Bank of the Republic of Turkey (TCMB).

-

By the end of 2025, the policy rate is expected to decline to 37%.

-

By the end of 2026, the rate is forecast to fall further to 26%.

The bank anticipates that the rate-cutting cycle will proceed cautiously, aligning with falling inflation expectations, while maintaining financial stability and investor confidence.

Tight Policy Already Showing Results

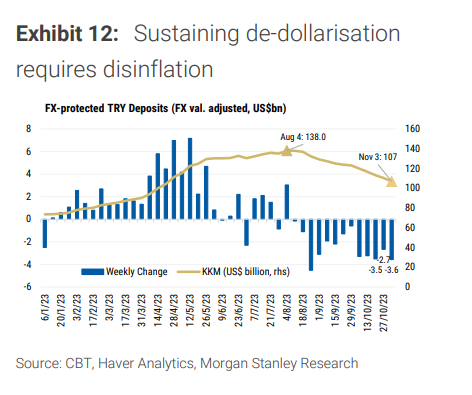

The report emphasized that the combination of monetary tightening, fiscal measures, and reforms in recent months has started to anchor expectations. According to Morgan Stanley, the real test will be whether Turkey can sustain discipline long enough to fully reap the benefits of disinflation.

The bank’s economists noted that if global financial conditions remain stable and Turkey stays committed to orthodox policy, inflation could continue to fall in line with forecasts.

Broader Implications for the Economy

Morgan Stanley’s projections carry major implications for businesses and investors:

-

Borrowing costs are expected to remain high in the short term but gradually ease in 2025–2026.

-

Consumer confidence could strengthen as inflation moderates, supporting more stable growth.

-

Foreign investor interest may increase as Turkey demonstrates progress in restoring economic stability.

Still, risks remain. Any deviation from tight monetary policy, external shocks, or domestic political instability could slow the disinflation path.

Controlled Optimism

Morgan Stanley’s analysis reflects cautious optimism for Turkey’s economic outlook. The gradual decline in inflation and interest rates suggests that the country could move closer to macroeconomic stability by 2026, provided that current policies remain intact.

While challenges persist, including structural reforms and global uncertainties, the report signals that Turkey’s long-term trajectory is shifting toward a more stable and predictable environment.