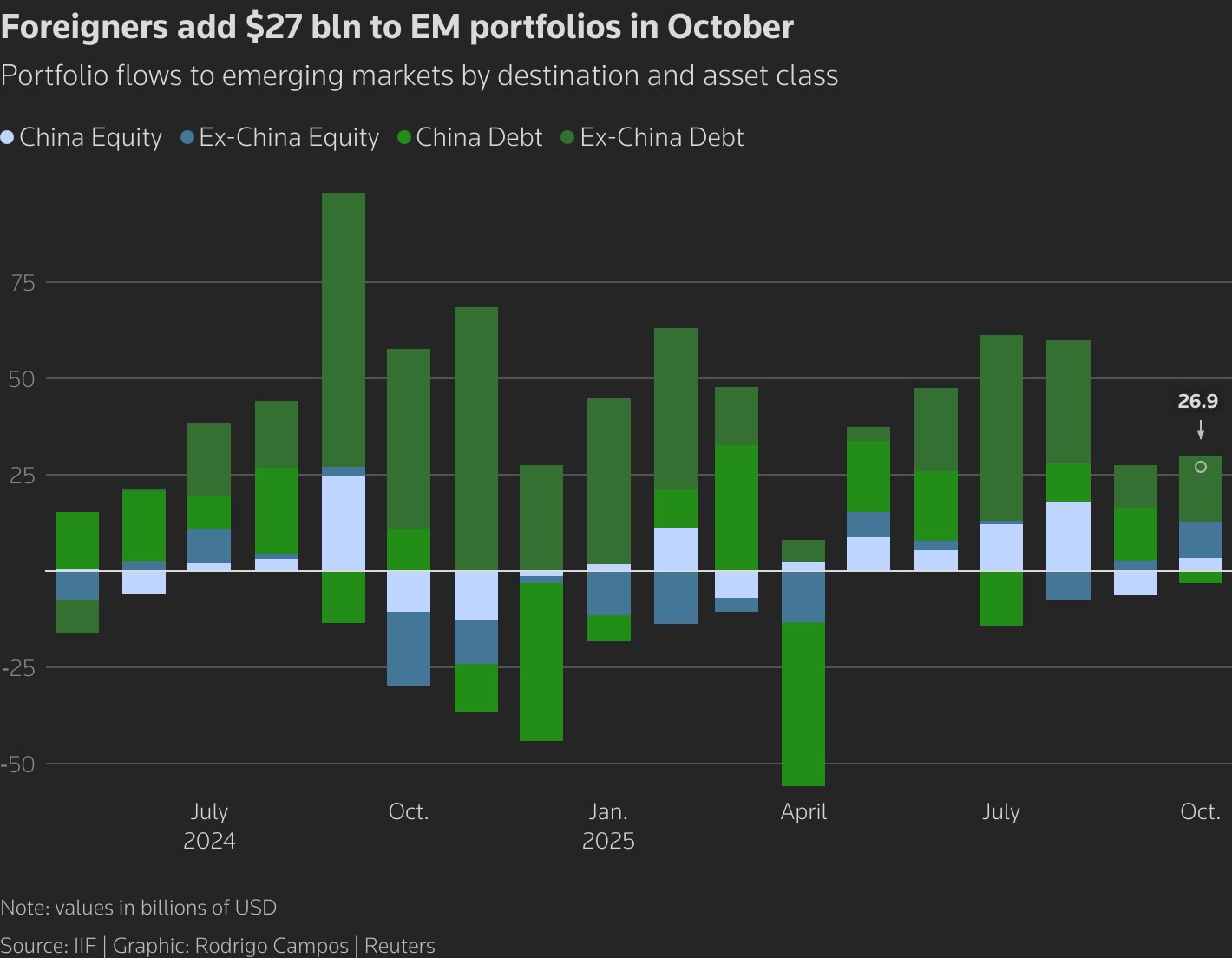

Foreign Investors Pour $27 Billion into Emerging Markets in October — IIF

em inflows 11now

em inflows 11now

Global equity flows hit strongest level since July; Turkey and Hungary noted as key beneficiaries

Non-resident investors added $26.9 billion to emerging-market (EM) equity and debt portfolios in October, driven by a rebound in risk appetite and expectations of further monetary easing by the U.S. Federal Reserve, according to the Institute of International Finance (IIF).

The figure marks a sharp increase from $21.1 billion in September, and contrasts with a $5 billion net outflow recorded in October 2024.

Strongest equity inflows in four months

EM equities attracted $12.9 billion in fresh inflows — the largest since July — while debt flows totaled $14.4 billion, the weakest since April but still firmly positive.

Flows into equities excluding China reached $9.4 billion, the highest level since December 2023.

“The most striking shift in October was the recovery of EM equity allocations,” said Jonathan Fortun, senior economist at the IIF. “Asia, Latin America and Europe all saw stronger inflows.”

By region, Asia led with $16.5 billion, followed by Europe, Latin America, Africa and the Middle East with inflows between $3.0–3.8 billion.

Fed policy drives appetite for risk

Market sentiment improved as traders priced in another Fed rate cut in December following last month’s reduction. Lower U.S. yields typically boost demand for higher-returning emerging-market assets.

Fortun noted that investors remain selective:

“Demand remains focused on credits with deep secondary markets, liquid benchmarks and transparent macro frameworks.”

China mixed, but other EMs surge

China saw a $3.5 billion inflow into equities, offset by a $3 billion outflow from its bond market — essentially flat for the month.

Bank of America: Türkiye and Hungary back on the radar

A separate Bank of America report confirmed broad-based inflows into emerging markets last week. Saudi Arabia was the only major market to record outflows, attributed to profit-taking.

The report highlighted improving investor sentiment toward Eastern Europe, Middle East and Africa (EEMEA), explicitly noting:

“Fund inflows have resumed in Hungary and Türkiye, reflecting improving market conditions.”

Consumer discretionary stocks remain the largest overweight among EEMEA funds, while technology leads in broader EM portfolios.