How the New Era of Global Energy Politics Is Reshaping the World Order

enerji

enerji

A sweeping realignment is underway in global energy politics as governments race to secure new resources, diversify supply chains, and position themselves within the accelerating shift toward cleaner technologies. From the strategic value of rare earth minerals to the rise of LNG, green hydrogen and transcontinental energy corridors, energy is emerging as one of the most decisive forces shaping international power dynamics.

The result is a world where competition is no longer limited to oil and gas production, but extends to the infrastructure, technology and geopolitical influence behind the energy systems of the future. New winners are emerging, new vulnerabilities are forming, and a growing number of middle powers are stepping into roles traditionally reserved for global giants.

Energy Diversification Becomes a Strategic Imperative

The global rush to diversify energy supplies is one of the main forces driving the transformation. The pandemic, Europe’s post-Ukraine gas crisis, and repeated disruptions in Middle Eastern supply lines forced governments to rethink their dependence on single suppliers.

Liquefied natural gas (LNG) has become a central geopolitical asset.

-

Qatar, the United States and Australia are competing for long-term dominance in LNG markets.

-

Europe is signing multi-decade contracts to replace Russian pipeline gas.

-

Azerbaijan has strengthened its role as a reliable supplier through the Southern Gas Corridor, while expanding into green energy diplomacy and rare earth development.

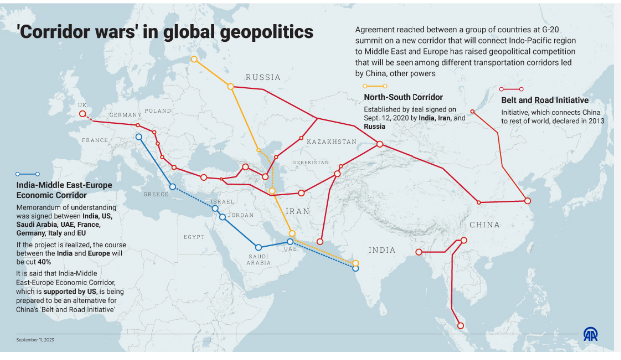

These trends underline a larger reality: energy security today is as much about routes and transit stability as it is about the resources themselves. The rise of the Middle Corridor, linking China to Europe via Central Asia and the South Caucasus, reflects this strategic recalibration, as states seek alternatives to routes influenced by Russia.

Critical Minerals: The New Strategic Battleground

As global demand for electric vehicles, batteries and renewable technologies accelerates, countries are entering a high-stakes competition for lithium, cobalt, nickel, graphite and rare earth elements.

China dominates the processing and manufacturing value chain, creating major vulnerabilities for the US, EU, Japan and South Korea.

This imbalance has triggered a global scramble:

-

The US Inflation Reduction Act,

-

the EU Critical Raw Materials Act,

-

and Japan’s mineral investment programs

all aim to cut dependence on Chinese-controlled supply chains.

Meanwhile, mineral-rich nations — Kazakhstan, Uzbekistan, Namibia, Chile, Indonesia — are gaining geopolitical leverage as demand surges. Azerbaijan is also emerging as a potential source of rare earths, putting the Caspian region on the radar of Western policymakers.

Governments now treat critical minerals as strategic assets, reviving forms of resource diplomacy reminiscent of the Cold War era.

Renewable Energy and Green Hydrogen Redraw Influence Zones

Solar and wind power are no longer primarily environmental initiatives; they have become tools of influence in global diplomacy.

-

Türkiye, the UAE, India and Morocco are investing heavily in green hydrogen and renewable export capacity.

-

The UAE’s COP diplomacy and Africa-focused green investments show how renewables are used to extend geopolitical reach.

-

Saudi Arabia, through Vision 2030, aims to position itself as a global clean-energy hub.

-

Azerbaijan’s renewable partnerships with Europe are reshaping its geopolitical footprint.

Yet the transition also brings risks. Countries heavily reliant on fossil revenues — from the Middle East to Africa and Latin America — face mounting pressure to diversify their economies or risk long-term instability.

Electricity, Digital Grids and the New Strategic Infrastructure

Energy politics is also shifting from hydrocarbons to the electricity networks that will underpin the next phase of global growth.

Power grids, smart systems, cross-border interconnectors and digital grid management technologies have become strategic assets.

-

Europe is accelerating electricity-market integration.

-

China dominates global solar and battery manufacturing.

-

Gulf states are investing in regional grid interconnections as part of broader diversification strategies.

Control of electricity infrastructure is becoming as politically consequential as control of oil and gas routes.

New Alliances and a Fragmented Energy Diplomacy

These changes are reshaping alliances and bringing new actors to the forefront.

-

The BRICS+ expansion,

-

renewed EU engagement with Caspian and Central Asian states,

-

the India–Middle East–Europe transport and energy initiatives,

-

and emerging regional renewable coalitions

illustrate a shift toward “minilateral” diplomacy — flexible, issue-driven partnerships that bypass traditional blocs.

Energy is now a multidimensional power instrument: a combination of pipelines, LNG terminals, rare-earth mining rights, hydrogen facilities, and digital infrastructure.

A Global Map in Transition

The new era of energy politics is redistributing geopolitical weight. Superpowers remain central, but the influence of middle-sized states — those with strategic corridors, mineral wealth or renewable export potential — is rapidly rising.

From the Caspian Basin to the Indo-Pacific, the future of global politics will increasingly hinge on who controls not only today’s hydrocarbons, but also tomorrow’s critical minerals, technologies and energy networks.

This emerging energy order is more complex, more interdependent, and more competitive than anything seen since the oil shocks of the 1970s — and it is already reshaping the world.