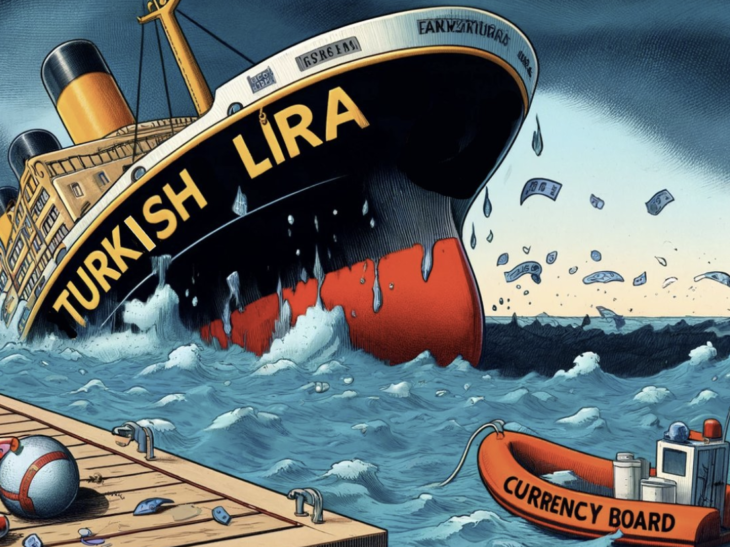

Fitch Ratings Sees Turkish Lira at 53 by 2027

Fitch

Fitch

Fitch Ratings reaffirmed its outlook on Türkiye, emphasizing the country’s low public debt, robust banking sector, and strong growth fundamentals as key factors supporting its credit profile. In its latest report, the global credit rating agency projected moderating inflation, a gradual decline in real interest rates, and a steady long-term currency depreciation trajectory, while maintaining its forecast of USD/TRY at 53 by the end of 2027.

According to Dünya Gazetesi, Fitch’s analysis noted that Türkiye’s track record of accessing external finance and its relatively high per-capita GDP continue to provide structural support to its sovereign rating, even amid ongoing macroeconomic challenges.

Inflation and Exchange Rate Outlook

The agency retained its medium-term inflation and currency projections, underscoring expectations of a gradual disinflation path over the next two years:

-

Inflation: 28% at the end of 2025, easing to 21% by 2026.

-

Exchange Rate: USD/TRY forecast remains unchanged at 53 by the end of 2027.

-

Real Interest Rate: Expected to decline to 3% by late 2026, reflecting tighter monetary discipline and improved inflation anchoring.

Fitch highlighted that while inflation remains well above target, ongoing fiscal restraint and credible monetary policy measures are helping stabilize expectations.

Fiscal Stability and Banking Sector Resilience

Fitch’s report commended Türkiye’s comparatively low government debt-to-GDP ratio, which remains below 40%, far under the median level of other emerging markets. The agency described this as a “key credit strength”, giving the government greater flexibility to absorb shocks and sustain fiscal support where necessary.

In addition, the agency pointed to Türkiye’s resilient banking system as another stabilizing factor. Despite currency volatility and inflationary pressures, the banking sector continues to demonstrate strong capitalization, adequate liquidity buffers, and robust profitability metrics. Fitch noted that prudent regulation and recapitalization efforts in recent years have reduced systemic risks in the financial system.

Growth Prospects and Political Outlook

Fitch maintained its GDP growth forecast at 3.5% for both 2025 and 2026, with a modest acceleration to 4.2% in 2027. The agency attributed Türkiye’s sustained growth outlook to domestic demand recovery, export diversification, and rising tourism revenues.

However, Fitch also cautioned that policy risks may re-emerge ahead of the 2027 general elections. The agency expects a slight loosening of fiscal and monetary policies as the election nears but does not anticipate a return to deeply negative real interest rates that characterized earlier years.

“Türkiye’s commitment to disinflation and financial stability remains central to its medium-term growth story,” the report stated, adding that sustained reforms could strengthen investor confidence and attract more long-term foreign capital inflows.

Steady but Cautious Optimism

Fitch’s outlook reflects a measured confidence in Türkiye’s ability to manage its macroeconomic challenges, balancing the risks of high inflation and external financing needs with structural strengths such as fiscal prudence, a solid banking base, and a growing private sector.

Analysts note that if the central bank maintains its restrictive stance and fiscal consolidation continues through 2026, Türkiye could see a meaningful improvement in its credit metrics, paving the way for potential rating upgrades over the medium term.