Erdal Saglam: Turkish Central Bank Fails to Reassure: Inflation Expectations Surge Amid Rate Cut Outlook

erdal-saglam

erdal-saglam

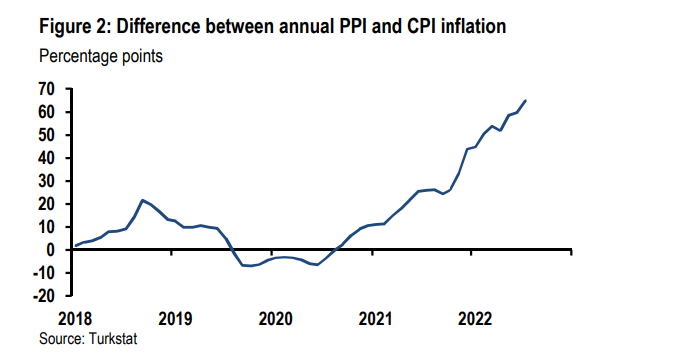

The Turkish Central Bank’s (TCMB) latest Inflation Report, released on November 7th, failed to assuage market fears regarding the government’s commitment to fighting persistent high inflation. Data from subsequent market participant surveys reveal a significant erosion of trust, with near- and long-term inflation expectations climbing sharply.

Despite the TCMB’s rhetoric emphasizing a “tight” policy stance, market consensus is now centered on the belief that the central bank will continue its easing cycle, a paradox that analysts warn is undermining economic stability.

Expectations Defy TCMB Targets

The TCMB’s November market participant survey, conducted after the release of the Inflation Report, clearly demonstrates the market’s lack of confidence in the official projections. Every key horizon saw an upward revision:

- 12-Month Outlook: The expected Consumer Price Index (CPI) for 12 months ahead rose from 23.49% to 23.72%.

- 24-Month Outlook: The CPI forecast for two years out climbed from 17.36% to 17.69%.

- 5-Year Outlook (Long-Term): Long-term inflation expectations jumped from 31.77% to 32.2%.

A major source of this skepticism stems from the TCMB’s decision to maintain its 2026 year-end inflation target at 16%. Analysts argue that since most market players anticipate this target will inevitably need to be raised significantly in the first report of the new year, the current insistence on the figure creates an impression that the Central Bank is prioritizing narrative over decisive action.

Economists note that this conflict between the verbal commitment to monetary tightness and the perceived policy reality (continued easing) has led to the strengthening conviction that the TCMB is not equipped to deliver a “sufficiently strong fight against inflation.”

Rate Cut Consensus and S&P Warnings

The erosion of confidence is further evidenced by market pricing for the next rate decision. Survey results indicate a dominant market expectation that the TCMB will deliver another 100 basis point (1%) interest rate cut at its Monetary Policy Committee (MPC) meeting in December.

This move toward continued easing comes despite sharp warnings from international rating agencies and investment banks:

- Deutsche Bank analysts suggested that keeping the 2026 target steady sends an implied message of a relaxed monetary stance, confirming market doubts about the government’s commitment to inflation control.

- S&P Global Ratings Senior Director Frank Gill issued a severe warning, noting that high inflation combined with the current low policy rates signal “structural challenges” within the Turkish economy. Gill projected that average inflation could hover around 20% between 2026 and 2030, and specifically warned that inflation could remain stubbornly high in 2026, potentially reaching 28%. Gill emphasized that low rates, maintained due to real sector constraints, were placing undue financial strain on small and medium-sized enterprises (SMEs).

In summary, the key challenge for Ankara’s economic team is the growing disconnect between their public statements and the market’s behavioral response. Until the TCMB can align its policy actions with its inflation rhetoric, the structural crisis of rising expectations and continued currency instability is likely to persist.