HSBC Predicts a Shock Jump in Turkey’s 2026 Minimum Wage

HSBC

HSBC

Turkey is entering one of the most consequential periods of the year for millions of workers as the official process to determine the 2026 minimum wage begins in December.

Ahead of the Minimum Wage Determination Commission meetings, global financial institutions have started releasing their own projections. Among them, HSBC’s latest Turkey report stands out, suggesting that a 20% increase is a realistic scenario, which would lift the net minimum wage to 26,525 TL.

The current net minimum wage of 22,104 TL has been under pressure due to persistent inflation and rising living costs. As economic uncertainty continues, wage negotiations will focus not only on inflation expectations but also on the potential inclusion of a “welfare share,” an adjustment frequently considered during high-cost periods.

HSBC’s 2026 Outlook: Inflation Eases, Wage Growth Moderates

In its updated 2026 Turkey outlook, the UK-based banking giant HSBC outlined expectations for next year’s economic trajectory. The report forecasts headline inflation easing toward 20% by the end of 2026 and projects GDP growth stabilizing around 3.5%. These macroeconomic assumptions form the foundation for the bank’s wage analysis.

HSBC noted in the report that its baseline scenario assumes “an approximately 20% increase in the minimum wage”, positioning this rate as consistent with expected inflation and economic balancing goals. If this scenario materializes, the new net minimum wage would reach 26,525 TL, marking one of the more conservative projections circulating ahead of official negotiations.

Market Scenarios: Could the Wage Reach 30,000 TL?

Beyond HSBC’s calculations, broader market expectations include several alternative scenarios. Analysts and labor groups have generated models that factor in both realized inflation and the possibility of an additional welfare adjustment. These projections outline potential outcomes that diverge from HSBC’s more restrained view.

Key market scenarios include:

Increase of 25% → 27,630 TL

Increase of 30% → 28,735 TL

Some labor representatives argue that, depending on inflation trends and social considerations, the commission could push the net figure closer to 30,000 TL, especially if a welfare share is added to ease pressure on low-income households.

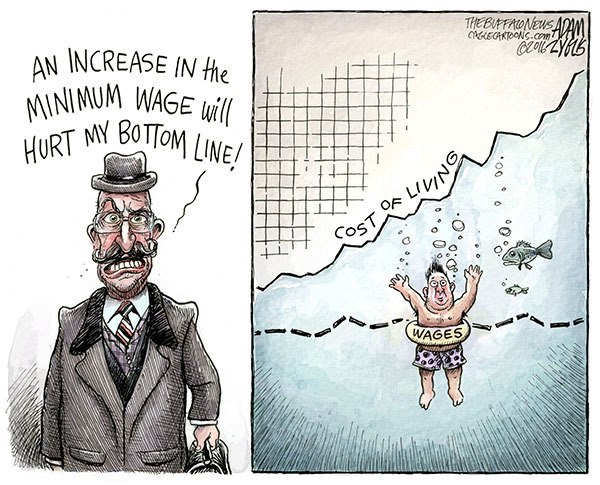

However, others warn that sharp wage increases could strain employers, tiny and medium-sized businesses still recovering from high financing costs and fluctuating input prices.

Structural Challenges: Purchasing Power and European Comparisons

While wage projections dominate the public discussion, another issue remains central to workers’ concerns: purchasing power. Recent analyses comparing European minimum wages reveal that Turkey has slipped to 25th place, with buying power declining by the equivalent of 176 euros over the past year. This erosion underscores why many labor groups argue that current wage levels fail to keep pace with essential living costs.

Simultaneously, organizations tracking cost-of-living indicators warn that the 2026 minimum wage risks falling below the hunger threshold unless substantial adjustments are made. These concerns reflect the widening gap between nominal wage increases and the real economic pressures households face.

Government: “Priority Is Consensus Through Social Dialogue”

Meanwhile, the political dimension of the wage-setting process is intensifying. Minister of Labor and Social Security Vedat Işıkhan confirmed that the Minimum Wage Determination Commission will convene at the beginning of December. Emphasizing cooperation, the minister reiterated that the government aims to achieve an agreement shaped through dialogue.

In his translated remarks, Işıkhan stated:

“I believe we will reach an optimal level that both protects the welfare of our workers and safeguards employers’ capacity for production and employment.”

The minister framed the negotiation process as a balancing act, ensuring that households maintain purchasing power while preventing undue burdens on employers still managing cost pressures.

A Pivotal December Ahead

As December approaches, attention will intensify on the commission’s meetings and the economic assumptions driving each proposal. With global banks issuing cautious forecasts and domestic analysts presenting a range of higher scenarios, the final number will hinge on how the government, labor representatives, and employer groups interpret both inflation expectations and social demands.