ING Investment CEO: Türkiye’s Inflation to Reach 31% as CBRT Keeps Rate Cuts Limited

ING

ING

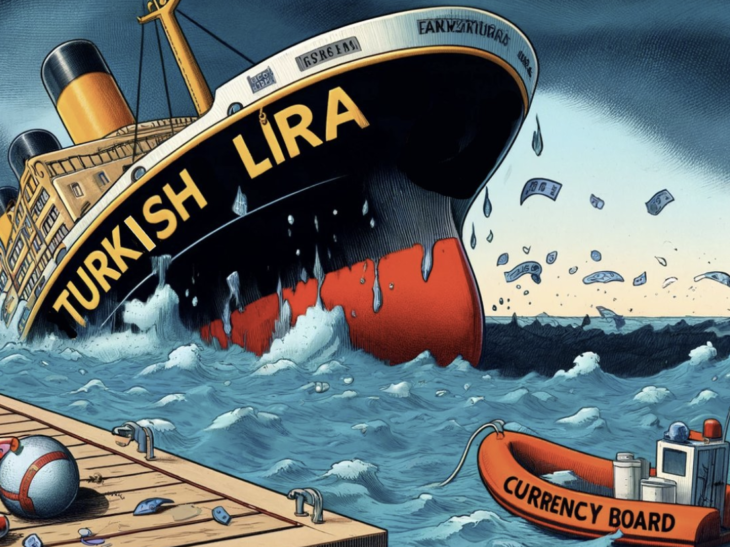

Following stronger-than-expected inflation data for September, ING Investment General Manager Murat Yılmaz announced that the firm has revised its expectations downward for monetary easing. “We now forecast annual CPI to approach 31% by the end of 2025, and we don’t expect the Central Bank of Türkiye (TCMB) to cut rates by more than 300 basis points through year-end,” Yılmaz told EKONOMİ.

Global and Domestic Factors Shape Market Outlook

Yılmaz noted that markets enter the final quarter of the year amid heightened uncertainty across major economies. “In the US, the duration of the federal government shutdown remains unclear, while France and Japan face political turbulence. The S&P 500, driven by tech giants, continues to hit record highs despite bubble concerns,” he said. However, he warned that recent volatility — like the 2.7% plunge in the S&P 500 after the US announced new tariffs on Chinese imports — shows how fragile investor sentiment remains.

Domestically, Türkiye’s higher-than-expected inflation figure has prompted ING to scale back rate-cut expectations. “The possibility of smaller rate reductions by the TCMB could weigh on equity markets in the short term,” Yılmaz said.

Borsa Istanbul Outlook: Seasonal Gains, Uncertain End

Despite global headwinds, historical data remains optimistic for the Borsa Istanbul (BIST 100). “Since 2018, the index has risen every November, with an average increase of 12.63%, which is impressive,” Yılmaz stated. Yet, he cautioned that multiple unknowns — from policy decisions to global risk appetite — make it difficult to issue a precise year-end forecast.

Domestic Asset Flows: Gold, FX, and Stocks in Focus

Yılmaz pointed out that money market funds and TL deposits have performed well but could face outflows if rate cuts accelerate. “We don’t expect meaningful withdrawals from money market funds unless bond yields rise. But if outflows occur, they could shift toward gold, foreign currency, and equity funds,” he explained.

Currency Funds and Risk Trends

After strong inflows earlier in the year, growth in foreign currency funds slowed between October 3–10. “We expect the upward trend to continue at a slower pace but don’t see it creating systemic FX risk,” Yılmaz added.

TCMB Rate Path and Inflation Forecast

The economist reaffirmed ING’s macro view that policy easing will remain cautious. “With monthly inflation at 3.23% in September, above the 2.6% consensus, core inflation pressures remain. As a result, we revised our inflation forecast slightly higher and now expect limited rate cuts. By the end of 2025, CPI will near 31%, while total cuts by TCMB this year shouldn’t exceed 300 basis points,” he said.

Portfolio Strategy: Balanced and Flexible

For investors with moderate risk tolerance, Yılmaz recommends a diversified portfolio that can adapt to market shifts. “About 35% in TL deposits or similar products, 20% in commodities, 20% in equities, 15% in FX instruments, and 10% in bonds would represent a balanced structure,” he advised. Yılmaz also underlined the importance of setting stop-loss levels and using hedging tools to manage volatility.

2026: A Year Defined by Global Rate Cuts

Looking ahead, Yılmaz expects 2026 to be dominated by global monetary easing. “Key themes will include who succeeds as the next Fed Chair, how the US manages rate cuts, and the impact of tariff policies on global trade. Growth may slow slightly compared to 2025, but countries will diverge based on fiscal strength and reform pace,” he said.

Yılmaz projects Türkiye’s GDP to grow 3.3% in 2025 and 4.0% in 2026, with inflation dynamics and central bank policy remaining the central themes shaping foreign investor sentiment toward Turkish assets.

Digital Innovation as a Strategic Priority

Highlighting ING’s long-term vision, Yılmaz emphasized that digital transformation lies at the heart of the company’s growth strategy. “Our goal is to become Türkiye’s most trusted digital brokerage,” he said. “Today, 90% of our equity trading volume and 92% of our revenues come from digital channels, while all account openings are fully online.”

He added that 99% of VIOP transactions also occur through digital platforms. “We are investing heavily in personalized digital experiences, automation, and seamless end-to-end finance journeys — from account setup to credit agreements. Our focus remains on innovation that enhances customer experience.”