Industrial Output Weakness Extends Into the Final Quarter — Akbank & Gedik Investment Comment

ip nov2025

ip nov2025

Summary:

Turkey’s Industrial Production Index (IPI) fell 0.8% month-on-month in October, while annual growth slowed to 2.3%, below expectations (3.2%). Output has contracted 2.9% over the last two months and 4.6% since the beginning of the year. Akbank notes that weakness in core industrial sectors has clearly spilled over into Q4, while Gedik Investment highlights a sharp sectoral divergence — with capital and energy-intensive production holding up, but consumer-related industries continuing to struggle. Forward indicators such as PMI and electricity consumption suggest a mild recovery may emerge, yet external demand softness and financing costs remain downside risks.

Why the AK Party Cannot Solve Turkey’s Economic Crisis — Deniz Zeyrek’s Analysis

Akbank: Industrial slowdown persists, dragged by capital goods

According to Akbank’s analysis:

-

October IPI -0.8% MoM, +2.3% YoY, below the 3.2% forecast

-

Cumulative decline last two months -2.9%, last four months -4%, YTD -4.6%

-

Capital goods segment continues to drive volatility

-

Production of computer, electronics and optical devices posted a sharp -23.5% monthly drop, subtracting -0.6ppt from headline index

Akbank adds:

“Excluding capital goods, October contraction narrows to -0.3% MoM and -1.1% QoQ.”

This indicates underlying industrial weakness has extended into the final quarter of 2025, supported by soft readings in business tendency surveys and capacity utilization.

When removing electronics/optical equipment and other transport vehicles — two most volatile categories — the contraction moderates to -0.2% MoM, QoQ -0.8%, suggesting the headline downturn is somewhat overstated by specific sub-sectors.

Monthly output by category:

| Category | Monthly change |

|---|---|

| Capital goods | -2.3% |

| Durables | -1.8% |

| Intermediate goods | -0.6% |

| Non-durables | +0.8% (but still below Sep levels) |

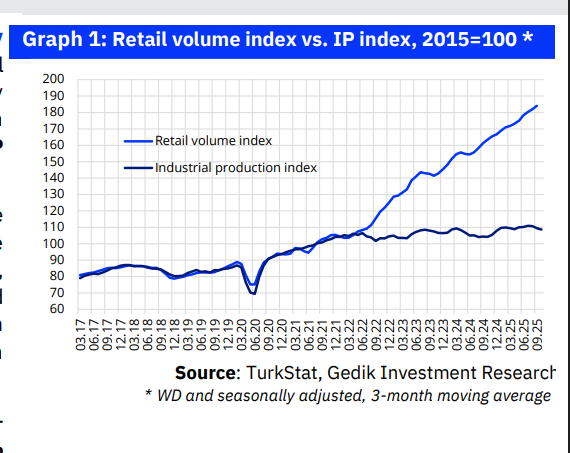

Gedik Investment: Positive annual growth driven by investment-heavy sectors

Gedik Investment highlights that annual growth remains supported by certain industries despite monthly contraction:

Sectors showing YoY growth:

-

Capital goods +12.2%

-

Metal products +14.3%

-

Non-metallic minerals +8.1%

-

Motor vehicles +8.1%

-

Basic metals +4.1%

-

Intermediate goods +2.6%

-

Chemicals +3.8%

-

Electrical equipment +6.5%

-

Energy +5.4%

-

Mining & quarrying +9.4%

Meanwhile, several consumer-linked sectors posted significant drops:

-

Clothing -21.6%

-

Machinery-equipment -9.5%

-

Durables -9%

-

Textiles -7.8%

-

Food -2.4%

-

Plastics & rubber -1.7%

Gedik Investment comments:

“Recovery remains investment and energy-led, while consumer-oriented production stays fragile.”

For the January–October period, capital goods, metals and energy show stable expansion, whereas machinery, apparel, textiles and durables remain in contraction.

Forward indicators point to potential mild recovery

-

Manufacturing PMI remains below 50, but improved to 48 in November from 46.5 in October

-

Daily electricity consumption +2.54% MoM, but still below year-ago levels

-

Forecast models suggest monthly IPI growth could reach 1.5–2% if momentum holds

Yet, weak global demand, tight financing and high costs keep downward risks alive.

PA Turkey aims to inform international readers with diverse perspectives. This content may not reflect the editorial board’s views.

Follow us for more:

YouTube: REAL TURKEY | Twitter: @AtillaEng | Facebook: Real Turkey Channel